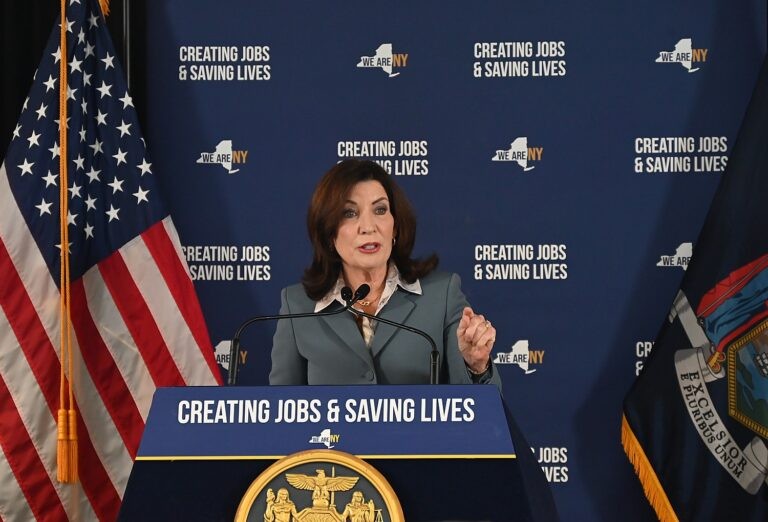

Governor Kathy Hochul is enacting an Affordability Agenda focused on making New York State affordable, especially in housing and higher minimum wages, and reducing out-of-pocket expenses. But New York Congressional Republicans are aiding and abetting the Trump/MAGA agenda that will undue all that effort, blowing a hole in the state’s budget by cutting billions in federal aid and support for programs, despite the fact New York State sends way more to the Treasury than DC sends back to the state.

The threat to health care is particularly acute from Trump’s “Big Ugly Bill”:

More than 240,000 New Yorkers would experience higher health insurance premiums as a result of eliminating American Rescue Plan enhanced tax credits and Additional Changes

Average monthly costs could rise by more than $228 — an increase of 38% for a couple — due to elimination of Enhanced Tax Credits

Estimated 65,000 to 80,000 New Yorkers – approximately one-third of enrollees, could lose individual marketplace coverage

Governor Kathy Hochul today released new data showing the massive impact the GOP’s ‘Big Ugly’ Reconciliation Bill would have on New York families. The latest bill threatens to severely disrupt health coverage for millions of New Yorkers. In addition to increasing the number of uninsured by 1.5 million and stripping $13.5 billion in annual funding from New York’s healthcare system, the bill would trigger steep increases in private health insurance premiums for vulnerable New Yorkers and impose excessive burdens on consumers enrolling through NY State of Health, the State’s official health plan marketplace.

“The GOP’s Big Ugly bill would slash health care coverage for millions of New Yorkers and raise monthly costs by hundreds of dollars,” Governor Hochul said. “If New York’s Republican delegation won’t stand up for their own constituents, I will.”

Health care providers, insurers and state leaders across the country are sounding the alarm over the proposed legislation, which would slash billions in federal health care support. In addition to jeopardizing and in some cases entirely eliminating coverage for New York’s 1.6 million Essential Plan enrollees, the bill would trigger steep increases in costs for many New Yorkers who purchase private health insurance. The elimination of American Rescue Plan enhanced premium tax credits, alone, will increase net cost of coverage across the State by an average of 38 percent for 140,000 low-income individuals and families purchasing plans through the state’s marketplace. This equates to an increase in cost of $114 per month for an individual and $228 per month for a couple.

See below for a summary of expected premium increases due to the elimination of American Rescue Plan enhanced premium tax credits across the State:

| Region | Average Monthly Cost Increase For a Couple ($) | Average Monthly Cost Increase For a Couple (%) |

| New York City | $211 | 38% |

| Mid-Hudson | $206 | 31% |

| Long Island | $219 | 32% |

| Capital Region | $231 | 33% |

| Western New York | $267 | 38% |

| Central New York | $256 | 43% |

| Finger Lakes | $248 | 42% |

| Mohawk Valley | $270 | 49% |

| Southern Tier | $265 | 48% |

| North Country | $253 | 44% |

| Statewide | $228 | 38% |

The combined impact of the elimination of enhanced premium tax credits and additional provisions of the proposed U.S. House Republican reconciliation bill will push more healthy consumers out of the insurance market, leaving behind a less healthy population and driving further rate increases. This cycle will result in spiraling insurance costs and lack of access to coverage for individuals and families.

New York State Health Commissioner Dr. James McDonald said, “The proposed cuts to federal health care support hurt everyone. These cuts take health insurance away from working New Yorkers. They undermine the progress we’ve made in providing affordable and accessible health insurance to New Yorkers. When people lose health insurance, they risk going without needed health care or suffering financial hardship.”

In addition to increasing premiums for low-income individuals and families who qualify for tax credits, it is estimated that the elimination of those tax credits will increase insurance rates for the more than 100,000 New Yorkers who purchase coverage in the individual commercial market but do not qualify for tax credits. Insurers have estimated that those consumers and families will face a 4.3 percent increase in their insurance rates next year solely due to the elimination of these credits.

Early estimates also indicate the proposed bill could result in 65,000 to 80,000 people — approximately one-third of enrollees in the individual market — losing their coverage. Many more consumers will experience significant new red tape that will make it harder to enroll in and renew coverage.

The proposed bill would also strip New York of its flexibility and autonomy in running its own marketplace and serving the needs of its residents, imposing onerous and costly new administrative burdens on the State. The State anticipates more than $10 million in new administrative costs to implement the changes required by the bill.

NY State of Health Executive Director Danielle Holahan said,“We have tremendous concerns about the compounding effects of this bill especially when combined with the expiration of the premium tax credits. Reducing eligibility for the financial assistance that helps New Yorkers afford care means people end up paying more for doctor visits, medications, and mental health care. Already struggling providers, especially in rural parts of the state, might not be able to sustain operations under this proposal, further restricting New Yorkers’ access to care.”

New York has had tremendous success over the past 12 years in operating its marketplace — with 6.7 million individuals currently enrolled in coverage — and has achieved a statewide uninsured rate of less than 5 percent, the lowest rate amongst large states across the country. This bill would reverse decades of progress in expanding coverage and making health care more affordable and accessible in New York and jeopardize the health of consumers across the State.