Unfortunately for Donald Trump, whose candidacy depends upon economic suffering, the US economy continues to grow, in fact, Real GDP grew 2.9% in the third quarter, and exports grew at 10%, the fastest quarterly pace since 2013, while consumer spending continued to grow at a solid pace.

But with the disinformation campaign intact, which the Trump campaign sees as the only way to an increasingly elusive victory, Dan Kowalski, Trump’s Deputy Policy Director, stated, “America can do better than the modest growth of 2.9 percent recorded for the 3rd quarter and the dismal growth of 1.5 percent for the past year. Growth hasn’t risen above 3 percent for a full year in any year of the Obama presidency. Decades of strong economic growth and global leadership have been replaced with low-paying jobs, global chaos and a national debt that has doubled under Obama-Clinton.

“The single most important issue facing the American people is an economy that has failed to deliver jobs, incomes, and opportunity. The Trump economic plan creates at least 25 million jobs and 4 percent growth through tax, trade, energy and regulatory reforms.”

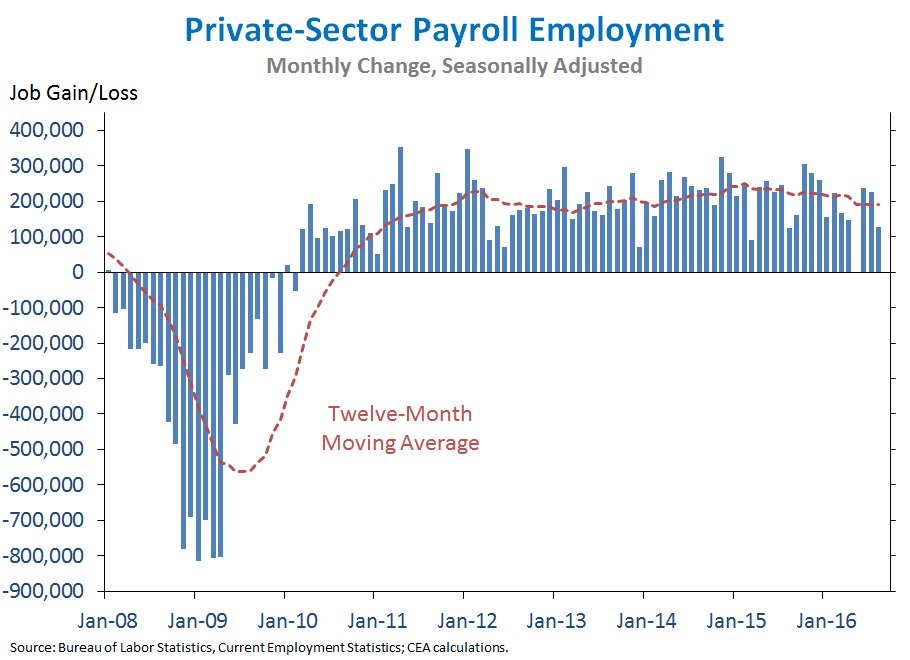

In contrast, Hillary for America Senior Policy Advisor Jacob Leibenluft stated: “Today’s GDP release shows economic growth at its fastest pace in two years. With more than 15 million jobs created since early 2010 and real median incomes growing more than 5 percent last year, it’s clear we’ve made real progress coming back from the crisis. But Hillary Clinton believes there is still more we need to do to build an economy that works for everyone, not just those at the top. Independent experts agree her plan would create good-paying jobs through investments in infrastructure, innovation and education. Donald Trump, on the other hand, would take us backwards, with experts across the political spectrum warning his plans would risk another recession and cost jobs.”

Jason Furman, Chairman of the Council of Economic Advisers, issued the following statement today on the advance estimate of GDP for the third quarter of 2016. You can view the statement HERE.

Summary: Real GDP grew 2.9 percent at an annual rate in the third quarter, with strong export growth and continued strength in consumer spending.

The economy grew 2.9 percent at an annual rate in the third quarter of 2016, a noticeably faster pace than in the first half of the year. Exports, which have faced significant headwinds in recent years from slow growth abroad, grew at an annual rate of 10.0 percent in the third quarter, their fastest quarterly pace since 2013. Consumer spending continued to grow at a solid pace in the third quarter, while inventory investment (one of the most volatile components of GDP) boosted GDP growth after subtracting from it in the prior five quarters. In contrast to the pattern of recent quarters, business fixed investment also contributed positively to GDP growth, though it continues to be restrained by slower global growth. But more work remains to strengthen economic growth and ensure that it is broadly shared, and the President will continue to take steps to promote greater competition across the economy, including in the labor market; support innovation; and call on Congress to increase investments in infrastructure and to pass the high-standards Trans-Pacific Partnership.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS (BEA)

- Real Gross Domestic Product (GDP) increased 2.9 percent at an annual rate in the third quarter of 2016, according to BEA’s advance estimate. Consumer spending grew 2.1 percent in the third quarter following its strong second-quarter growth of 4.3 percent, with continued solid growth in durable goods spending and a contraction in nondurable goods spending. Inventory investment—one of the most volatile components of GDP—added 0.6 percentage point to GDP growth in the third quarter after subtracting 1.2 percentage point in the second quarter. Nonresidential fixed investment contributed positively to GDP growth for the second quarter in a row, due in large part to a pickup in structures investment growth (see point 4 below). Residential investment declined for the second quarter in a row, albeit at a slower pace in the third quarter than in the second quarter. Notably, exports grew 10.0 percent at an annual rate in the third quarter, its fastest quarterly growth since late 2013, despite continued headwinds from slow growth abroad (see point 3 below).

- The pace of third-quarter real GDP growth was noticeably faster than its pace in the first half of 2016. Real GDP growth averaged 1.1 percent at an annual rate in the first half of 2016. The pickup in growth in the third quarter can be attributed largely to two components of GDP: inventory investment and exports. In the first half of the year, these components contributed -0.8 percentage point and 0.1 percentage point, respectively, to overall real GDP growth. Both components saw substantial pickups in growth in the third quarter relative to the first half of the year: inventory investment contributed 0.6 percentage point to GDP growth, while exports contributed 1.2 percentage point, their second-largest quarterly contribution to growth since 2010. Other components of GDP, including both structures and equipment investment and government purchases, also saw faster growth or smaller contractions in the third quarter. These were partly offset by smaller positive contributions from consumer spending and intellectual property products investment and a larger negative contribution from residential investment.

- Real exports grew 10.0 percent in the third quarter, their fastest quarterly growth since 2013. In recent years, slowing global demand has been a key headwind to U.S. growth, as the volume of U.S. exports to foreign countries is sensitive to GDP growth abroad. In its October World Economic Outlook, the International Monetary Fund (IMF) revised down its forecast of global growth for the four quarters of 2016, removing an expected pickup in growth from 2015 to 2016. The IMF currently forecasts global growth to pick up in 2017, suggesting less downward pressure on export growth going forward. Nevertheless, real export growth in the third quarter was substantially faster than in recent quarters, due in part to a large increase in agricultural exports. (As shown in the chart below, real export growth had slowed even faster in recent quarters than the slowdown in world growth would have implied, potentially explaining some of the bounce-back in the third quarter.) The sensitivity of U.S. exports to foreign demand and the large contribution of exports to overall growth in the third quarter underscore both the importance of opening foreign markets to U.S. exports by passing the high-standards Trans-Pacific Partnership and the agreement’s potential to strengthen the U.S. economy as a whole.

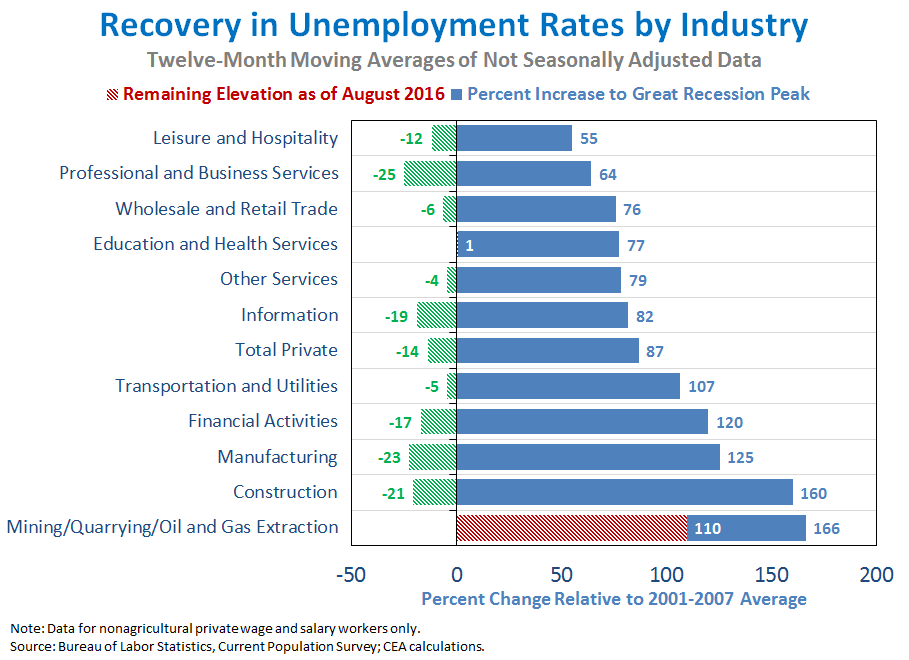

- As oil prices have risen slightly in recent months, contractions in oil-related investment have weighed somewhat less on overall growth. The price of Brent crude oil was $31 per barrel in January 2016, nearly three-quarters lower than its recent peak in June 2014. While the decline in oil prices has benefitted consumers and the economy overall, it has weighed heavily on both mining and logging employment and on investment in mining exploration, shafts, and wells—which includes petroleum drilling structures—which declined by nearly two-thirds from the fourth quarter of 2014 through the second quarter of 2016. Partly as a result, overall structures investment subtracted an average of 0.2 percentage point from quarterly real GDP growth over this period. From its trough in January, however, the monthly price of Brent crude oil increased to $47 per barrel as of September, and the number of oil and natural gas rigs in operation (which reflects the rate of drilling for new oil and natural gas) has risen for five consecutive months. Consistent with the increase in oil prices, investment in mining exploration, shafts, and wells contracted more slowly in the third quarter of 2016 than in earlier quarters, and overall structures investment added 0.1 percentage point to GDP growth. Since both oil-related investment and employment tend to lag prices by several months, the recent moderation in oil prices may translate into a slowdown in the pace of employment losses and further slowing in the rate of contraction in mining exploration, shafts, and wells investment in future quarters.

- Real private domestic final purchases (PDFP)—the sum of consumption and fixed investment—rose 1.6 percent at an annual rate in the third quarter, a somewhat slower pace than in recent quarters. PDFP—which excludes more volatile components of GDP like net exports and inventory investment, as well as government spending—is generally a more reliable indicator of next-quarter GDP growth than current GDP. In the third quarter, the divergence between overall real GDP growth and the relatively weaker contribution of PDFP to growth was largely accounted for by the large positive contributions of inventory investment and exports to real GDP growth. Overall, PDFP rose 1.9 percent over the past four quarters, above the pace of GDP growth over the same period.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any single report, and it is informative to consider each report in the context of other data as they become available.