President Biden and Vice President Harris came into office determined to end the COVID-19 pandemic while making progress toward a world that is safe from biological threats. Today we are releasing the final annual global health security report of the Biden-Harris Administration, U.S. Government Support for Global Health Security – Protecting Lives and Safeguarding Economies, which highlights progress in global health security and identifies remaining challenges. This fact sheet was provided by the White House:

The Biden-Harris Administration has advanced a bold agenda to prevent the devastating toll of outbreaks and pandemics, including investing more than $3 billion in strengthening global health security (GHS) since 2020. These investments have helped to: prepare countries around the world to more effectively prevent, detect and respond to biological threats; build stronger and more effective regional and global institutions to support health emergency preparedness and response; and respond rapidly to numerous outbreaks – from Ebola to mpox – to limit the health and economic impacts on the American people, as well as people living around the world. U.S. leadership in global health security is built on decades of investments in global health and research and development, as well as strong partnerships with other countries, regional and multilateral institutions, civil society, and the private sector.

REDUCING THE RISK OF NEW THREATS EMERGING AND BUILDING COUNTRY CAPACITY TO RESPOND TO THREATS

The most effective way to limit the impact of biological threats is to stop them at their source. The United States is working with countries and partners around the world to ensure they have the capacity to identify and stop emerging threats before they grow into regional or global threats. Central to these partnerships is the development of a shared plan based on gaps in each country’s capacity, as well as country ownership to sustain global health security capacities once U.S. Government support has ended. Highlights from the report include:

- More than 100 countries are building stronger global health security capacities: Over the last four years, the Biden-Harris Administration expanded formal Global Health Security partnerships from 19 countries to more than 50 countries and one regional group. The United States has also leveraged financial resources and diplomatic channels to mobilize support for 50 additional countries to strengthen their health security capacities, for a total of more than 100 countries receiving support. For example, through U.S. support to the Pandemic Fund and the Global Fund to Fight AIDS, Tuberculosis and Malaria (Global Fund) COVID-19 Response Mechanism, over sixty countries received financing to strengthen core health security capacities. The United States is not the sole provider of these resources, as countries around the world contribute, including through co-financing by low and middle-income countries.

- Measuring the impact of U.S. investments: The Biden-Harris Administration is focused on measurable results of these investments. Of the 25 formal GHS partner countries that have received U.S. support for at least two years, five have achieved the U.S. target of “demonstrated capacity” in at least five technical areas, and an additional five countries are close. We can also see the impact of investments when threats emerge. For example, the Democratic Republic of the Congo (DRC) – a U.S. government GHS partner since 2015 – has successfully contained five Ebola outbreaks since 2020, dramatically improving detection and response times. In 2022 the government of DRC detected an Ebola outbreak in 48 hours and contained the outbreak with only five lives lost to the disease.

- Country ownership on global health security: Many United States GHS partner countries are leading their own responses to crises, with U.S. collaboration when needed. For example, the U.S. Government is partnering with Nigeria to build stronger capacity on zoonotic diseases, disease surveillance, and health emergency management, among other areas. In 2023, Nigeria experienced outbreaks of anthrax, a zoonotic disease that can cause severe illness in people and animals. Nigeria activated national response mechanisms to coordinate collaboration across the human and animal sectors and reduce the risk for further disease transmission. Nigeria also collaborated with Ghana to exchange strategies for anthrax prevention and control. These and other measures helped curtail the impact of anthrax in Nigeria.

- Reducing the risk of biosafety and biosecurity incidents: Expanding biosurveillance capacity and the rapid evolution of technology are critical for health security, but can also elevate the risk of accidental and deliberate incidents. The Biden-Harris Administration has taken significant steps to minimize the chances of laboratory accidents; reduce the likelihood of deliberate use or accidental misuse; ensure effective biosafety and biosecurity practices and oversight; and promote responsible research and innovation. For example, the United States secured inclusion of biosafety and biosecurity as a critical component of the Pandemic Fund grants to support laboratory strengthening. One of the projects, the Caribbean Public Health Agency Train-the-Trainer Workshop on the Safe Transportation of Infectious Substances, resulted in certified trainers well-positioned to serve as national trainers and advisors in biosafety and safe transport protocols, ensuring safer practices across the region. The U.S. global health security bilateral partnerships also build capacity in biosafety and biosecurity: the GHS partner countries with at least two years of U.S. Government support demonstrated a net improvement in biosafety and biosecurity capacity from 2018 to 2023.

- Modernizing biorisk management: The Administration released the 2024 United States Government Policy for Oversight of Dual Use Research of Concern and Pathogens with Enhanced Pandemic Potential, marking a major new step in modernizing biorisk management. This policy streamlines and expands oversight of research of concern across the entire U.S. Government – setting a new global standard for effective research oversight. The Administration also introduced a new framework for biotechnology safeguards on federally funded purchases of synthetic DNA and RNA. These safeguards, which include Know-Your-Customer screening, will reduce the likelihood of misuse of synthetic biology.

BUILDING MORE EFFECTIVE AND SUSTAINABLE GLOBAL HEALTH SECURITY GOVERNANCE AND FINANCING SYSTEMS

Strong national systems within the United States and other countries are essential to global health security. However, each country, including the United States, operates within a regional or global system that can either facilitate or hamper quick and effective responses to health emergencies. The Biden-Harris Administration has invested in building stronger multilateral systems and partnerships to strengthen global health security.

Multilateral Partnerships

- Multilateral Negotiations: Through strong leadership and diplomatic outreach to World Health Organization (WHO) Member States, the United States helped secure an ambitious suite of amendments to the International Health Regulations (IHR) that will strengthen health emergency prevention, preparedness, and response. The United States is actively negotiating a pandemic agreement, with the goal of putting in place practical measures to prevent future pandemics, and strengthening the international community’s ability to respond rapidly and effectively in the event of a pandemic. The United States has also supported successful negotiations through the United Nations (UN) and UN agencies such as WHO on pandemic prevention, preparedness and response; antimicrobial resistance; biosafety and biosecurity; and biological weapons nonproliferation; among other areas.

- Multi-country Partnerships: The Biden-Harris Administration has worked closely with our allies and partners to advance initiatives critical to improving health security. For example, the G20 has been instrumental in establishing and sustaining stronger links between health and finance ministries. The G7 has committed to support more than 100 countries to strengthen their global health security capacities, and has led progress in transforming pandemic preparedness and response financing. The U.S. Department of State launched the Foreign Ministry Channel for Health Security to foster greater diplomatic engagement among Foreign Ministries on global health security. The Quad, a diplomatic grouping between the United States, Australia, India, and Japan, delivered more than 400 million safe and effective COVID-19 vaccine doses to Indo-Pacific countries and almost 800 million doses globally; advanced health security priorities in the Indo-Pacific region; and recently launched the Quad Cancer Moonshot, which will deliver up to 40 million doses of the human papillomavirus vaccine and support other efforts to address cervical cancer to the Indo-Pacific. Since its inception in 2014, the United States has actively engaged in the Global Health Security Agenda (GHSA), a partnership of over 70 countries, more than 10 international organizations and coalitions, and more than 30 non-governmental organizations, including private sector and civil society partners, working together to accelerate implementation of the International Health Regulations.

Financing

Limitations in the existing systems to finance pandemic prevention, preparedness, and response left countries and financial institutions ill prepared to effectively contain COVID-19, contributing to the health and financial crises that resulted in the deaths of over 1.2 million Americans and an estimated $14 trillion in economic losses to the U.S. economy. On day one, President Biden called on his Administration to transform the existing financing institutions and to cultivate new financing sources for global health security that are more effective and sustainable, and that are less dependent on U.S. government assistance.

- Expanding Reliable Financing for Pandemic Prevention and Preparedness: The United States was instrumental in the creation of the Pandemic Fund in 2022, the only multilateral financing facility dedicated exclusively to pandemic preparedness financing for low- and middle- income countries. The Pandemic Fund made significant progress in its first two years, awarding grants totaling $885 million, which mobilized an additional $6 billion in investments, to support 75 countries and economies across six geographic regions. The Pandemic Fund also effectively pivoted to support countries to prepare for mpox outbreaks as part of the global response to the ongoing mpox public health emergency. The United States has supported the Pandemic Fund’s $2 billion replenishment goal by pledging up to $667 million by 2025, calling on other donors to step up their contributions and end the cycle of panic and neglect.

- Strengthening Existing Financing Institutions to Support GHS: The United States is working to evolve Multilateral Development Banks to be better equipped to respond to the increasing frequency, scope, and complexity of global challenges, including pandemics. The Biden-Harris Administration strongly supported the establishment of the International Monetary Fund Resilience and Sustainability Trust and its goal of supporting low-income and vulnerable middle-income countries to access long-term, affordable financing to address longer-term challenges, such as health emergencies.

- Improving Timely Access to Emergency Response Financing: During the COVID-19 pandemic, many countries and institutions lacked the liquidity to procure the medical countermeasures (MCM) needed to mount effective and timely responses. The U.S. Development Finance Corporation helped develop and lead a G7 Surge Financing Initiative, through which G7 development finance institutions (DFIs), the European Investment Bank, the International Finance Corporation, and global and regional health stakeholders are developing and deploying innovative financing tools to accelerate access to MCMs in health emergencies. The United States also supported the establishment of the Day Zero Financing Facility, a suite of tools that will enable Gavi, The Vaccine Alliance, to quickly meet demand for vaccines during a pandemic, including up to $2 billion in bridge financing loans. The United States also supports the roles of the Coalition for Epidemic Preparedness Innovations (CEPI), the Global Fund, and other regional and multilateral organizations in the development of solutions to surge financing for MCMs during emergencies.

- Increasing International Coordination and Cooperation in Health Security Financing: During health emergencies donors often surge rapid financial and technical support, with limited effective means for transparency and coordination, which can lead to inefficiencies, duplication of efforts, and gaps in support. The Biden-Harris Administration has taken action to enhance the impact of financing though increased coordination and cooperation including supporting the establishment of the G20 Finance-Health Task Force to strengthen coordination between Finance and Health Ministries; and contributed to improved international mpox response coordination.

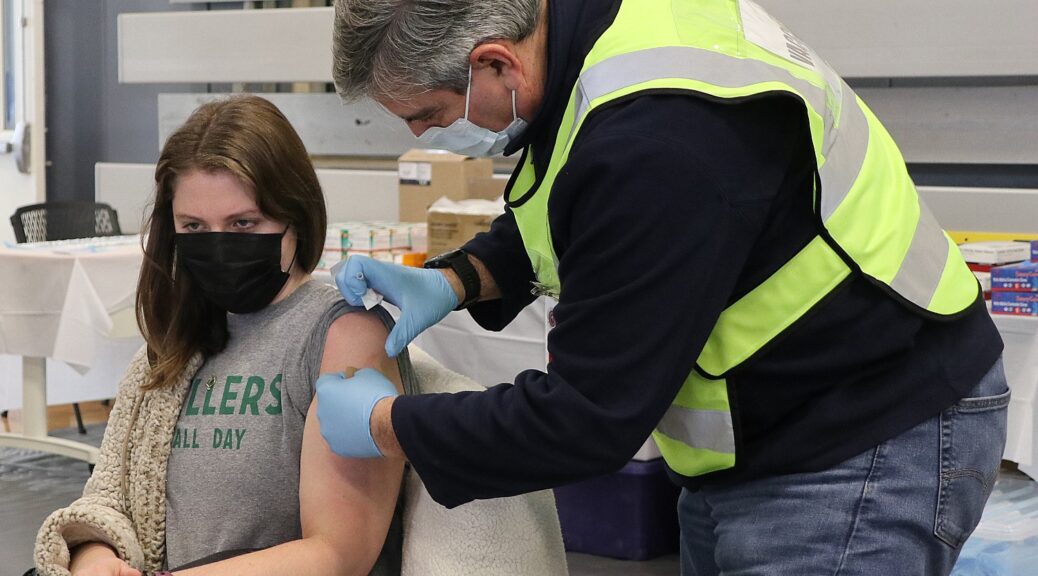

EXPANDING ACCESS TO MEDICAL COUNTERMEASURES

The Biden-Harris Administration has prioritized expanding access to quality medical countermeasures (MCMs) around the world, building on decades of global health and health security leadership by the United States. The United States has long led the world in innovation, research and development. The COVID-19 pandemic demonstrated the vital role of U.S. biotechnology and biomanufacturing in developing and producing the life-saving diagnostics, therapeutics, and vaccines needed to protect American lives and livelihoods, and national and economic security against future biological threats, whether naturally-occurring, accidental, or deliberate. The Biden-Harris Administration has strengthened sustainable global manufacturing and supply chain capacity; donated vaccines, diagnostic tests and treatments and support for their delivery; expanded pandemic response financing for MCMs; and strengthened legal and regulatory systems to ensure quality products and overcome barriers to rapid access.

- Investments in Research and Development for Preparedness: While there will always be new or evolving biological threats, developing effective countermeasures for known threats is a critical piece of preparedness. For example, the U.S. government invested billions of dollars in mRNA technology in advance of the COVID-19 pandemic. These public investments translated into millions of lives saved in the United States and around the world, and were crucial to developing the mRNA vaccine technology that can be leveraged in a future pandemic, as well as potentially treating other diseases. The U.S. supports the goals of the mRNA Technology Transfer Programme, a capacity-building initiative in low- and middle-income countries to sustainably produce mRNA vaccines. Similarly, the United States Government invested more than $2 billion in the JYNNEOS vaccine as part of smallpox preparedness. These investments directly led to product licensure for both smallpox and mpox. On September 13, 2024, WHO announced pre-qualification of the JYNNEOS vaccine for global use, including in the Africa region in response to ongoing mpox outbreaks. The JYNNEOS vaccine that has now been used to protect Americans and people living around the world from mpox; it would not exist without the investment and technical expertise provided by the United States.

- Investments in Biotechnology: The Biden-Harris Administration has prioritized transforming our biotechnology capabilities, including catalyzing advances in science, technology, and core capabilities and has advanced a whole-of-government approach to strengthening U.S. biotechnology and biomanufacturing, including for health security. The United States Government’s historic investments in science and technology, from basic science to piloting innovative financing mechanisms to real-time research during health emergencies, are transforming the tools and approaches we use to detect, contain and respond to health threats. These efforts support the ambitious international goal of developing vaccines, treatments and diagnostics within 100 days from the onset of a potential pandemic.

- Support for the Coalition for Epidemic Preparedness Innovations (CEPI): CEPI is working to accelerate the development of life-saving vaccines against emerging disease threats, and to transform capability for rapid countermeasure development in response to future threats. Notable achievements include: the market authorization of the world’s first Chikungunya vaccine and technology transfer to regional producers for regional supply to LMICs; the advancement through clinical development of vaccine candidates against Lassa, Nipah, and coronaviruses, among others; and the launch of a new Disease X Vaccine Library with six viral families prioritized as high risk.

- Expanding Access to Publicly-supported Medical Inventions: The U.S. supports broad access to medical inventions facilitated by public investments and science, including through: the NIH proposal to promote access to products that rely on NIH-owned inventions (“Promoting Equity Through Access Planning”); fair pricing guarantees in funding agreements between manufacturers and the Biomedical Advanced Research and Development Authority (BARDA); and appropriate provisions in a Pandemic Agreement for timely and equitable access to pandemic-related health products. During the COVID-19 pandemic, NIH licensed COVID-19 technologies arising from NIH intramural research to the Medicines Patent Pool (MPP) for access through WHO’s COVID-19 Technology Access Pool (C-TAP). Such contributions are an important step toward facilitating wider availability of lifesaving interventions around the world.

- Respecting Countries’ Rights to Protect Public Health: The United States respects countries’ right to protect public health and to promote access to medicines for all. The United States respects and does not call out countries for exercising health rights and flexibilities enshrined in the World Trade Organization’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), including with respect to compulsory licenses, in a manner consistent with TRIPS obligations. Toward that end, the United States endorsed negotiations of a temporary waiver of WTO intellectual property rules to support access to COVID vaccines.

STOPPING BIOLOGICAL THREATS AT THEIR SOURCE

In February 2021, just a few weeks into the Biden-Harris Administration and during the height of the COVID-19 pandemic, DRC and Guinea experienced two unrelated Ebola outbreaks. Since then, the United States Government has supported responses to numerous outbreaks, from Ebola disease and Marburg virus disease to mpox, avian influenza, Oropouche virus, as well as ongoing threats including dengue, cholera, measles, malaria and HIV. United States Government support to emergency response is closely linked with ongoing bilateral investments in preparedness, with the goal of each country developing the capacity and resources to lead and coordinate responses to threats as soon as they emerge. Examples of U.S. Government support to outbreak responses during the Biden-Harris Administration include:

- COVID-19 Pandemic: Starting in 2021, the United States invested $16 billion in the global COVID-19 response. The Administration accelerated global access to COVID-19 vaccines, including sharing nearly 700 million COVID-19 vaccine doses with countries around the world, as well as diagnostics and therapeutics, supporting health workers, securing supply chains, and combatting mis- and disinformation on safe and effective COVID-19 vaccines. The United States was the world’s largest donor to the Access to COVID-19 Tools Accelerator (ACT-A) and provided global leadership to raise additional billions in critical funding through the U.S.-hosted and co-hosted Global COVID-19 Summits to save lives globally, end the pandemic, and build stronger health security.

- Mpox Outbreaks: The world has faced two regional or global outbreaks of mpox during the Biden-Harris Administration. In 2022, the Biden-Harris Administration mounted a robust response to the spread of clade IIb mpox by making vaccines available to those at risk, making testing more convenient, and providing treatments to those who needed them both in the United States and worldwide. During the ongoing clade I mpox outbreak, the U.S. Government has committed over $500 million to support mpox preparedness and response activities in mpox-affected countries in Africa, and the U.S. Government has made more than one million mpox vaccine doses available for global use. The United States has delivered additional support through technical assistance and in-kind contributions to surveillance, case investigation, procurement of diagnostic kits, consumable reagents, other laboratory supplies, and personal protective equipment.

- Marburg Virus Disease (MVD): After learning of the MVD outbreak in Rwanda in September 2024, the United States committed to making nearly $11 million available to address urgent health needs in Rwanda and surrounding countries, including for surveillance and contact tracing, infection prevention and control guidance, and exit screening. Within days of learning of the MVD outbreak, CDC deployed three senior scientists to Rwanda to support its response. Although there are currently no FDA-approved vaccines or drugs against MVD, the United States contributed thousands of investigational vaccine doses and a small number of investigational therapeutics doses, which arrived in Rwanda within a week of the U.S. Government learning of the outbreak. The United States has also contributed hundreds of MVD tests and units of personal protective equipment.

- Enhanced U.S. Government Response Coordination: Building on work in previous Administrations, the Biden-Harris Administration has successfully shepherded the “Playbook for Biological Incident Response” and a “Biological Incident Notification and Assessment” protocol from concept stage to an established and well-exercised process for rapid communication and coordination when biological threats emerge. This playbook and the protocol serve to give U.S. federal agencies “off-the-shelf” tools to respond to biological threats from all sources – natural, accidental and deliberate – that avoid response delays that cost lives and resources.

While we have made progress since emerging from the acute phase of the COVID-19 pandemic, continued investment of financial, political, and technical resources is needed to ensure success in building stronger preparedness today, sustainability of those efforts, and resilience to future biological threats. Both at home and abroad, willingness to invest critical financial and political resources has waned as global health security competes with other priorities for attention and resources. Collective action across sectors and throughout the world is needed to ensure we do not cycle once more into neglect, rather that we sustain and build on the significant progress made. Success in these efforts will make Americans safer, protect our economy and reduce international reliance on U.S. resources and expertise during times of crisis.