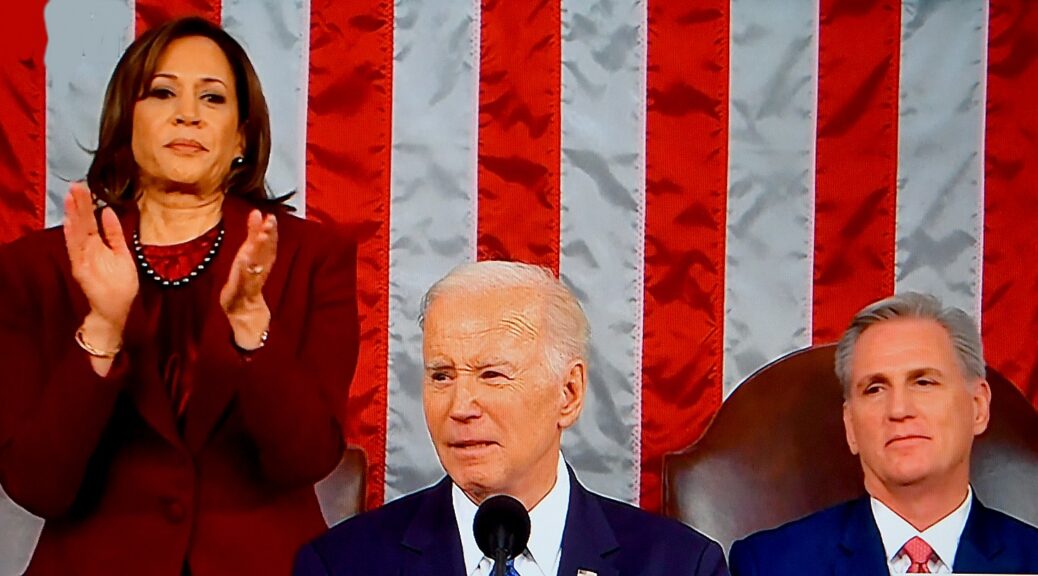

The White House released a fact sheet detailing President Biden’s proposed budget, aimed at investing in America, lowering costs for working class and middle class families, cutting taxes for working families, and protecting and strengthening Medicare and Social Security. It demonstrates the president’s long-held values that seeks to achieve stable, sustainable economy that grows from the bottom up and the middle out.

President Biden has long believed that we need to grow the economy from the bottom up and middle out, not the top down. Over the past two years, in the face of significant challenges, that economic strategy has produced historic progress for the American people.

Under the President’s leadership, the economy has added more than 12 million jobs—more jobs in two years than any president has created in a four-year term—including 800,000 manufacturing jobs. The unemployment rate has fallen to 3.4 percent, the lowest in 54 years. The Black and Hispanic unemployment rates are near record lows. The past two years were the best two years for new small business applications on record. The President has taken action to lower costs and give families more breathing room, including cutting prescription drug costs, health insurance premiums, and energy bills, while driving the uninsured rate to historic lows. And the President’s plan is rebuilding America’s infrastructure, making the economy more competitive, investing in American innovation and industries that will define the future, and fueling a manufacturing boom that is strengthening parts of the country that have long been left behind while creating good jobs for workers, including those without college degrees.

The President has done all of this while delivering on his commitment to fiscal responsibility. While the previous Administration passed a nearly $2 trillion unpaid-for tax cut with benefits skewed to the wealthy and big corporations while dramatically increasing the deficit, President Biden cut the deficit by more than $1.7 trillion during his first two years in office—the largest decline in American history. And the reforms he signed into law to take on Big Pharma, lower prescription drug costs, and make the wealthy and large corporations pay their fair share will reduce the deficit by hundreds of billions of dollars more over the coming decade.

The President’s Budget details a blueprint to build on this progress, deliver on the agenda he laid out in his State of the Union, and finish the job: continuing to grow the economy from the bottom up and middle out by investing in America, lowering costs for families, protecting and strengthening Medicare and Social Security, and reducing the deficit by nearly $3 trillion over the next decade by making the wealthy and big corporations pay their fair share and cutting wasteful spending on Big Pharma, Big Oil, and other special interests. No one earning less than $400,000 per year will pay a penny in new taxes.

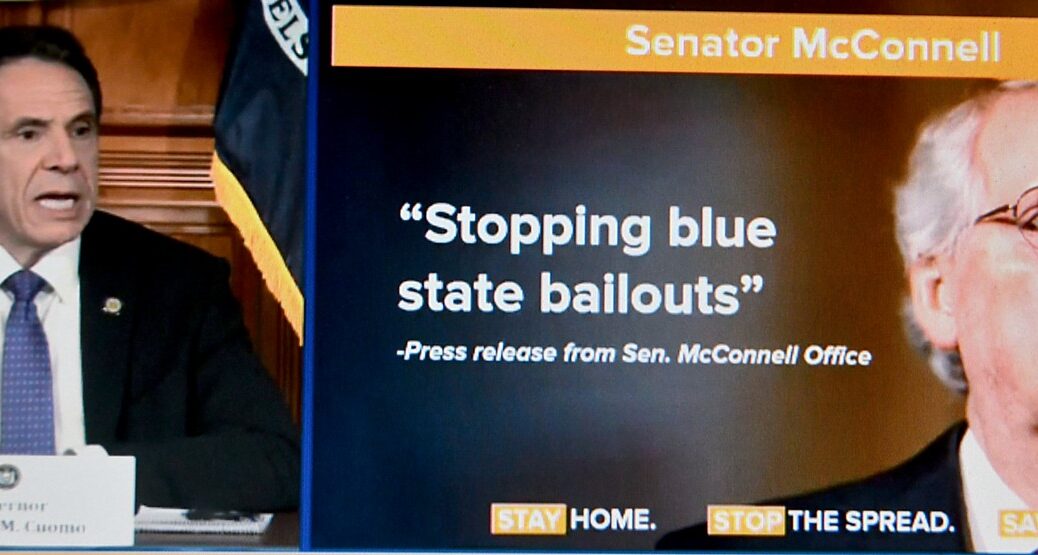

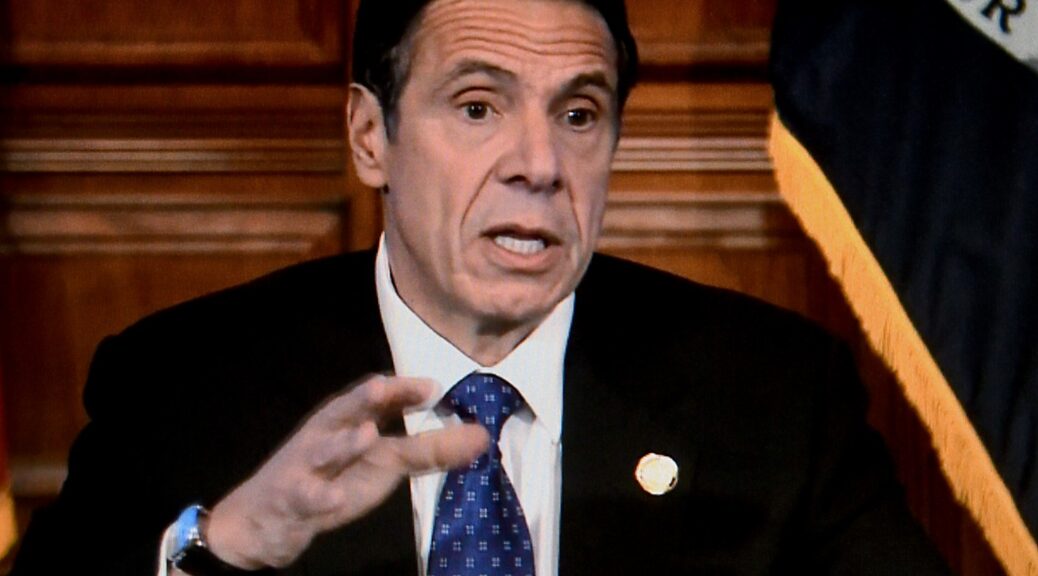

Congressional Republicans have taken a very different approach. While they have consistently said that reducing the deficit is a top priority, Congressional Republicans have already proposed policies that would add an additional $3 trillion to the debt over the next decade—all while raising costs for working families and handing out tax giveaways to the wealthy and big corporations. As the President has made clear, they owe the American people a detailed accounting of exactly what they plan to cut in order to cover the costs of their proposals, while also achieving the kinds of fiscal targets that they claim to support. Until they produce a plan, we’re left to rely on a wide array of Republican budgets, statements, and proposals—past and present—which provide clear and consistent evidence that many critical programs the American people count on will be on the chopping block.

Lowering Costs and Giving Families More Breathing Room

As our economy transitions from a historically strong recovery to stable and steady growth, the President has remained laser-focused on continuing to lower costs for families and giving them more breathing room, without giving up the historic economic gains we’ve made. While more work remains, there are clear signs that the President’s strategy is working. Annual inflation is lower than it was seven months ago, gas prices are down $1.60 per gallon since their peak last summer, and unemployment remains at its lowest level in 54 years, while take home pay has gone up. And the Biden-Harris Administration has taken historic action to lower the costs of health care, clean energy, and prescription drugs, eliminate junk fees that make it harder for families to make ends meet, promote greater competition to lower costs, and address pandemic-driven supply chain bottlenecks. While some Congressional Republicans have proposed repealing the Inflation Reduction Act and taken other actions that would raise costs for working families, the President’s Budget takes a very different approach—proposing a package of policies to continue lowering everyday costs for the American people.

Cuts Taxes for Families with Children and American Workers. The President is calling for the restoration of the full Child Tax Credit enacted in the American Rescue Plan, which cut child poverty in half in 2021, to the lowest level in history. The Budget would expand the credit from $2,000 per child to $3,000 per child for children six years old and above, and to $3,600 per child for children under six. The Budget would also permanently reform the credit to make it fully refundable. The President also calls on the Congress to make the Earned Income Tax Credit expansion for childless workers permanent, which would help pull low-paid workers out of poverty.

Lowers Health Care Costs. The President believes that health care should be a right, not a privilege. With enrollment in affordable health coverage at an all-time high, the Budget builds on the remarkable success of the Affordable Care Act (ACA), by making permanent the average $800 per year premium cuts through expanded premium tax credits that the Inflation Reduction Act extended. It also provides Medicaid-like coverage to individuals in States that have not adopted Medicaid expansion under the ACA, paired with financial incentives to ensure States maintain their existing expansions.

Reduces Prescription Drug Costs for All Americans. The Budget builds upon the Inflation Reduction Act to continue lowering the cost of prescription drugs. For Medicare, this includes further strengthening the newly established negotiation power by extending it to more drugs and bringing drugs into negotiation sooner after they launch. The Budget also proposes to limit Medicare Part D cost-sharing for high-value generic drugs used for certain chronic conditions like hypertension and high cholesterol to no more than $2. For Medicaid, the Budget includes proposals to ensure Medicaid and CHIP programs are prudent purchasers of prescription drugs, authorizing HHS to negotiate supplemental drug rebates on behalf of interested States in order to pool purchasing power. For the commercial market, the Budget includes proposals to curb inflation in prescription drug prices and cap the prices of insulin products at $35 for a monthly prescription.

Expands Access to Quality, Affordable Health Care. The Budget invests $150 billion over 10 years to improve and expand Medicaid home and community-based services, such as personal care services, which would allow seniors and individuals with disabilities to remain in their homes and stay active in their communities as well as improve the quality of jobs for home care workers. And because community health centers—which provide comprehensive services regardless of ability to pay—serve one in three people living in poverty and one in five rural residents, the Budget puts the Health Center Program on a path to double its size and expand its reach. To bolster the health care workforce, the Budget provides a total of $966 million in 2024 to expand the National Health Service Corps, which provides loan repayment and scholarships to health care professionals in exchange for practicing in underserved areas, and a total of $350 million to expand programs that train and support the nursing workforce.

Expands Access to Affordable, High-Quality Early Child Care and Learning. Too many families across America cannot access high-quality, affordable child care—preventing parents from working and holding back our entire economy. The President’s Budget enables states to increase child care options for more than 16 million young children and lowers costs so that parents can afford to send their children to high-quality child care. The Budget also funds a Federal-State partnership that provides high-quality, universal, free preschool to support healthy child development and ensure children enter kindergarten ready to succeed.

Lowers Housing Costs by Increasing Affordable Housing Supply and Expanding Access to Homeownership and Affordable Rent. The President believes that everyone deserves a safe and affordable place to live. To address the critical shortage of affordable housing in communities throughout the country that has exacerbated inflation, the Budget includes $59 billion in mandatory funding and tax incentives aimed at increasing the affordable housing supply, including for extremely low-income households. The Budget also includes $10 billion in mandatory funding to incentivize State, local, and regional jurisdictions to make progress in removing barriers to affordable housing developments, such as restrictive zoning. By expanding the supply of housing, the Budget would help prevent the kind of rapid increases in rental and homeownership costs we have seen in recent years. The Budget also includes $10 billion in mandatory funding for a new First-Generation Down Payment Assistance program to help address racial and ethnic homeownership and wealth gaps—making homeownership more attainable for Americans who have been locked out of the generational wealth building that can come with owning a home. And the Budget expands access to affordable rent through the Housing Choice Voucher (HCV) program to well over 200,000 additional households. In addition to assisting all current voucher recipients and providing new vouchers for tens of thousands of additional families, the Budget includes mandatory funding to support two populations that are particularly vulnerable to homelessness—guaranteed assistance for all 20,000 youth who age out of foster care annually and an incremental expansion to cover the 450,000 extremely low-income (ELI) veteran families nationwide.

Improves College Affordability and Expands Free Community College. The Budget proposes to increase the discretionary maximum Pell Grant by $500—helping more than 6.8 million students pay for college, building on successful bipartisan efforts to increase the maximum Pell Grant award by $900 over the past two years, and laying out a path to double the award by 2029. The Budget also invests mandatory and discretionary funding to expand free community college, and provides mandatory funding for two years of subsidized tuition for students from families earning less than $125,000 enrolled in a participating four-year Historically Black College or University (HBCU), Tribally-Controlled College or University (TCCU), or Minority-Serving Institution (MSI).

Lowers Home Energy and Water Costs. The Budget provides $4.1 billion for the Low Income Home Energy Assistance Program (LIHEAP), building on the $13 billion provided in the Inflation Reduction Act to reduce energy bills for families, expand clean energy, transform rural power production, and create thousands of good-paying jobs for people across rural America. Since the Low Income Household Water Assistance Program (LIHWAP) expires at the end of 2023, the Budget proposes to expand LIHEAP funding and allow States the option to use a portion of their LIHEAP funds to provide water bill assistance to low-income households.

Increases Food Security. As called for in the National Strategy on Hunger, Nutrition and Health, the Budget provides over $15 billion to allow more States and schools to leverage participation in the Community Eligibility Program and provide healthy and free school meals to an additional 9 million children. The Budget also includes $6.3 billion to support the 6.5 million individuals expected to participate in the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

Protecting and Strengthening Medicare and Social Security

The President has always believed that Medicare and Social Security are a promise—a rock-solid guarantee generations of Americans have counted on to be able to retire with dignity and security. The President will reject any efforts to cut the Medicare or Social Security benefits that seniors and people with disabilities have earned and paid into their entire working lives. The Budget honors that ironclad commitment—not only by rejecting benefit cuts, but by embracing reforms and investments that will protect and strengthen both programs. The President is committed to working with Congress to ensure Medicare and Social Security remain strong for their beneficiaries, now and in the future.

Protects and Strengthens Medicare. The Budget strengthens Medicare by extending the solvency of the Medicare Trust Fund by at least 25 years, without cutting any benefits or raising costs for beneficiaries. The Budget includes key reforms to the tax code to ensure high-income individuals pay their fair share into the Medicare HI trust fund. It also directs the revenue from the Net Investment Income Tax into the HI trust fund as was originally intended. Finally, the Budget directs the savings from the Budget’s proposed Medicare drug reforms into the HI trust fund.

Protects the Social Security Benefits that Americans Have Earned. The Administration is committed to protecting and strengthening Social Security and opposes any attempt to cut Social Security benefits for current or future recipients. The Administration looks forward to working with the Congress to responsibly strengthen Social Security by ensuring that high-income individuals pay their fair share. The Budget also invests in staff, information technology, and other improvements at the Social Security Administration, providing an increase of $1.4 billion, a 10 percent increase, over the 2023 enacted level. These funds would improve customer service at Social Security Administration field offices, State disability determination services, and teleservice centers for retirees, individuals with disabilities, and their families.

Growing the Economy from the Bottom up and Middle Out by Investing in America and Its People

The Budget proposes smart, targeted investments to grow the economy from the bottom up and middle out, not the top down, by investing in America and its people—investing in the foundations of our country’s economic strength; confronting the climate crisis while creating clean energy jobs; and advancing equity, dignity, and opportunity and strengthening our democracy.

Investing in the Foundations of Our Economic Strength

Invests in American Manufacturing. The Budget provides $375 million for the National Institutes of Standards and Technology’s (NIST) Industrial Technology Services to support the progress of NIST’s existing manufacturing institute, fund a new institute to be launched in 2023, and promote domestic production of institute-developed technologies. The Budget also includes $277 million for the Manufacturing Extension Partnership, a public-private partnership that offers advisory services to small and medium enterprises.

Makes Historic Investments in Innovation and Cutting-Edge Research. The Budget provides almost $21 billion in discretionary spending for CHIPS and Science Act-authorized activities. This funding includes $1.2 billion for the CHIPS and Science Act-authorized Directorate for Technology, Innovation, and Partnerships to help accelerate and translate scientific research into innovations, industries, and jobs, as well as $300 million for NSF’s Regional Innovation Engines program to galvanize use-inspired research, technology translation, and workforce development. Within DOE’s Office of Science, the Budget also supports cutting-edge research in artificial intelligence, quantum information sciences, microelectronics, and isotope production at the national laboratories and universities. In addition, the Budget requests $4 billion in new mandatory funding for the Regional Technology and Innovation Hub Program at the Economic Development Administration. And the Budget provides $210 billion for Federal research and development, an historic level of investment in American science, technology and innovation.

Provides National, Comprehensive Paid Family and Medical Leave and Calls for Paid Sick Leave for All Workers. Workers power our economy—and when they thrive, our economy thrives. The Budget proposes to establish a national, comprehensive paid family and medical leave program, providing up to 12 weeks of leave to allow eligible workers to take time off to care and bond with a new child; care for a seriously ill loved one; heal from their own serious illness; address circumstances arising from a loved one’s military deployment; or find safety from domestic violence, sexual assault, or stalking. The President also calls on Congress to require employers to provide seven job-protected paid sick days each year to all workers.

Expands Workforce Training that Provides Pathways to Good Jobs. The Budget invests in evidence-based training models to ensure all workers—including women, workers of color, and workers in rural areas—have the skills they need for the good jobs being created by the President’s historic legislative accomplishments. The Budget invests $335 million in Registered Apprenticeship, an earn-and-learn model, to provide debt-free pathways to careers in construction, clean energy, semiconductor manufacturing, and other in-demand industries. The Budget also provides $200 million for the new Sectoral Employment through Career Training for Occupational Readiness (SECTOR) program, which will support development and expansion of public-private partnerships to equitably deliver high-quality training in growing industries, and invests $100 million to help community colleges partner with employers and the public workforce system to design and deliver effective training models in communities across the Nation.

Invests in High-Poverty Schools. The Budget provides $20.5 billion for Title I, a $2.2 billion increase above the 2023 enacted level, delivering critical funding to 90 percent of school districts across the Nation and helping them provide students in low-income communities the academic opportunities and support they need to succeed. This increase in funding addresses chronic funding gaps between high-poverty schools—which disproportionately serve students of color—and their wealthier counterparts.

Taking Historic Action to Cut Energy Bills for Families and Confront the Climate Crisis While Creating Clean Energy Jobs Across America

Cuts Energy Bills for Families and Creates Jobs Building Clean Energy Infrastructure. The Budget invests $4.5 billion in clean energy across America, bringing jobs to rural communities and cities, leaving no one behind. The Budget supports clean energy workforce development and sustainable infrastructure projects across the country, including $1.8 billion to weatherize and retrofit low-income Americans’ homes, and $83 million to electrify Tribal homes and transition Tribal Colleges and universities to renewable energy.

Makes Historic Investments in Science & Research to Continue to Cut the Cost of Clean Energy. To boost American innovation and sustain American leadership in research and scientific discovery, the Budget also provides a historic investment of $16.5 billion in climate science and clean energy innovation. The Budget includes $3.5 billion of the $8.8 billion total for DOE’s Office of Science and $1.6 billion at NSF, and makes advancements toward the CHIPS and Science Act authorizations, including $1 billion for fusion, the largest ever investment in the promise of a clean energy power source.

Cuts Global Warming Pollution. The Budget invests in reducing global warming pollution and achieving the President’s target to cut greenhouse gas emissions 50-52 percent by 2030. These investments include an additional $64.4 million at EPA to implement the American Innovation and Manufacturing (AIM) Act and continue phasing out potent greenhouse gases known as hydrofluorocarbons (HFCs). The Budget supports $1.2 billion in DOE industrial decarbonization activities.

Helps Increase Climate Resilience and Bolsters Conservation. The Budget invests more than $24 billion to help build communities’ resilience to floods, wildfires, storms, extreme heat, and drought brought on by climate change, expand conservation and ecosystem management, strengthen America’s natural disaster response capabilities, increase the resilience of rural housing to the impacts of climate change while reducing rent burdens, and ensure the resilience of our nation’s defense to climate change.

Advances Equity and Environmental Justice. The Administration continues to prioritize efforts to deliver environmental justice in communities across the United States, including meeting the President’s Justice40 Initiative to ensure that 40 percent of the overall benefits of Federal investments in climate and clean energy reach disadvantaged communities, including rural and Tribal communities. The Budget bolsters these efforts by investing nearly $1.8 billion at EPA across numerous programs that will support securing environmental justice for communities that bear the brunt of toxic pollution and climate change. The Budget also provides EPA $219 million to help remediate lead contamination in water, an increase of $163 million over the 2023 enacted level.

Increases Global Energy Security, Infrastructure, and Resilience. The Budget supports the President’s pledges to more than quadruple international climate finance and to provide more than $3 billion for the President’s Emergency Plan for Adaptation and Resilience (PREPARE). This includes a $1.6 billion contribution to the Green Climate Fund and a $1.2 billion loan to the Clean Technology Fund. The Budget also advances new tools, such as loan guarantees, to re-assert U.S. leadership in the Indo-Pacific to finance energy security and infrastructure projects and reduce reliance on volatile energy supplies and prices.

Expanding Access to High-Quality Health Care and Improving Health Outcomes

Advances Maternal Health and Health Equity. The United States has the highest maternal mortality rate among developed nations, and rates are disproportionately high for Black and American Indian and Alaska Native women. The Budget includes $471 million to reduce maternal mortality and morbidity rates; expand maternal health initiatives in rural communities; implement implicit bias training for health care providers; create pregnancy medical home demonstration projects; and address the highest rates of perinatal health disparities, including by supporting the perinatal health workforce. In addition, the Budget requires all States to provide continuous Medicaid coverage for 12 months postpartum, eliminating gaps in health insurance at a critical time.

Advances Cancer Moonshot Goals. The Cancer Moonshot aims to reduce the cancer death rate by at least 50 percent over the next 25 years and improve the experience of people who are living with or have survived cancer, their families, and caregivers. The Budget includes $1.7 billion for dedicated Cancer Moonshot activities across the Department of Health and Human Services (HHS), in addition to targeted investments at the Departments of Veterans Affairs, Defense, Agriculture, and other Cancer Cabinet agencies, and a total investment of $7.8 billion at the National Cancer Institute (NCI) to drive progress on ways to prevent, detect, and treat cancer. The Budget also provides an increase of $1 billion for the Advanced Research Projects Agency for Health (ARPA-H), for a total of $2.5 billion, to drive innovative health research and speed the implementation of breakthroughs that would transform the treatment, prevention, and early detection of cancer and other diseases.

Transforms Behavioral Health Care. The United States is facing a mental health crisis. While recently enacted legislation takes significant steps to address this crisis, much more can be done. For people with private health insurance, the Budget expands coverage of mental health benefits and strengthens the network of behavioral health providers. For people with Medicare, the Budget lowers patients’ costs for mental health services, requires parity in coverage between behavioral health and medical benefits, and expands coverage for behavioral health providers. The Budget provides historic investments in the behavioral health workforce, youth mental health care, Certified Community Based Behavioral Health Clinics, Community Mental Health Centers, and mental health research.

Making Our Communities Safer, Advancing Equity and Opportunity, and Strengthening American Democracy

Invests in Federal Law Enforcement, Community Violence Interventions, and Prevention to Combat Gun Violence and Other Violent Crime. The Budget continues to fund the President’s comprehensive Safer America Plan, including funding to put 100,000 additional police officers on our streets for accountable, community-oriented policing; $19.4 billion over 10 years for crime prevention strategies; and $5 billion over 10 years for community violence interventions. The Budget also includes $17.8 billion for DOJ law enforcement, including a total of nearly $2 billion for the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) to expand multijurisdictional gun trafficking strike forces with additional personnel, increase regulation of the firearms industry, and implement the Bipartisan Safer Communities Act. The Budget also includes $1.9 billion for the U.S. Marshals Service to support personnel dedicated to fighting violent crime, as well as $51 million to the Federal Bureau of Investigation (FBI) to support the continued implementation of enhanced background checks required by the Bipartisan Safer Communities Act.

Prioritizes Efforts to End Gender-Based Violence. The Budget proposes $1 billion to support implementation of programs through the Violence Against Women Act of 1994 (VAWA), which was recently reauthorized and strengthened in 2022. The Budget supports substantial increases for longstanding VAWA programs, including key investments in legal assistance for victims, transitional housing, and sexual assault services. The Budget also includes $519 million for the Family Violence Prevention and Services (FVPSA) program and the National Domestic Violence Hotline to support domestic violence survivors—double the 2023 enacted level.

Advances Child and Family Well-Being in the Child Welfare System. The Budget proposes to expand and incentivize the use of evidence-based foster care prevention services to keep families safely together and reduce the number of children entering foster care. The Budget provides States with support to place more foster children with relatives or other adults who have an existing emotional bond with the children, while also providing additional funding to support youth who age out of care without a permanent caregiver. In addition, the Budget proposes to make the adoption tax credit refundable and to extend the credit to legal guardianships. This would reduce the financial burden on low- and moderate-income families wishing to pursue adoption, as well as for families who opt for legal guardianship.

Strengthens Our Democracy. To continue efforts to restore and strengthen American democracy, the Budget proposes $5 billion in new election assistance funding to be allocated over 10 years, $1.5 billion to support increasing the living allowance provided to AmeriCorps members so that national service is a more accessible pathway to success, and $73 million to support American history and civics education programs.

Keeping America Safe and Confronting Global Challenges

Even as he has taken decisive action to strengthen America at home, the President has worked with allies and partners to confront pressing global challenges. The Budget builds on that progress through proposals to continue addressing threats to global security and strengthening the U.S. military, addressing pressing global challenges, strengthening border security and the U.S. immigration system, and honoring America’s commitment to veterans, servicemembers, families, caregivers, and survivors.

Supports Ukraine, European Allies, and Partners. The Budget continues support for Ukraine, the United States’ strong alliance with the states of the North Atlantic Treaty Organization (NATO), and other European partner states by prioritizing funding to enhance the capabilities and readiness of U.S. forces, NATO allies, and regional partners in the face of continued Russian aggression.

Invests in New Ways to Out-Compete China and Deepens Alliances and Partnerships in the Indo-Pacific. China is the United States’ only competitor with both the intent to reshape the international order and, increasingly, the economic, diplomatic, military, and technological power to do it. During these unprecedented and extraordinary times, the Budget requests both discretionary and mandatory resources to out-compete China and advance American prosperity globally. The mandatory proposal will strengthen the U.S. role in the Indo-Pacific, and advance the U.S. economy by investing $2 billion to create a new International Infrastructure Fund to support “hard” critical infrastructure; $2 billion to create a new equity revolving fund at the U.S. International Development Finance Corporation to support equity investments; and $2 billion to make game-changing investments in the Indo-Pacific to strengthen partner economies and support their efforts in pushing back against predatory efforts. As part of this mandatory proposal, the Budget also requests a total of $7.1 billion over the next 20 years for the Compacts of Free Association with the Freely Associated States of the Marshall Islands, Micronesia, and Palau.

Promotes Integrated Deterrence in the Indo-Pacific and Globally. The Budget prioritizes China as America’s pacing challenge in line with the 2022 National Defense Strategy. The Department of Defense’s 2024 Pacific Deterrence Initiative highlights $9.1 billion of targeted investments the Department is making to U.S. force posture, infrastructure, presence, and readiness as well as efforts to bolster the capacity and capabilities of U.S. allies and partners in the Indo-Pacific region.

Strengthens Democracy and Promotes Human Rights Globally. The Budget provides more than $3.4 billion to advance democratic governance and foster democratic renewal globally. The Budget would strengthen free and independent media, fight corruption, bolster democratic institutions, advance technology for democracy, promote gender equality and women’s civic and political participation, and defend free and fair elections and political processes.

Enhances Border Security and Immigration Enforcement. Strengthening border security and providing safe, lawful pathways for migration remain top priorities for the Administration. The Budget includes nearly $25 billion for U.S. Customs and Border Protection (CBP) and Immigration and Customs Enforcement (ICE). The Budget includes funds for CBP to hire an additional 350 Border Patrol Agents, $535 million for border technology at and between ports of entry, $40 million to combat fentanyl trafficking and disrupt transnational criminal organizations, and funds to hire an additional 460 processing assistants at CBP and ICE.

Expands Health Care, Benefits, and Services for Military Environmental Exposures. The PACT Act represents the most significant expansion of VA health care and disability compensation benefits for veterans exposed to burn pits and other environmental exposures in more than 30 years. As part of the PACT Act, the Congress authorized the Cost of War Toxic Exposures Fund (TEF) to fund increased costs above 2021 funding levels for health care and benefits delivery for veterans exposed to a number of environmental hazards—and ensure there is sufficient funding available to cover these costs without shortchanging other elements of veteran medical care and benefit delivery. The Budget provides $20.3 billion for the TEF in 2024, which is $15.3 billion above the 2023 enacted level.

Reducing Deficits by Nearly $3 Trillion by Making the Wealthy and Big Corporations Pay Their Fair Share and Cutting Wasteful Spending on Big Pharma, Big Oil, and Special Interests

After inheriting historically high deficits from the previous Administration, President Biden told the American people he would reduce the deficit, pay for his proposals, and ensure that no one making less than $400,000 a year would pay a penny more in new taxes. That’s exactly what he has done—and exactly what he will continue to do.

The President’s Budget builds on the record-breaking deficit reduction he achieved during his first two years in office. It more than fully pays for its investments, reduces deficits by nearly $3 trillion over the next decade by making the wealthy and big corporations pay their fair share and cutting wasteful spending on Big Pharma, Big Oil, and other special interests, and ensures that no one making less than $400,000 per year will pay a penny more in new taxes.

The Budget reflects the President’s ironclad belief that we need a tax system that rewards work, not wealth—and that ensures the wealthiest Americans and biggest corporations don’t pay lower tax rates than teachers or firefighters. That’s in sharp contrast with Congressional Republicans, who in recent months have proposed policies that would add $3 trillion to the debt over the next decade while handing out tax giveaways to the wealthy and big corporations.

Building on the progress the President has already made to promote a fairer tax code, the Budget proposes additional reforms that would ensure the wealthy and corporations pay their fair share while cutting wasteful spending on Big Pharma, Big Oil, and other special interests.

Proposes a Minimum Tax on Billionaires. The tax code currently offers special treatment for the types of income that wealthy people enjoy. While the wages and salaries that everyday Americans earn are taxed as ordinary income, billionaires make their money in ways that are taxed at lower rates, and sometimes not taxed at all. This special treatment, combined with sophisticated tax planning and giant loopholes, allows many of the wealthiest Americans to pay lower rates on their full income than many middle-class households pay. To finally address this glaring problem, the Budget includes a 25 percent minimum tax on the wealthiest 0.01 percent.

Ensures Corporations Pay Their Fair Share. The Budget includes an increase to the rate that corporations pay in taxes on their profits. Corporations received an enormous tax break in 2017, cutting effective U.S. tax rates for U.S. corporations to a low of less than 10 percent. While their profits soared, their investment in the economy did not. Their shareholders and top executives reaped the benefits, without the promised trickle down to workers, consumers, or communities. The Budget would set the corporate tax rate at 28 percent, still well below the 35 percent rate that prevailed prior to the 2017 tax law. This tax rate change is complemented by other proposals to incentivize job creation and investment in the United States and ensure large corporations pay their fair share.

Stops the Race to the Bottom in International Corporate Tax and End Tax Breaks for Offshoring. For decades, countries have competed for multinational business by slashing tax rates, at the expense of having adequate revenues to finance core services. Thanks in part to the Administration’s leadership, more than 130 nations signed on to a global tax framework to finally address this race to the bottom. Building on that framework, the Budget proposes to reform the international tax system to reduce the incentives to book profits in low-tax jurisdictions, stop corporate inversions to tax havens, and raise the tax rate on U.S. multinationals’ foreign earnings from 10.5 percent to 21 percent. These reforms will ensure that profitable multinational corporations pay their fair share.

Quadruples the Stock Buybacks Tax. Last year, the President signed into law a surcharge on corporate stock buybacks, which reduces the differential tax treatment between buybacks and dividends and encourages businesses to invest and grow as opposed to funneling tax-preferred profits to foreign shareholders. The Budget proposes quadrupling the stock buybacks tax from one percent to four percent to address the continued tax advantage for buybacks and encourage corporations to invest in productivity and the broader economy.

Repeals Trump Tax Cuts for the Wealthy and Reform Capital Gains Tax to Ensure the Wealthy Pay Their Fair Share. The 2017 tax law lowered rates for the wealthiest Americans, delivering massive tax cuts to the top one percent. The Budget repeals the Trump tax cuts for the highest-income Americans, restoring the top tax rate of 39.6 percent for single filers making more than $400,000 a year and married couples making more than $450,000 per year. It also proposes taxing capital gains at the same rate as wage income for those with more than $1 million in income and finally closes the carried interest loophole that allows some wealthy investment fund managers to pay tax at lower rates than their secretaries.

Cuts Wasteful Spending on Big Pharma, Big Oil, and Other Special Interests, Combats Fraud, and Makes Programs More Efficient. The Budget puts forward reforms that cut wasteful spending on Big Pharma, Big Oil, and other special interests, crack down on fraud, and strengthen program integrity—saving taxpayers hundreds of billions of dollars. For example, the Budget cuts Federal spending by $160 billion—and saves billions of dollars for seniors—by increasing the number of drugs Medicare can select for negotiation and bringing more drugs into the negotiation process sooner, building on the Inflation Reduction Act’s reforms. It also includes a package of reforms to crack down on systemic fraud—combatting identity theft and other fraud in Unemployment Insurance, increasing funding for the Anti-Pandemic Fraud Strike Force, and investing in Inspectors General.