By Karen Rubin, News-Photos-Features.com, [email protected]

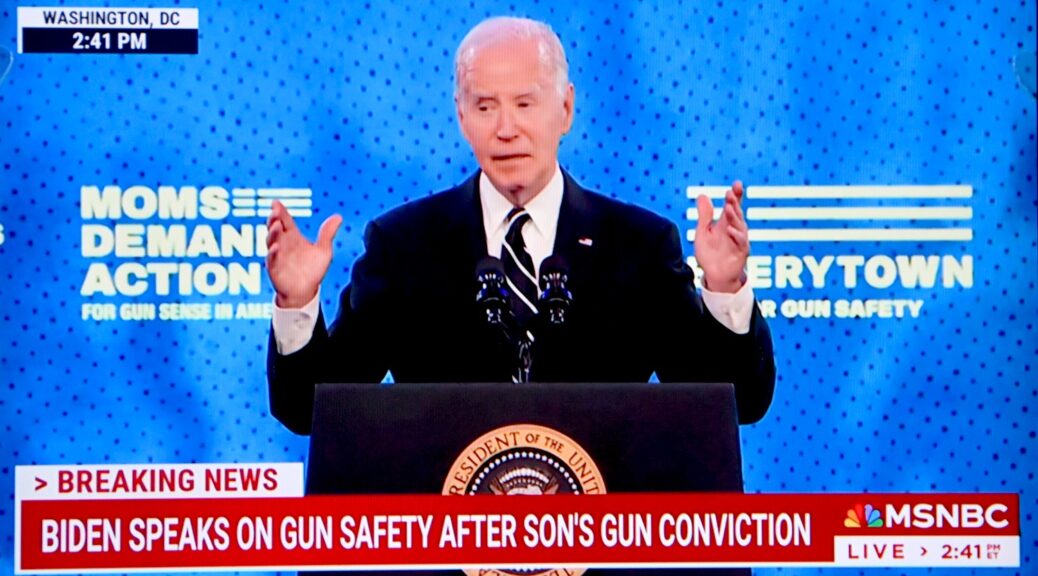

Less than two hours after hearing his only surviving son, Hunter, was found guilty of 3 gun possession offenses, President Joe Biden stood steadfast to uphold policies and laws to reduce America’s gun violence epidemic and change America’s cultural idolatry with guns. In that moment, he did two critical things befitting a president and a man of character and commitment: he upheld the rule of Law and the judicial process, saying he would respect the jury’s verdict and would not pardon his son, and vowed to continue the yeoman’s job of reversing America’s uniquely horrendous level of gun violence.

There are those who are pushing for the Supreme Court, which has a record now of putting the sanctity of the 2nd Amendment over the sanctity of life, to overturn the very gun regulations that ensnared Hunter, basically arguing for drug addicts, domestic abusers, those suffering mental illness, should be allowed to purchase all the guns they want and Hunter should appeal based on how rarely the charges against him have ever been prosecuted. But that would be wrong. With two-thirds of gun deaths due to suicide and the majority of murders of women and children by domestic abusers, no drug addict, as Hunter was at the time and as the jury found, should be allowed to purchase a gun. It is very possible that this law saved Hunter’s life and his family. This Supreme Court is also itching to overturn Red Flag laws that keep guns out of the hands of anyone who is a danger to themselves or someone else, hearing the plea of a domestic abuser who was refused a gun. Biden’s Solicitor General is trying to keep the law intact.

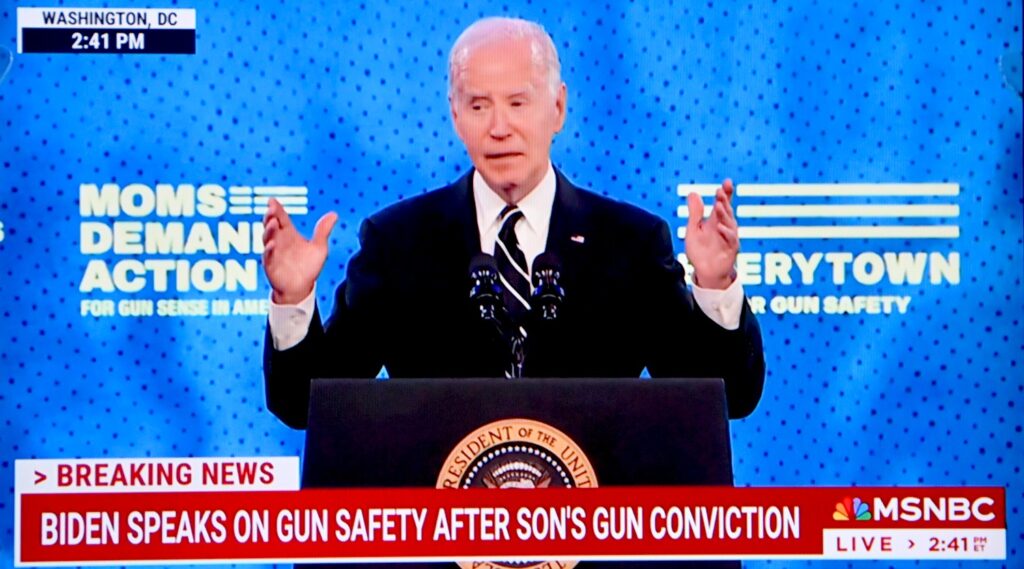

The irony of the timing of this important event with his son’s jury verdict is worthy of fiction. But Biden made no mention of it in his speech. Instead, he pointed to success of historic, landmark legislation and historic policies and actions that are already yielding result, including record DECREASES in violent crime.

In a statement issued by the White House, President Biden declared, ”Violent crime is dropping at record levels in America. It’s good news for our families and our communities. Today, the FBI released preliminary data collected from over 11,000 law enforcement agencies around the country showing that, in the first quarter of this year, murders decreased by 26%, robberies by almost 18%, and violent crime overall by 15%. These large decreases follow major reductions in crime in nearly every category in 2023 – including one of the lowest rates for all violent crime in 50 years and significant declines in murder.

“This progress we’re seeing is no accident. My Administration is putting more cops on the beat, holding violent criminals accountable, and getting illegal guns off the street – and we are doing it in partnership with communities. As a result, Americans are safer today than when I took office.

“After we saw the largest increase in murders ever recorded during the previous Administration, my Administration got to work protecting the American people. My America Rescue Plan – which every Republican voted against – delivered $15 billion to cities to hire and retain more cops and keep communities safe. I took on the gun lobby and signed the Bipartisan Safer Communities Act into law, the most significant gun violence legislation in nearly 30 years. But there is more to do. I will continue fighting for funding for 100,000 additional police officers, and crime prevention and community violence intervention programs. Every American deserves to feel safe in their community – which is why I will continue to invest in public safety.”

Over chants of “Four More Years” Biden thanked Everytown for Gun Safety and Moms Demand Action gunsense activists for all their work actually changing the culture, getting politicians to their side, that has made brought his efforts, his ideas to fruition, while pledging that there is so much more to do.

Biden turned the cheers into appreciation for the activists. “You’ve helped power a movement,” Biden said.

The contrast – in character, commitment, mission, purpose – between Biden, upholding the Rule of Law in face of significant personal pain and pushing forward with policies to address America’s scourge of gun violence, and Trump who said of school shooting victims, “Get over it” and boasted to the NRA convention that he did nothing during his term to rein in gun violence, could not be more dramatic.

“Heroic. What it means to live a principle,” said former prosecutor Andrew Weissmann on MSNBC, of President Biden.

Just a couple of hours after his son, Hunter Biden, was found guilty of three gun possession violations, the President delivered remarks at Everytown for Gun Safety Gun Sense University in Washington, D.C., where he highlighted the progress his Administration has made to reduce crime and keep guns out of dangerous hands thanks to the Bipartisan Safer Communities Act (BSCA), ahead of the two year anniversary since the signing of the law. During his remarks, he announced that the Department of Justice has charged more than 500 defendants for violating the new gun trafficking and straw purchasing provisions created by BSCA.

In his remarks, the President underscored how — as a result of critical investments made through BSCA and his American Rescue Plan –the Biden-Harris Administration has made our communities safer by helping get illegal guns off our streets and putting more cops on the beat, while promoting accountable policing and community violence intervention programs.

The President’s remarks at Gun Sense University build upon outreach and engagement his Administration and the White House’s first-ever Office of Gun Violence Prevention have undertaken to connect with victims, survivors, groups and organizations that are on the frontlines of the fight against gun violence. Last year, the President spoke at the National Safer Communities Summit and the Vice President recently announced two commonsense gun safety solutions while meeting with survivors in Parkland—the launch of the first-ever National Extreme Risk Protection Order (ERPO) Resource Center, which will support the effective implementation of state red flag laws, and calling on states to pass red flag laws and to use BSCA funding to help implement laws already enacted.

A White House fact sheet details the Biden Administration actions to end the epidemic of gun violence:

The Biden-Harris Administration has deployed a historic effort to partner with state and local law enforcement and keep communities safe by addressing the illegal sources of guns. The strategy is focused not just on the person who pulled the trigger of a firearm, but also on all of the links in the chain that led to the firearm being in the wrong hands, including the gun trafficker, the source of the gun trafficker’s firearms, rogue gun dealers who are willfully violating the law, and ghost gun manufacturers. Key Administration actions to stop the illegal flow of guns into our communities include:

- Gun Trafficking Law Enforcement: In 2021, the Justice Department launched five new law enforcement strike forces focused on addressing significant firearms trafficking corridors that have diverted guns to New York, Chicago, Los Angeles, the Bay Area, and Washington, D.C. The Bipartisan Safer Communities Act also enacted the first ever federal gun trafficking law and federal straw purchasing law. These new provisions created by BSCA have been used to charge more than 500 defendants.

- Cracking Down on Rogue Gun Dealers: The Justice Department enacted a new policy to maximize the efficacy of ATF resources to crack down on rogue gun dealers violating our laws and underscored zero tolerance for willful violations of the law by federally licensed firearms dealers that put public safety at risk. The new ATF inspection policies have led to 245 license revocations over the past two years.

- Stopping Gun Manufacturers Illegally Selling Ghost Guns: The Justice Department issued a final rule to rein in the proliferation of ghost guns, which are unserialized, privately made firearms that are increasingly being recovered at crime scenes. According to ATF, the recovery of ghost guns by law enforcement increased 1,083 percent between 2017 and 2021.

Most recently, the Biden-Harris Administration announced a new rule that will save lives by reducing the number of firearms sold without background checks. This final rule implements the Bipartisan Safer Communities Act’s expansion of firearm background checks—the most significant expansion of the background check requirement since then-Senator Biden helped shepherd the Brady Bill over the finish line in 1993. This action is part of the Biden-Harris Administration’s strategy to stem the flow of illegally acquired firearms into our communities and hold accountable those who supply the firearms used in crime.

“The President’s Administration will continue taking action, but Congress must do their part. The President and Vice President continue to call on Congress to pass universal background checks, a national red flag law, and ban assault weapons and high-capacity magazines. As the President has said, ‘we need Congress to do something—do something—so that communities won’t continue to suffer due to the epidemic of gun violence’.”

The Giffords PAC stated: “The FBI just released new data indicating that rates of violent crime dropped 15 percent overall in the first few months of 2024 in comparison to the first few months of 2023. Murders have dropped by about 26 percent. This is a BIG deal, and it’s a testament to the work we’ve done together in our movement to end gun violence.

“Of course, this drop in violence crime could have never been possible without President Biden, the strongest gun safety president we’ve had in office in decades. He had the courage to stand up to the gun lobby and signed the Bipartisan Safer Communities Act into law in 2022. It is the most significant federal gun safety legislation passed in nearly 30 years.

“President Biden has made it clear that as long as he’s in office, he will be a champion for gun safety.”

The same cannot be said if Trump or in fact any Republican takes the office.

See next:

__________________________

© 2024 News & Photo Features Syndicate, a division of Workstyles, Inc. All rights reserved. For editorial feature and photo information, go to www.news-photos-features.com, email [email protected]. Blogging at www.dailykos.com/blogs/NewsPhotosFeatures. ‘Like’ us at facebook.com/NewsPhotoFeatures, Tweet @KarenBRubin