Eight Years of Labor Market Progress and the Employment Situation in December

WASHINGTON, DC – Jason Furman, Chairman of the Council of Economic Advisers, issued the following statement on the employment situation in December and reviewing eight years of job growth including the longest streak of total job growth on record, adding 15.8 million jobs.

Summary: The economy added 156,000 jobs in December, extending the longest streak of total job growth on record, with U.S. businesses adding 15.8 million jobs over the recovery.

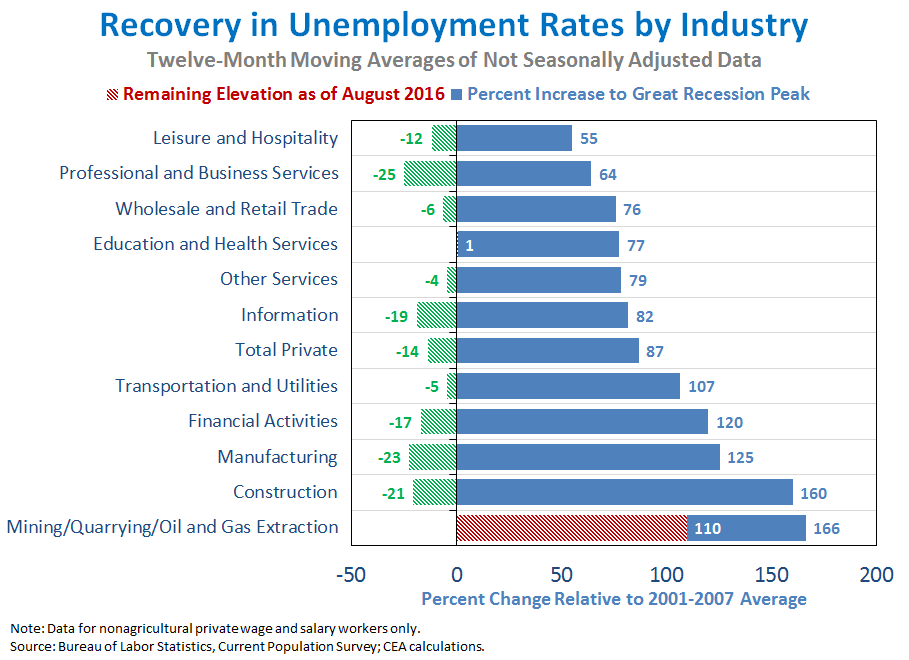

Employment grew at a solid rate of 156,000 jobs in December as the longest streak of total job growth by far on record continued. Average hourly earnings for private employees increased 2.9 percent in 2016, the fastest twelve-month pace since the financial crisis. U.S. businesses have now added 15.8 million jobs since early 2010 amid the U.S. economy’s strong recovery from its worst crisis since the Great Depression. The unemployment rate—4.7 percent in December—has been cut by more than half since its peak, falling much faster and further than expected, and nearly all measures of labor underutilization have fallen below their pre-recession averages. Real wages have grown faster over the current business cycle than in any since the early 1970s, and in 2015 U.S. households saw the largest increase in real median income on record. Since 2010, the United States has put more people back to work than all other G-7 economies combined. Thanks in part to the forceful response to the crisis and policies throughout the eight years of the Obama Administration to promote robust, shared growth, the U.S. economy is stronger, more resilient, and better positioned for the 21st century than ever before. Even with this remarkable progress, it remains important to build on these efforts to support further job creation and real wage growth in the years ahead.

THIRTEEN KEY POINTS ON LABOR MARKET PROGRESS OVER THE LAST EIGHT YEARS

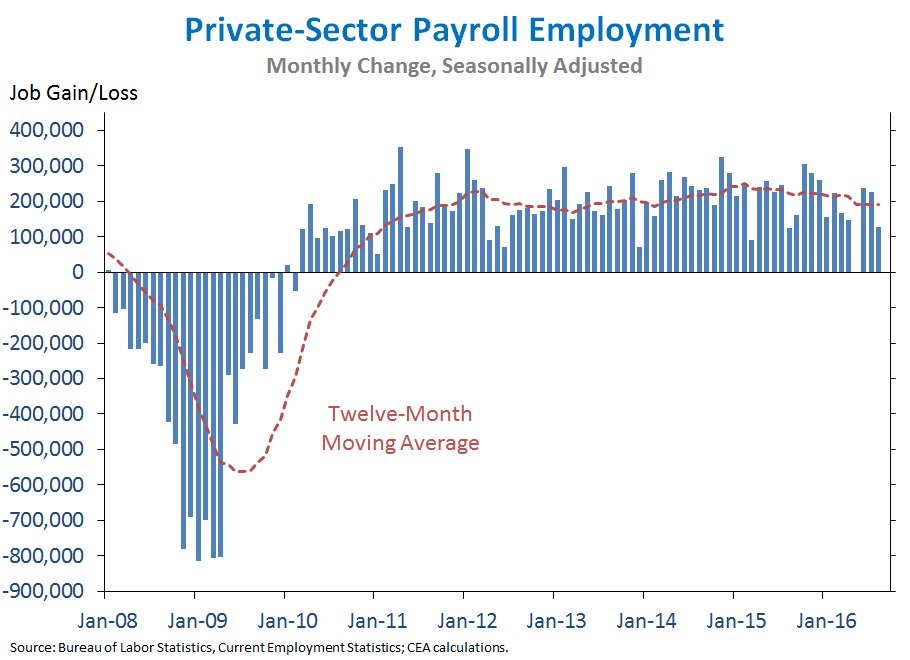

1. U.S. businesses have now added 15.8 million jobs since private-sector job growth turned positive in early 2010. Today, we learned that private employment rose by 144,000 jobs in December. Total nonfarm employment rose by 156,000 jobs, slightly below the monthly average for 2016 as a whole but substantially higher than the pace of about 80,000 jobs per month that CEA estimates is necessary to maintain a low and stable unemployment rate given the impact of demographic trends on labor force participation. The unemployment rate ticked up to 4.7 percent in December, less than half its peak during the recession, while the labor force participation rate—which has been largely unchanged over the past three years despite downward pressure from demographic trends—increased to 62.7 percent. Average hourly earnings for all private workers increased 2.9 percent over the past year, the fastest twelve-month pace since the end of the recession and above the pace of inflation in 2016.

2. Since job growth turned positive in October 2010, the U.S. economy has added jobs for 75 straight months—the longest streak of job growth on record and more than two years longer than the next-longest streak. Over this period, nonfarm employment growth has averaged a robust 199,000 jobs a month. On a calendar-year basis, the pace of job growth peaked at 251,000 jobs a month in 2014, the best year for job creation since the 1990s. In 2016, job growth remained strong, averaging 180,000 jobs a month. As of December 2016, total nonfarm employment exceeded its pre-recession peak by 6.9 million jobs. All of the net job creation in the current recovery has been in the private sector, as private-sector payroll employment exceeded its pre-recession peak by 7.0 million jobs as of December.

3. The unemployment rate has been cut by more than half since its peak in 2009, falling much faster and further than expected. After peaking at 10.0 percent in October 2009, the unemployment rate fell rapidly over the course of the recovery, and by mid-2015 had recovered fully to its pre-recession average. Since then, it has fallen even further, standing at 4.7 percent at the end of 2016. The rapid decline in the unemployment rate came far more quickly than most economists predicted: as recently as March 2014, private forecasters expected the unemployment rate to remain above 5.0 percent until at least 2020.

4. Real hourly wages have grown faster over the current business cycle than in any cycle since the early 1970s. In recent years, American workers have seen sustained real wage gains, as hourly earnings have grown faster than inflation. The chart below plots the average annual growth of real hourly earnings for private production and nonsupervisory workers—a group comprising about four-fifths of private nonfarm employment—over each business cycle, including both recessions and recoveries. (Economists prefer comparing across entire business cycles, as they generally represent economically comparable periods.) Since the beginning of the current business cycle in December 2007, real wages have grown at a rate of 0.8 percent a year, faster than in any other cycle since 1973.

5. Since the end of 2012, real wages for non-managerial workers have grown nearly 18 times faster than they did from 1980 to 2007. In fact, since the end of 2012, real wages for private production and nonsupervisory workers have grown over 5 percent cumulatively, more than double their 2.1-percent total growth from the business cycle peak in 1980 to the business cycle peak in 2007—a sign of the remarkable progress made by American families in the current recovery after years of slow growth in wages.

6. Robust real wage growth and strong employment growth have translated into rising real incomes for households, with the largest gains going to low- and middle-income families. From 2014 to 2015, real median household income increased by $2,800, or 5.2 percent, the largest annual increase on record. Gains were even larger in the lower half of the income distribution, ranging from an increase of 5.5 percent for households at the 40th percentile to an increase of nearly 8 percent for households at the 10th percentile. While households in the top half of the income distribution also saw increases, their gains were smaller, with an increase of 2.9 percent at the 90thpercentile of household income. Growth in both real wages and employment in 2016 point to continued gains in real incomes for American households.

7. On net, essentially all of the increase in employment over the recovery has been in full-time jobs. As measured by the household survey, U.S. employment reached a trough in December 2009. Since then, full-time employment has increased by 13.7 million. In contrast, part-time employment has increased by just 420,000 over the course of the recovery.

8. Broader measures of labor underutilization have also steadily improved, and all but one are below their pre-recession averages. The headline unemployment rate, the U-3 rate, includes unemployed persons who have looked for work in the last four weeks. Broader measures of labor underutilization each include a progressively larger group of individuals: U-4 counts discouraged workers in addition to the unemployed, U-5 adds in others who are marginally attached to the labor force, and U-6 also includes people working part-time who would prefer a full-time job (“part-time for economic reasons”). Like the headline unemployment rate, all of these measures saw large increases during the recession, with the U-6 rate in particular reaching a record high. However, U-3, U-4, and U-5 all recovered fully to their respective pre-recession averages in the summer of 2015 and have fallen further since. As of December, the U-6 rate was just 0.1 percentage point above its pre-recession average.

9. Real average hourly wages have risen in every major industry over the current business cycle—and in nearly all, the pace of increase has been faster than in the previous cycle. Since the beginning of the current business cycle, real wages for non-managerial workers have grown at an average rate of 0.8 percent a year. However, this average masks considerable variation in real wage growth among workers in different industries. As the chart below shows, workers in all major sectors have seen real increases in their hourly earnings, ranging from average gains of 0.1 percent a year for workers in the transportation and warehousing industry to gains of 1.7 percent a year for workers in the financial activities sector. For nearly all major industries, real wage gains so far in the current business cycle have outpaced gains in the 2000s business cycle.

10. Unemployment rates for all major demographic groups have recovered to below their respective pre-recession averages, though more work remains to close longstanding disparities in the labor market. The unemployment rates for African Americans and Hispanic Americans peaked at 16.8 percent and 13.0 percent, respectively, after experiencing larger percentage-point increases from their pre-recession averages than the overall unemployment rate did. By mid-2015, both the African-American and Hispanic-American unemployment rates had recovered to their respective pre-recession averages. Similarly, the unemployment rates for white Americans and for Asian Americans, which have historically tended to be lower than the overall unemployment rate, have more than recovered to their pre-recession averages. Still, the fact that the unemployment rates for African Americans and Hispanic Americans are much higher than the overall unemployment rate is a reminder that much more work remains to ensure that the benefits of the strong labor market are shared among all Americans, including through efforts like the My Brother’s Keeper initiative.

11. Initial claims for unemployment insurance (UI) have been below 300,000 for 96 consecutive weeks, the longest such streak since 1970. During the Great Recession, claims for unemployment insurance—which are an important leading indicator of recessions—rose sharply to near-record highs. However, they have since declined to well below their pre-recession average, and average weekly initial claims in 2016 were the lowest of any calendar year since 1973. Still, the share of unemployed workers eligible for unemployment insurance has fallen in recent years, in part as a result of reductions in coverage within States’ UI programs. A number of reforms—including several in the President’s Fiscal Year 2017 Budget—would build on the strengths of the UI system to ensure that it both provides effective assistance for those who lose a job through no fault of their own and helps to stabilize the U.S. economy during future downturns.

12. Two-thirds of States have seen their unemployment rates fall below their pre-recession averages. There was extremely wide variation in the effect of the Great Recession on unemployment rates across States and the District of Columbia, with increases ranging from nearly 200 percent (Nevada) to just 13 percent (Alaska) of their respective pre-recession averages. As of November 2016, however, 34 States and the District of Columbia have seen their unemployment rates recover fully, with a number of States seeing unemployment rates substantially below their pre-recession averages. The sixteen States that still have elevated unemployment rates include the six that saw the largest percentage increases in their unemployment rates in the recession.

13. Since 2010, the United States has put more people back to work than all the other G-7 economies combined. The rebound of the U.S. economy from the Great Recession occurred much faster than in most other advanced economies and compares favorably with the historical record of countries recovering from systemic financial crises. As shown in the chart below, the United States has been responsible for a disproportionate share of employment growth in the G-7 economies during the recovery. Although the United States comprises about two-fifths of total employment in the G-7, it has been responsible for more than 55 percent of the net employment growth since 2010, a further sign of the strength and resilience of the U.S. economy and the importance of the policies of the last eight years in putting it on a sounder footing.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.