By Karen Rubin, News& Photo Features

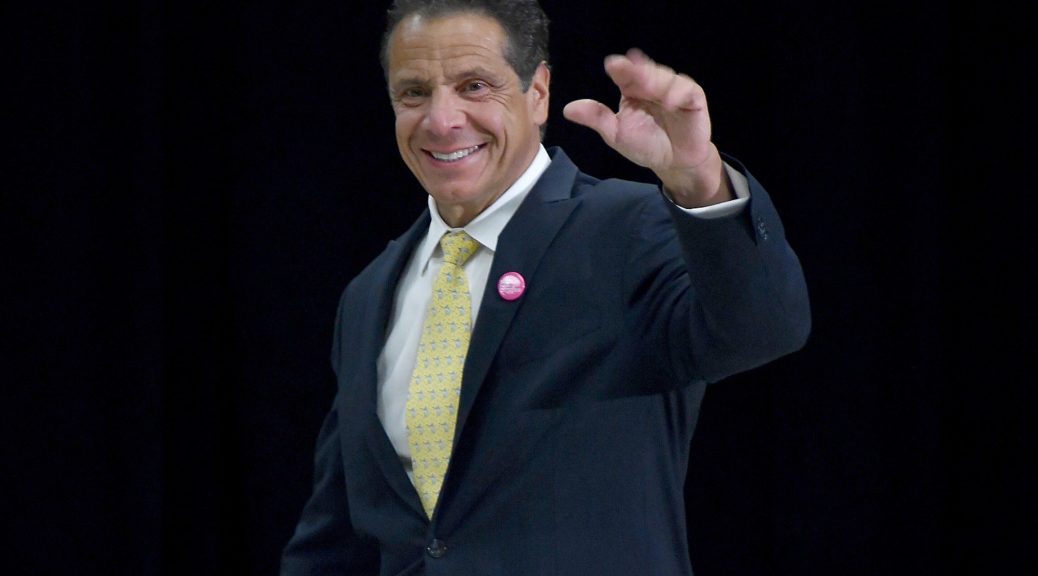

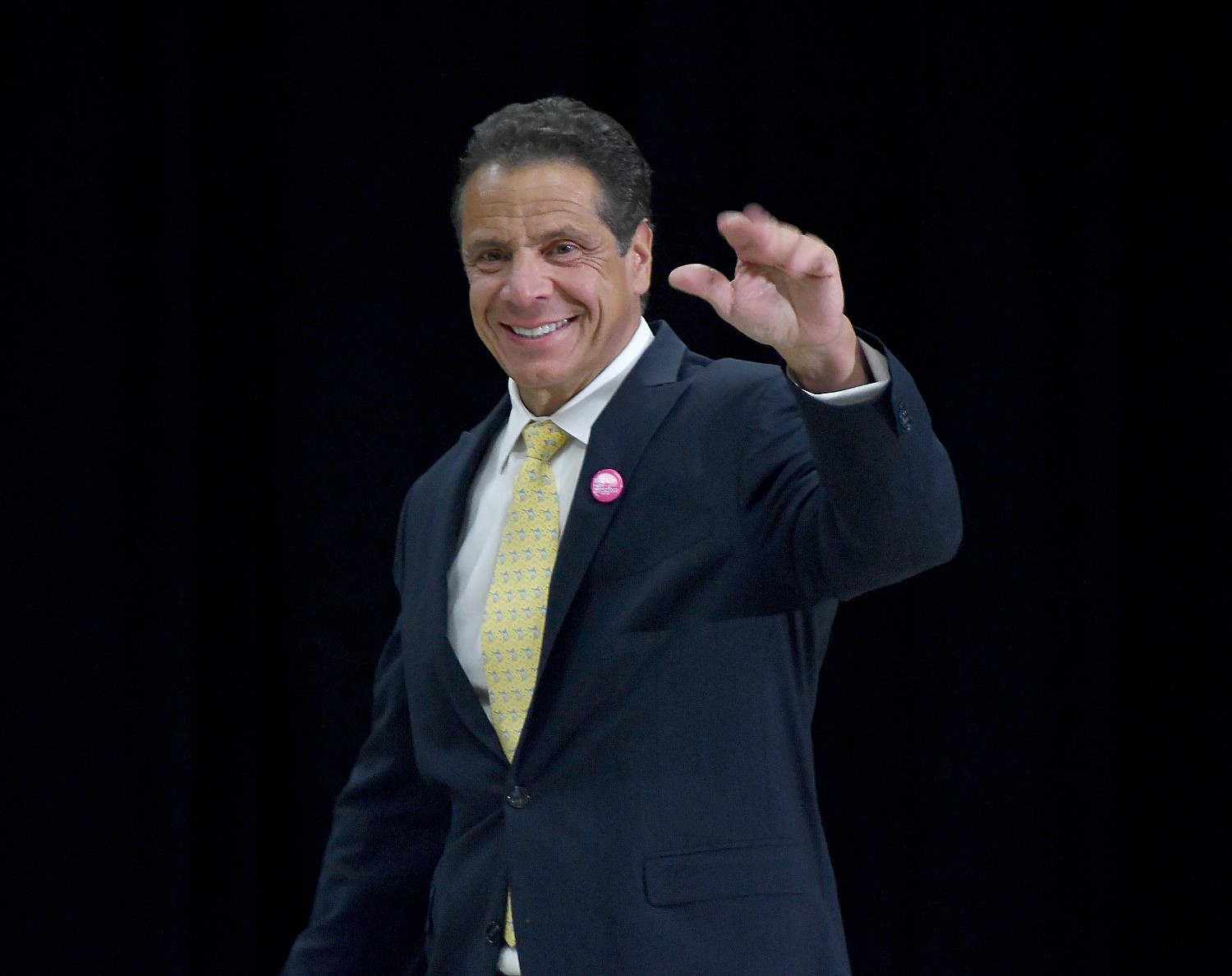

New York State Governor Andrew Cuomo has said he won’t sign the state budget unless it makes permanent the property tax cap.

“The highest tax in the state is the property tax and it is a killer,” Governor Cuomo said.”We want to reduce economic pressure on families by making sure government is not aggravating the problem with increased expenses. We’re going to cut your state income tax and we’re going to cap your property taxes so you know it’s not going higher than 2 percent. And I will tell you this as sure as I am before you today: if we do not have the permanent property tax cap in that state budget, this hand will never sign that state budget until it’s in there.”

From the very beginning, I have objected to this trampling off local control with an arbitrary and unreasonable constraint designed to hamstring and ultimately destroy local governments. Cuomo’s original intent was to force school districts and other local governments to cannibalize their reserve funds; the second was to force consolidation and dissolution of local governments and the third was to use local taxes as the bogeyman, so politicians could appear to be on the side of taxpayers.

Of course the property tax is the largest state tax and of course school taxes are the largest component. Something has to be “largest”. What should be? But local property taxes are spent where they are used, and local people have the greatest ability to participate in spending decisions. In fact, school and library taxes are the only taxes we taxpayers directly vote.

What the property tax cap does, though, is remove local control. Communities should have the right to decide if they want to improve their schools or parks. The property tax cap which basically keeps the annual increase to 2% or the rate of inflation whichever is less says: we don’t want any growth or improvement or new investment in your community. We want the status quo, and if that means deterioration, so be it. (Little known fact: the property tax cap incentivizes bonding because the debt service isn’t counted toward the cap.)

Somehow, and fairly ingeniously I think, the Great Neck Public School district has managed to continue to be among the best in the country and still average only 1.8 percent increase in the tax levy since the property tax cap was implemented in 2012, despite increasing enrollments and unfunded state mandates. This year, though, through the complicated formula, the school district could have raised taxes by 4.09 percent and still fall within the cap, is only seeking 1.94 percent increase. .

I resent the property tax cap by which the Governor and state legislators can declare themselves champions of reducing or controlling taxes.

But here’s the thing: New York State’s property taxes are not the highest in the nation; Nassau County’s taxes are not the highest; and both of these do not take into account that Long Island and New York’s incomes and our housing values are higher.

According to a survey by Wallethub, a financial services company, New York State ranks 8th (not first) in property taxes. New York ranks 43rd in its real estate tax rate, at 1.68 percent. You know which states are higher? Nebraska (1.80), Texas (1.83), Vermont (1.83), Wisconsin (1.94), Connecticut (2.07), New Hampshire (2.20), Illinois (2.31), and New Jersey (2.44) (See the study: https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/)

Even so, do you want to be Alabama, which is #2 on the list for lowest taxes, where the median home value is $132,000 and the tax is $558 (0.42%), or Louisiana, #3, where the median home value is $152,900 and median tax is $795 (0.52%)? Louisiana ranks 51st in health care, Alabama is 48th. New York is 17th (fourth most physicians per capita)

USA Today ranks New York’s public education 9th noting, “Between 2003 and 2015, the achievement gap between eighth graders living in poverty and their wealthier peers narrowed by the largest amount of all states…Annual public school funding totals $18,665 per pupil in New York, the third highest expenditure of all states.” (Top three are Massachusetts, New Jersey and Vermont). Alabama ranks 43rd (14th lowest in public school spending at $10,142). Louisiana is 46th, Mississippi is 48th.

Yes, total taxes are high: New Yorkers spend 17.07 percent of income on taxes, second highest after Connecticut (17.65 percent). But New York State is spending billions on a 21st century infrastructure and racing toward 50:50 clean energy by 2030. This is where I want to live. So do 20 million others, a number that is increasing, even as unemployment rates are at the lowest ever and the number of jobs is at an all-time high.

We pay a lot in taxes because our incomes are higher and our housing values are higher, what is more, we get more for our money, making for a higher quality of life.

The states that don’t charge an appropriate amount of state and local taxes – that is related to the cost of providing services and public investment – depend on federal handouts. New York is one of 11 states that send more money to the federal government than it gets back, in fact the #1 donor state, sending $36-$48 billion more to the federal government than it gets back. Alabama is 4th “most federally dependent state”; Louisiana is 10th.

New York sends the second highest amount in federal taxes, $133 billion (California sends $227 billion), and is fourth in the average amount of federal taxes per adult ($8,490), behind Connecticut $10,279), Massachusetts ($9,445), and New Jersey ($8,811).

(Here’s an idea: New York should do what tenants do in a landlord dispute and put that $36 billion into escrow until the SALT deductibility issue is fixed.)

But we shouldn’t be punishing our localities because of the criminality of Republicans to use the tax code as political weapon – according to State Comptroller Tom Dinapoli, the SALT deduction cap has driven down tax receipts by $2.3 billion, as wealthiest New Yorkers choose other places for primary residency.

But the tax cap is also a political weapon.

The larger objective is to eliminate local municipalities entirely – to force villages to consolidate into towns, towns into counties, school districts into larger school districts. But the fallacy in that is all that it saves is a few administrative positions. Villages and school districts already have cooperative purchasing, mutual aid; school districts even cooperate on transportation where feasible. Our school district spends 4 percent of its budget on administration, the lion’s share, 75 percent, on instruction (12 percent on building, grounds & capital projects, 6 percent on transportation). (To see where your schools spend every penny, come to Great Neck South High School this Saturday at 9:30 am for the line-by-line budget review.)

The state boasts that since implementation the tax cap has “saved” taxpayers $24.4 billion statewide – that works out to $1000 per capita, divided by 7 years, or $142 a year. I’m not sure that’s worth giving up local control.

But just as Cuomo and the Congressmembers decry Trump’s disparity in federal spending for blue states versus red states and the attack on state control over its ability to raise revenue and spend, it is the same thing with local spending: there is gigantic disparity in the level of state aid to school districts, with the result that New York City only has to raise 50 percent of its school budget from property taxes, while Great Neck, which gets just 4 percent from the state, has to raise 95 percent through property taxes. Here’s another measure: Roosevelt, with 3270 enrolled students, gets $53 million in state aid; Great Neck, with 6399 enrolled students, gets $10 million – the difference made up from property taxes. That’s just the way it is.

What the property tax cap means is that virtually all Great Neck’s school spending is governed by the cap; other districts have much less that is controlled by the tax cap.

The responsibility for determining if our elected representatives are properly handling our tax appropriations is on the community, not an arbitrarily selected cap enshrined in law.

We see what our school taxes (and park and library and sewer district) pay for and I don’t want the state – or some politician looking to score points – deciding we can’t have low class size or a robotics club or a fencing team or an opera performance (Great Neck South High marks its 50th anniversary full-scale opera production, April 12). This community has decided these things are just as important to our district’s mission of helping every child fulfill their full potential as cramming the latest incarnation of ELA and math or operating school buildings as if they were prisons. Our mission has been to instill a love of life-long learning. And the investment this community has made in public education has brought solid ROI day after day.

____________________

© 2019 News & Photo Features Syndicate, a division of Workstyles, Inc. All rights reserved. For editorial feature and photo information, go to www.news-photos-features.com, email [email protected]. Blogging at www.dailykos.com/blogs/NewsPhotosFeatures. ‘Like’ us on facebook.com/NewsPhotoFeatures, Tweet @KarenBRubin