In a clear demonstration of the Biden Administration refusing to give up or give in, President Biden just announced next steps to cancel student debt for some 30 million Americans – despite Republicans actually going to the Supreme Court to prevent the administration from exercising its authority.

“Today, my Administration took another major step to cancel student debt for approximately 30 million Americans,,” President Biden stated. “By providing more information to borrowers on how they can take advantage of our upcoming debt relief programs, borrowers will be prepared to benefit swiftly once the rules are final. Despite attempts led by Republican elected officials to block our efforts, we won’t stop fighting to provide relief to student loan borrowers, fix the broken student loan system, and help borrowers get out from under the burden of student debt.

“Today’s announcement comes on top of the significant progress we’ve made for students and borrowers over the past three years. That includes canceling student debt for nearly 5 million Americans so far through various actions; providing the largest increases to the maximum Pell Grant in over a decade; fixing Income-Driven Repayment so borrowers get the relief they are entitled to under the law; and holding colleges accountable for taking advantage of students and families.

:From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity. I will never stop working to make higher education affordable and to make sure our Administration delivers for the American people.”

This fact sheet was provided by the White House:

Next Step Toward Additional Debt Relief for Tens of Millions of Student Loan Borrowers This Fall

Starting tomorrow, the Department will email borrowers telling them about potential debt relief and giving them the opportunity to opt out

The Biden-Harris Administration today announced that it will begin the next step toward providing student debt relief to tens of millions of borrowers this Fall. Starting tomorrow, the U.S. Department of Education (Department) will begin emailing all borrowers with at least one outstanding federally held student loan to provide updates on potential student debt relief, and to inform them they have until August 30 to call their servicer and opt out if they do not want this relief.

The rules that would provide this relief are not yet finalized, and the email does not guarantee specific borrowers will be eligible. The Department will provide additional information to borrowers once the rules are finalized this fall. These proposed rules build upon the Administration’s existing work that has approved more than $168 billion in student loan relief for nearly 4.8 million borrowers through various actions. These rules, if finalized as proposed, would bring the total number of borrowers eligible for student debt relief to over 30 million, including borrowers who have already been approved for debt cancellation by the Biden-Harris Administration over the past three years.

“Today, the Biden-Harris administration takes another step forward in our drive to deliver student debt relief to borrowers who’ve been failed by a broken system,” said U.S. Secretary of Education Miguel Cardona. “These latest steps will mark the next milestone in our efforts to help millions of borrowers who’ve been buried under a mountain of student loan interest, or who took on debt to pay for college programs that left them worse off financially, those who have been paying their loans for twenty or more years, and many others. The Biden-Harris Administration made a commitment to deliver student debt relief to as many borrowers as possible as quickly as possible, and today, as we near the end of a lengthy rulemaking process, we’re one step closer to keeping that promise.”

In April, the Administration released its first set of draft rules that proposed authorizing the Secretary of Education to grant student debt relief to tens of millions of borrowers across the country, including those whose balances have grown due to runaway interest and those who entered repayment on their loans a long time ago, among others. If these rules are finalized as the Department has proposed, they would authorize the Secretary of Education to provide partial or full debt relief for the following groups of borrowers:

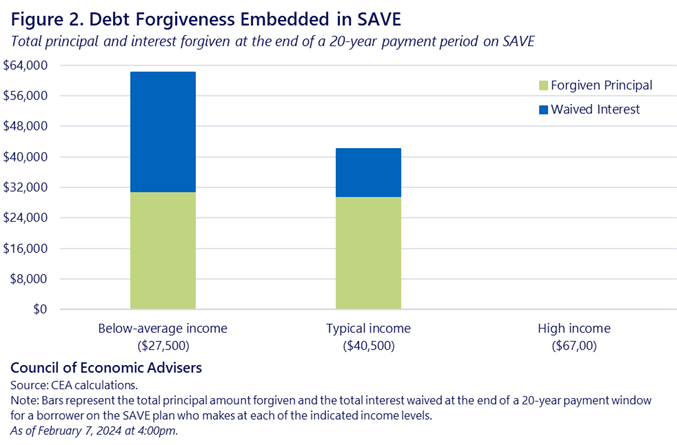

- Borrowers who owe more now than they did at the start of repayment. Borrowers would be eligible for relief if they have a current balance on certain types of Federal student loans that is greater than the balance of that loan when it entered repayment due to runaway interest. The Department estimates that this debt relief would impact nearly 23 million borrowers, the majority of whom are Pell Grant recipients.

- Borrowers who have been in repayment for decades. If a borrower with only undergraduate loans has been in repayment for more than 20 years (received on or before July 1, 2005), they would be eligible for this relief. Borrowers with at least one graduate loan who have been in repayment for more than 25 years (received on or before July 1, 2000) would also be eligible.

- Borrowers who are otherwise eligible for loan forgiveness but have not yet applied. If a borrower hasn’t successfully enrolled in an income-driven repayment (IDR) plan but would be eligible for immediate forgiveness, they would be eligible for relief. Borrowers who would be eligible for closed school discharge or other types of forgiveness opportunities but haven’t successfully applied would also be eligible for this relief.

- Borrowers who enrolled in low-financial value programs. If a borrower attended an institution that failed to provide sufficient financial value, or that failed one of the Department’s accountability standards for institutions, those borrowers would also be eligible for debt relief.

If finalized as proposed, these new rules would authorize relief for borrowers across the country who have struggled with the burden of student loan debt. The Department expects that all four of these proposed forms of relief would be provided to eligible borrowers without requiring any action from borrowers; no application would be needed.

If, however, borrowers prefer to opt out of this debt relief for any reason, they can do so by contacting their servicer by Aug. 30, 2024. Borrowers who opt out of this debt relief will not be able to opt back in, and they will also be temporarily opted out of forgiveness due to enrollment in an IDR plan until the Department is able to automatically assess their eligibility for that benefit in a few months. In addition, borrowers would only be eligible for the proposed relief if they have entered repayment at the time that the Department would be determining eligibility, after the proposed rules are finalized.

More information for borrowers about this debt relief is available at StudentAid.gov/debt-relief.

An unparalleled track record of borrower assistance

The Biden-Harris Administration has taken historic steps to reduce the burden of student debt and ensure that student loans are not a barrier to educational and economic opportunity for students and families. The Administration secured a $900 increase to the maximum Pell Grant—the largest increase in a decade—and finalized new rules to help protect borrowers from career programs that leave graduates with unaffordable debts or insufficient earnings. The Administration continues its work to issue debt relief regulations under the Higher Education Act, with final regulations expected this fall.

The Biden-Harris Administration has approved the following debt relief for borrowers:

- $69.2 billion for 946,000 borrowers through fixes to Public Service Loan Forgiveness (PSLF).

- $51 billion for more than 1 million borrowers through administrative adjustments to IDR payment counts. These adjustments have brought borrowers closer to forgiveness and addressed longstanding concerns with the misuse of forbearance by loan servicers.

- $28.7 billion for more than 1.6 million borrowers who were cheated by their schools, saw their institutions precipitously close, or are covered by related court settlements.

- $14.1 billion for more than 548,000 borrowers with a total and permanent disability.

$5.5 billion for 414,000 borrowers through the SAVE Plan