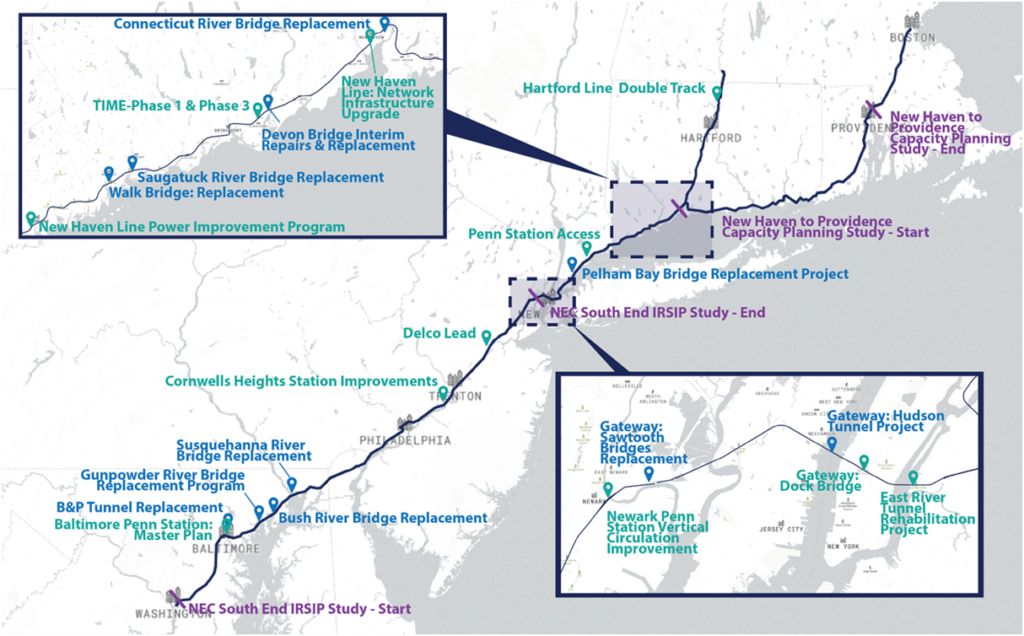

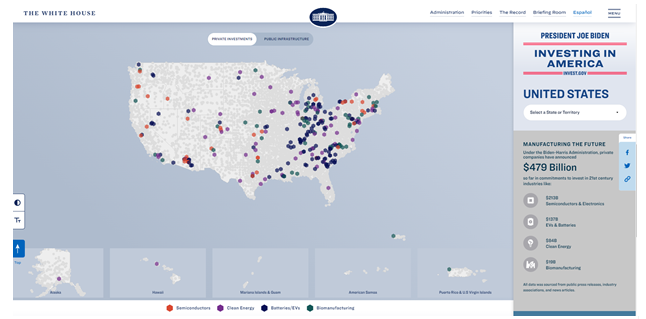

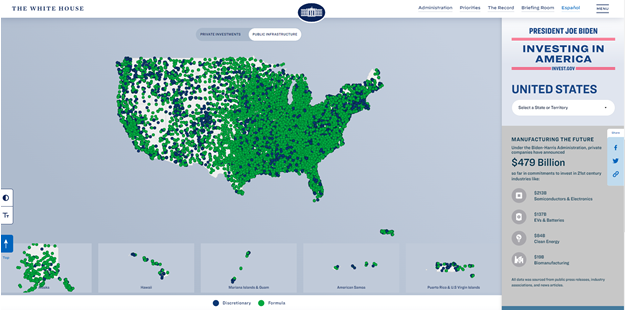

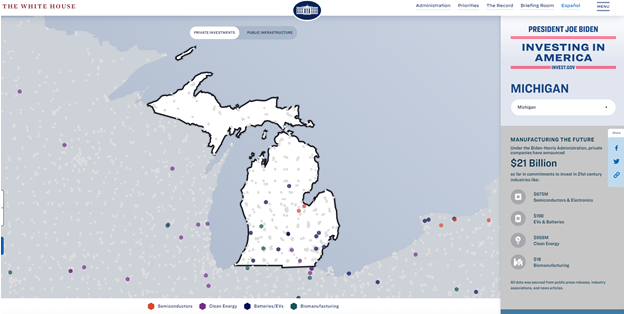

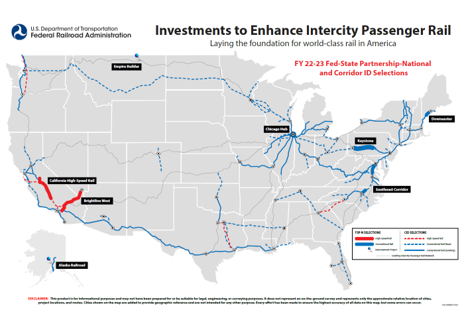

| The White House issued this fact sheet about the Biden Administration allocating $8.2 billion from the Investing in America Agenda to deliver transformative passenger rail service across the country. President Biden’s Investing in America Agenda – a key pillar of Bidenomics – is delivering world class-infrastructure across the country, expanding access to economic opportunity, and creating good-paying jobs. By delivering $66 billion from the Bipartisan Infrastructure Law – the largest investment in passenger rail since the creation of Amtrak 50 years ago – President Biden is delivering on his vision to rebuild America and win the global competition for the 21st century. Today, the Biden-Harris Administration is announcing $8.2 billion in new funding for 10 major passenger rail projects across the country, including the first world-class high-speed rail projects in our country’s history. Key selected projects include: building a new high-speed rail system between California and Nevada, which will serve more than 11 million passengers annually; creating a high-speed rail line through California’s Central Valley to ultimately link Los Angeles and San Francisco, supporting travel with speeds up to 220 mph; delivering significant upgrades to frequently-traveled rail corridors in Virginia, North Carolina, and the District of Columbia; and upgrading and expanding capacity at Chicago Union Station in Illinois, one of the nation’s busiest rail hubs. These historic projects will create tens of thousands of good-paying, union jobs, unlock economic opportunity for communities across the country, and open up safe, comfortable, and climate-friendly travel options to get people to their destinations in a fraction of the time it takes to drive. The Biden-Harris Administration is building out a pipeline of passenger rail projects in every region of the country in order to achieve the President’s vision of world-class passenger rail. Announced projects will add new passenger rail service to cities that have historically lacked access to America’s rail network, connecting residents to jobs, healthcare, and educational opportunities. Investments will repair aging rail infrastructure to increase train speeds, reduce delays, benefit freight rail supply chains to boost America’s economy, significantly reduce greenhouse emissions, and create good-paying union jobs. Additionally, electric high-speed rail trains will take millions of cars off the roads and reduce emissions, further cementing intercity rail as an environmentally-friendly alternative to flying or driving and saving time for millions of Americans. These investments will also create tens of thousands of good-paying union jobs in construction and related industries – adding to over 100,000 jobs that the President is creating through historic investments in world-class rail. Today’s investment includes $8.2 billion through the Federal Railroad Administration’s Federal-State Partnership for Intercity Passenger Rail Program, as well as $34.5 million through the Corridor Identification and Development program to guide passenger rail development on 69 rail corridors across 44 states, ensuring that intercity rail projects are ready for implementation. President Biden will travel to Las Vegas, Nevada to make this announcement. To date, President Biden has announced $30 billion for rail projects across the country – including $16.4 billion on the Northeast Corridor, $1.4 billion for passenger rail and freight rail safety projects, and $570 million to upgrade or mitigate railroad crossings. Fed-State National Project selections include:The Brightline West High-Speed Intercity Passenger Rail System Project will receive up to $3 billion for a new 218-mile intercity passenger rail system between Las Vegas, Nevada, and Rancho Cucamonga, California. The project will create a new high-speed rail system, resulting in trip times of just over 2 hours – nearly twice as fast as driving. This route is expected to serve more than 11 million passengers annually, taking millions of cars off the road and, thanks to all-electric train sets, removing an estimated 400,000 tons of carbon dioxide per year. This project will create 35,000 jobs supporting construction and support 1,000 permanent jobs in operations and maintenance once in service. Brightline’s agreement with the California State and Southern Nevada Building Trades will ensure that this project is built with good-paying union labor, and the project has reached a separate agreement with Rail Labor to employ union workers for its ongoing operations and maintenance. The project will also allow for connections to the Los Angeles Metro area via the Metrolink commuter rail system. The California Inaugural High-Speed Rail Service Project will receive up to $3.07 billion to help deliver high-speed rail service in California’s Central Valley by designing and extending the rail line between Bakersfield and Merced, procuring new high-speed trainsets, and constructing the Fresno station, which will connect communities to urban centers in Northern and Southern California. This 171-mile rail corridor will support high-speed travel with speeds up to 220mph. The project will improve connectivity and increase travel options, along with providing more frequent passenger rail service, from the Central Valley to urban centers in northern and Southern California. New all-electric trainsets will produce zero emissions and be powered by 100% renewable energy. By separating passenger and freight lines, this project will benefit freight rail operations throughout California as well. This project has already created over 11,000 good-paying union construction jobs and has committed to using union labor for operations and maintenance. The Raleigh to Richmond (R2R) Innovating Rail Program Phases IA and II project will receive up to $1.1 billion to build approximately additional parts of the Southeast Corridor from Raleigh to Wake Forest, North Carolina, including new and upgraded track, eleven grade separations and closure of multiple at-grade crossings. The investment will improve system and service performance by developing a resilient and reliable passenger rail route that will also contribute to freight and supply chain resiliency in the southeastern U.S. The proposed project is part of a multi-phased effort to develop a new passenger rail route between Raleigh, North Carolina, and Richmond, Virginia, and better connect the southern states to DC and the Northeast Corridor. Once completed, this new route will save passengers an estimated 90 minutes per trip. The Long Bridge project, part of the Transforming Rail in Virginia – Phase II program, will receive $729 million to construct a new two-track rail bridge over the Potomac River to expand passenger rail capacity between Washington, D.C. and Richmond, VA. Nearly 6 million passengers travel over the existing bridge every year on Amtrak and Virginia Railway Express lines. This upgrade will reduce congestion and delays on this heavily-traveled corridor to our nation’s capital.Other significant projects receiving grants under this announcement include: upgrades to Chicago Union Station; upgrades to the Pennsylvania Keystone Corridor, extending the service west of Philadelphia-Harrisburg to Pittsburgh and adding frequencies; improving the Downeaster corridor in Maine, connecting Boston, Massachusetts, to Brunswick, Maine; rail infrastructure improvements in Montana along a route carrying Amtrak’s Empire Builder long-distance rail service between Chicago and the Pacific Northwest; and replacing a key rail bridge in Alaska used by freight and intercity passenger trains. Pipeline for Future Investments Through the Federal Railroad Administration’s Corridor ID Program As part of President Biden’s vision for world-class passenger rail, the Administration is planning for future rail growth in new and unprecedented ways through the Bipartisan Infrastructure Law-created Corridor ID Program. The program establishes a new planning framework for future investments, and corridor selections announced today stand to upgrade 15 existing rail routes, establish 47 extensions to existing and new conventional corridor routes, and advance 7 new high-speed rail projects, creating a pipeline of intercity passenger rail projects ready for future investment. Project selections include:Scranton to New York, reviving a dormant rail corridor between Pennsylvania, New Jersey, and New York, to provide up to three daily trips for commuters and other passengers; Colorado Front Range, a new rail corridor connecting Fort Collins, CO, and Pueblo, CO, to serve an area that currently has no passenger rail options; The Northern Lights Express, connecting Minneapolis, MN and Duluth, MN, with several stops in Wisconsin, for greater regional connectivity; Cascadia High-Speed Rail, a proposed new high-speed rail corridor linking Oregon, Washington, and Vancouver, with entirely new service; Charlotte to Atlanta, a new high-speed rail corridor linking the Southeast and providing connection to Hartsfield-Jackson Airport, the busiest airport in the world;Major regional hubs will benefit from multiple corridor selections, such as the Chicago Hub, where a comprehensive plan for the Chicago terminal and service chokepoints south of Lake Michigan will benefit all corridors and long-distance trains south and east of Chicago. Other Rail Investments Made Through President Biden’s Bipartisan Infrastructure Law After waiting years for new federal funding, 2023 is the year in which major rail and transit projects across the country are moving forward. Today’s announcement builds on the Biden-Harris Administration’s historic commitment to our nation’s rail network. Major rail progress that has already been made under President Biden includes the following:Last month, FRA announced $16.4 billion for 25 passenger rail projects along the Northeast Corridor (NEC), the nation’s busiest rail corridor, running between Boston, Massachusetts, and Washington, D.C. The Northeast Corridor supports 800,000 trips per day in a region that represents 20% of U.S. Gross Domestic Product. The trains carry five times more passengers than all flights between Washington and New York. Funded through the Bipartisan Infrastructure Law’s Federal-State Partnership for Intercity Passenger Rail Program, projects will rebuild tunnels and bridges that are over 100 years old; upgrade tracks, power systems, signals, stations, and other infrastructure; and advance future projects to significantly improve travel times by increasing operating speeds and reducing delays. These investments will also contribute to more than 100,000 good-paying union jobs in construction. You can read more about the 25 Fed-State NEC project selections and their benefits here.In addition to unprecedented passenger rail investment, the Biden-Harris Administration is making major investments in rail safety through track improvements, bridge rehabilitations, fewer grade crossings, upgrades on routes carrying hazardous materials, and enhanced multi-modal connections to increase safety for people who live near or travel along America’s rail lines:In September, FRA announced more than $1.4 billion from President Biden’s Bipartisan Infrastructure Law for 70 projects in 35 states and Washington, D.C. This is the largest amount ever awarded for rail safety and rail supply chain upgrades through the Consolidated Rail Infrastructure and Safety Improvements — or CRISI — program. CRISI projects will improve nearly 1,900 miles of track, upgrade or replace aging bridges, invest in locomotives with fewer emissions, and fund sustainable and resilient infrastructure that protects against threats of extreme weather. Overall, nearly two-thirds of CRISI funding announced this year is going to rural communities. While the majority of selected projects support freight rail safety and supply chains, CRISI investments are also laying the groundwork to expand world-class passenger rail to more communities nationwide in places like Alabama, Louisiana, and Mississippi as well as Virginia, Massachusetts, and California. Additionally, the CRISI program provides funding to develop the U.S. rail workforce and industry. Funding for this popular program has quadrupled since President Biden signed the Bipartisan Infrastructure Law. In June 2023, FRA announced $570 million for 63 projects in 32 states under the new Railroad Crossing Elimination Program, created by the President’s Bipartisan Infrastructure Law. This inaugural round of funding will address more than 400 at-grade crossings nationwide, improve safety, and make it easier to get around railroad tracks by adding grade separations, closing at-grade crossings, and improving existing at-grade crossings where train tracks and roads intersect. Over each of the next four years, additional program funding will be made available annually. In November 2022, FRA granted $4.3 billion to Amtrak, which represents the first year of the $22 billion in direct funding to Amtrak provided in the Bipartisan Infrastructure Law. Amtrak is using these funds to modernize the intercity passenger rail network, modernize and increase accessibility at more than 280 Amtrak-served stations across the country, and replace Amtrak’s existing fleet with over 1,000 accessible, comfortable, state-of-the-art railcars and locomotives. In fiscal year 2023 alone, Amtrak has invested nearly $3 billion in 750 projects across the country, including bringing 15 Amtrak stations to full ADA compliance. Through these investments, Amtrak has created nearly 5,000 jobs, including employing over 4,000 union workers. In August 2022, the FRA announced $233 million in grants to upgrade intercity passenger rail service across the country through the Federal-State Partnership for State of Good Repair Program. These investments will help replace bridges and tunnels along the Northeast Corridor, many of which are over 100 years old. Grants were also awarded to improve rail infrastructure in California, Michigan, and Chicago Union Station.Map: Selections Through Fed-State National and Corridor ID Program  |