The White House issued a fact sheet explaining how President Joe Biden’s American Families Plan will support children, teachers and working families and advances equity and racial justice:

On his first day in office, President Biden signed an Executive Order directing the whole of the federal government to advance equity and racial justice. Today, the President announced a historic new set of investments to deliver on his vision of a more equitable America through the American Families Plan. The American Families Plan will help restore the promise of America for communities who have been left behind and locked out of opportunity—investing in teachers and students, empowering workers and their families, and reimagining a tax code that rewards work over wealth. By extending and building upon the provisions of the American Rescue Plan, the American Families Plan would lift more than 10 million people out of poverty in 2022. This means a 29 percent reduction in Black poverty, a 31 percent reduction in Latino poverty, and a 15 percent reduction in Asian American, Native Hawaiian, and Pacific Islander poverty, relative to the projected poverty rate for 2022. Among children, it would reduce poverty by more than 47 percent.

President Biden’s American Families Plan will deliver a fairer and more equitable America by:

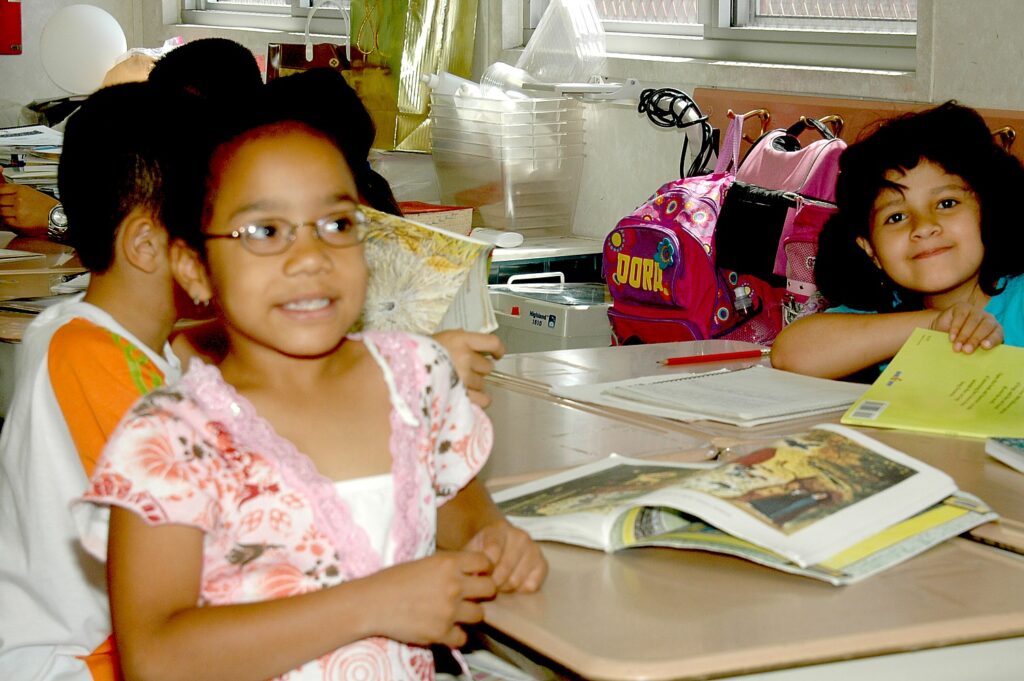

- Closing opportunity gaps for low-income children and children of color by providing universal access to preschool, and making quality, affordable child care more accessible across the nation.

- Investing in educational opportunity for underserved communities by providing two years of free community college for Americans, including DREAMers; making Historically Black Colleges and Universities (HBCUs), Tribal Colleges and Universities (TCUs), and institutions such as Hispanic-serving institutions (HSIs), Asian American and Native American Pacific Islander-serving institutions (AANAPISIs), and other Minority-serving Institutions (MSIs) more affordable; increasing the value of Pell Grants to help more low-income students attend college; and ensuring more students are supported through completion.

- Empowering teachers by investing in the training and support they need and ensuring more teachers of color can reach the classroom.

- Creating a right to paid family and medical leave to ensure working parents and caregivers, including workers of color and low-wage workers, can equitably access the time off they need to support their families.

- Closing gaps in our social safety net to ensure that kids have the nutritious food they need to be healthy and succeed in school.

- Extending the American Rescue Plan’s historic expansions of the Child Tax Credit, the Earned Income Tax Credit, and the Child and Dependent Care Tax Credit to provide income support and cut poverty among families and workers.

Together, these investments will give millions of children across the country a fair shot at the American dream.

UNIVERSAL PRE-SCHOOL FOR ALL 3- AND 4-YEAR-OLDS

Preschool is critical to ensuring that children start kindergarten with the skills and supports that set them up for success in school. In fact, research shows that kids who attend universal Pre-K are more likely to take honors classes and less likely to repeat a grade, and another study finds low-income children who attend universal programs do better in math and reading as late as eighth grade. Unfortunately, most children, and especially children of color and low-income children, do not have access to the full range of high-quality pre-school programs available to their peers. In addition, children with disabilities benefit from inclusive, accessible pre-school programs with their peers, and all children benefit when we create socio-economically diverse Pre-K classrooms where all students thrive.

President Biden’s American Families Plan will:

- Close opportunity gaps by providing universal pre-school to all 3- and 4-year-olds. President Biden is calling for a national partnership with states to offer free, high-quality, accessible, and inclusive preschool to all 3-and 4-year-olds—benefitting 5 million children. This historic investment in America’s future will first prioritize high-need areas and enable communities and families to choose the setting that works best for them, whether that’s a preschool classroom in a public school, a center, or a Head Start program. The President’s plan will also ensure that all publicly-funded preschool is high-quality with low student-to-teacher ratios, a high-quality and developmentally appropriate curriculum, and supportive classroom environments that are inclusive for all students. The President’s plan will leverage investments in tuition-free community college and teacher scholarships to support those who wish to earn a bachelor’s degree or other credential that supports their work as an educator or their work to become an early childhood educator. And, educators will receive job-embedded coaching, professional development, and wages that reflect the importance of their work. All employees in participating Pre-K programs and Head Start will earn at least $15 per hour, and those with comparable qualifications will receive compensation commensurate with that of kindergarten teachers. These investments will give American children a head start and pave the way for the best-educated generation in U.S. history

FREE COMMUNITY COLLEGE AND OTHER POSTSECONDARY INVESTMENTS

For much of the 20th century, graduating from high school was a gateway to a stable job and a living wage. But over the last 40 years, we have seen the most growth in jobs requiring higher levels of job preparation, including education and training. Today, 70 percent of jobs are held by people with more than a high school degree. American workers, and especially workers of color, need support to build their skills, increase their earnings, remain competitive, and share in the benefits of the new economy. President Biden’s American Families Plan will:

- Offer two years of free community college to all Americans, including DREAMers. Community colleges provide educational opportunities for students who are often underserved by four-year universities, including first-generation students, students of color, low-income students, and adult learners. President Biden’s proposal creates a federal-state, -territory, and -tribal partnership that allows first-time college students and workers wanting to reskill to enroll in a community college to earn a degree or credential for free. Students can use the benefit for up to three years and, if circumstances warrant, up to four years, recognizing that many students’ lives and other responsibilities can make full-time enrollment difficult. If all states, territories, and tribes participate, about 5.5 million students would pay $0 in tuition and fees.

- Provide up to approximately $1,400 in additional assistance to low-income students by increasing the Pell Grant award. Nearly 60 percent of Black, almost half of Latino, half of American Indian or Alaska Native, and more than one-third of Native Hawaiian or Pacific Islander students depend on Pell Grants to help pay for college. But the grant has not kept up with the rising cost of postsecondary education; over the last 50 years, the maximum Pell Grant value has plummeted from nearly 80 percent of the cost of a four-year college degree to just 30 percent — leading millions of low-income students to take out debt to finance their education. The American Families Plan would increase the maximum Pell Grant award by approximately $1,400 and allow DREAMers to access the funding.

- Increase college retention and completion rates. Just 40 percent and 54 percent of first-time Black and Latino students at four-year colleges and universities, respectively, go on to earn their degree, compared to 64 percent of white students. And overall, just 40 percent of community college students, who are disproportionately low-income and people of color, graduate within 6 years. The President is proposing a $62 billion formula grant program that will provide funding to states, territories, and Tribes to support retention and completion activities at colleges and universities that serve high numbers of low-income students, including wraparound services ranging from child care and mental health services to faculty and peer mentoring; emergency basic needs grants; practices that recruit and retain faculty; transfer agreements between colleges; and evidence-based remediation programs.

- Provide two years of subsidized tuition and expand programs in high-demand fields at HBCUs, TCUs, and MSIs. Research has found that HBCUs, TCUs, and MSIs are vital to helping underrepresented students move to the top of the income ladder. But despite their record of success, these institutions have significantly fewer resources than other top colleges and universities, undermining their ability to grow and support more students. The President is calling for $39 billion to provide tuition subsidies to low- and middle-income students attending HBCUs, TCUs, and MSIs. The President is also calling for $5 billion to expand existing institutional aid grants to HBCUs, TCUs, and MSIs, which can be used by these institutions to strengthen their academic, administrative, and fiscal capabilities, including by creating or expanding educational programs in high-demand fields (e.g., STEM, computer sciences, nursing, and allied health), with an additional $2 billion funding directed towards building a pipeline of skilled health care workers with graduate degrees. These proposed investments, combined with the $45 billion proposed in the American Jobs Plan targeted to these institutions, will enable America’s HBCUs, TCUs, and MSIs to help advance underrepresented students and make the U.S. more competitive on the global stage.

EDUCATION AND PREPARATION FOR TEACHERS

Few people have a bigger impact on a child’s life than a great teacher. Unfortunately, the U.S. faces a large and growing teacher shortage. Before the pandemic, schools across the nation needed an estimated additional 100,000 certified teachers, resulting in key positions going unfilled, granting of emergency certifications, or teachers teaching out of their certification area. Shortages of certified teachers disproportionately impact schools with higher percentages of students of color, which have a higher proportion of teachers that are uncertified and higher shares of inexperienced teachers, exacerbating educational disparities. President Biden is calling for investments to improve the impact of new teachers entering the profession, increase retention rates, and increase the number of teachers of color, all of which will improve student outcomes.

President Biden’s American Families Plan will:

- Address teacher shortages, improve teacher preparation, and strengthen pipelines for underrepresented teachers, including teachers of color. Our country faces a serious teacher shortage problem, which disproportionately impacts students of color. The percentage of teachers in their first or second year of teaching in schools with the highest percentage of students of color is 7 percentage points higher than schools with the lowest percentage of students of color (17 percent vs. 10 percent). The percentage of teachers who are uncertified is more than three times as large (4.8 percent vs. 1.3 percent). At the same time, while teachers of color can have a particularly strong impact on students of color, around one in five teachers are people of color, compared to more than half of K-12 public school students. These disparities help drive gaps in student outcomes. Strengthening the teacher pipeline and improving teacher preparation, supporting teachers so they stay in the classroom, and investing in the recruitment and preparation of underrepresented teachers will help narrow persistent educational disparities. President Biden is calling on Congress to invest in America’s teachers, including by doubling scholarships for future teachers from $4,000 to $8,000 per year, which would help underrepresented teachers, including teachers of color, access high-quality teacher preparation programs that best prepare them for the work ahead. The plan also will invest $2.8 billion in Grow Your Own programs and year-long, paid teacher residency programs, which have a greater impact on student outcomes, teacher retention, and are more likely to enroll underrepresented teacher candidates, including candidates of color; and invest $400 million in teacher preparation programs at HBCUs, TCUs, and MSIs.

- Support the development of special education teachers. There has been a 17 percent decline in the number of special educators over the last decade. Additionally, while only about half of the students receiving special education services are white, approximately 82 percent of special education teachers are white. The American Families Plan will invest $900 million in personnel preparation funds under the Individuals with Disabilities Education Act (IDEA), funding pathways to additional certifications, and strengthening existing teacher preparation programs for special educators.

- Help current teachers earn in-demand credentials. Many teachers are eager to answer the call to get certified in areas their schools need, like bilingual education, but are deterred due to the high cost of getting an additional certification. President Biden is calling on Congress to create a new fund to provide more than 100,000 educators with the opportunity to obtain additional certifications in high-demand areas like special education, bilingual education, and certifications that improve teacher performance. This will particularly benefit students with disabilities and English learners.

- Invest in educator leadership. Millions of teachers – and the students they educate – would stand to benefit from greater mentorship and leadership opportunities. President Biden is calling on Congress to invest $2 billion to support programs that leverage teachers as leaders, such as high-quality mentorship programs for new teachers and underrepresented teachers, including teachers of color.

CHILD CARE

High-quality early care and education helps ensure that children can take full advantage of education and training opportunities later in life, especially for children from low-income families, who face learning disparities before they even can go to preschool. One study by Nobel Laureate James Heckman found that every dollar invested in a high-quality, comprehensive birth to five program for the most economically disadvantaged children resulted in $7.30 in benefits as children grew up healthier, were more likely to graduate high school and college, and earned more as adults. But we have grave disparities when it comes to child care in our country. One analysis finds that more than half of Latino and Native American families live in child care deserts. Difficulty finding high-quality, affordable child care leads some parents, especially mothers, to drop out of the labor force entirely, some to reduce their work hours, and others to turn down a promotion – leading to lifetime consequences in terms of earnings, savings, and retirement. Lack of affordable child care can be especially challenging for the families of the nearly 7 in 10 Black women who are their families’ primary or sole breadwinners.

President Biden’s American Families Plan will:

- Ensure low- and middle-income families can access affordable child care for children under the age of five. Under the President’s plan, families will pay only a portion of their income based on a sliding scale. For the most hard-pressed working families, child care costs for their young children would be fully covered and families earning 1.5 times their state median income will spend no more than 7 percent of their income on child care for their young children. The plan will also provide families with a range of inclusive and accessible options to choose from for their child, from child care centers to family child care providers to Early Head Start programs.

- Invest in high-quality care. The last time the U.S. prioritized major, long-term investments in child care was when President Roosevelt signed the Lanham Act to provide free, high-quality child care in an effort to support women going to work during World War II. Not only did it enable women to work, but children who participated experienced long-lasting economic benefits, proving most beneficial for the most disadvantaged children. Under the President’s plan, child care providers will receive funding to support the true cost of quality early childhood education–including a developmentally appropriate curriculum, small class sizes, and culturally and linguistically responsive environments that are accessible and inclusive of children with disabilities. These investments support positive interactions between educators and children that promote children’s social-emotional and cognitive development.

- Invest in the care workforce, including the women of color who make up a substantial percentage of the field. More investment is needed to support early childhood providers and educators, more than nine in ten of whom are women and more than four and ten of whom are women of color. They are among the most underpaid workers in the country. The typical child care worker earned $12.24 per hour in 2020, and one report found nearly half rely on public income support programs. The American Families Plan includes a $15 minimum wage for early childhood educators and ensures that those with similar qualifications as kindergarten teachers receive comparable compensation and benefits.

When fully implemented, the President’s plan will provide 3 million children from low- and middle-income families with high quality care, saving the average family $14,800 a year on child care expenses.

PAID LEAVE

Paid family and medical leave supports workers and families and is a critical investment in the strength and equity of our economy. Paid leave has been found to reduce racial disparities in wage loss between workers of color and white workers, improve child health and well-being, support employers by improving employee retention and reducing turnover costs, and increase women’s labor force participation. However, currently, 95 percent of the lowest wage workers, mostly women and workers of color, lack access to any paid family leave. Sixty-two percent of Black adults and 73 percent of Latino adults are either ineligible for or cannot afford to take unpaid leave, compared to 60 percent of white adults. Additionally, Black and Latina mothers are more likely than white women to report being let go by an employer or quitting their jobs after giving birth in order to have some leave.

President Biden’s American Families Plan will:

- Create a national comprehensive paid family and medical leave program. Paid family and medical leave can help reduce racial disparities in wage loss between workers of color and white workers. People with disabilities may also have less access to paid leave due to higher rates of part time and low wage employment. The program will ensure workers receive partial wage replacement to take time to bond with a new child, care for a seriously ill loved one, deal with a loved one’s military deployment, find safety from sexual assault, stalking, or domestic violence, heal from their own serious illness, or take time to deal with the death of a loved one. It will guarantee twelve weeks of paid parental, family, and personal illness/safe leave by year 10 of the program, and also ensure workers get three days of bereavement leave per year starting in year one. The program will provide workers up to $4,000 a month, with a minimum of two-thirds of average weekly wages replaced, rising to 80 percent for the lowest wage workers. The plan has an inclusive definition of family, ensuring workers can care for and be cared by a loved one who is not related by blood, which will greatly impact LGBTQ individuals and people with disabilities. We estimate this program will cost $225 billion over a decade.

NUTRITION

The pandemic has added urgency to the moral travesty of nutrition insecurity among children, which disproportionately affects low-income families and children of color. No one should have to worry about whether they can provide nutritious food for themselves or their children. A poor diet jeopardizes a child’s ability to learn and succeed in school. Nutrition insecurity can also have long-lasting negative impact on overall health and put children at higher risk for diseases such as diabetes, heart disease, and high blood pressure.

President Biden’s American Families Plan will:

- Expand summer EBT to all eligible children nationwide. The Summer EBT Demonstrations help low-income families with children eligible for free- and reduced-price meals during the school year purchase food during the summer. The American Families Plan builds on the American Rescue Plan’s support for Summer Pandemic-EBT by making the successful program permanent and available to all 29 million children receiving free- and reduced-price meals. Research shows that this program decreases food insecurity among children and led to positive changes in nutritional outcomes.

- Expand school meal programs. Currently, just 70 percent of eligible schools have adopted Community Eligibility Provision (CEP), which allows high-poverty schools to provide meals free of charge to all of their students—breaking down barriers for students who may be eligible for school meals but may not apply for them due to stigma or not fully understanding the application process. The President’s plan will allow more schools in high poverty districts to offer meals free of charge to all of their students by reimbursing a higher percentage of meals at the free reimbursement rate through CEP. Additionally, the plan will target elementary schools by reimbursing an even higher percentage of meals at the free reimbursement through CEP and lowering the threshold for CEP eligibility for elementary schools. The plan will also expand direct certification to automatically enroll more students for school meals based on Medicaid and Supplemental Security Income data.

- Facilitate re-entry for formerly incarcerated individuals through SNAP eligibility. Individuals convicted of a drug-related felony are currently ineligible to receive SNAP benefits unless a state has taken the option to eliminate or modify this restriction. Denying these individuals—many of whom are parents of young children—SNAP benefits jeopardizes nutrition security and poses a barrier to re-entry into the community in a population that already faces significant hurdles to obtaining employment and stability. SNAP is a critical safety net for many individuals as they search for employment to support themselves and their families. This restriction disproportionately impacts African Americans, who are convicted of drug offenses at much higher rates than white Americans.

TAX CUTS FOR AMERICAN FAMILIES AND WORKERS

While the American Rescue Plan provided meaningful relief for hundreds of millions of Americans, that is just a first step. Now is the time to build back better, to help families and workers who for too long have felt the squeeze of stagnating wages and an ever-increasing cost-of-living. Direct assistance to families in the form of tax credits paid on a regular basis lifts children and families out of poverty, makes it easier for families to make ends meet, and boosts the academic and economic performance of children over time.

President Biden’s American Families Plan will:

- Extend expanded ACA premiums tax credits in the American Rescue Plan. Health care should be a right, not a privilege, and Americans facing illness should never have to worry about how they are going to pay for their treatment. No one should face a choice between buying life-saving medications or putting food on the table. President Biden has a plan to build on the Affordable Care Act and lower prescription drug costs for everyone by letting Medicare negotiate prices, reducing health insurance premiums and deductibles for those who buy coverage on their own, creating a public option and the option for people to enroll in Medicare at age 60, and closing the Medicaid coverage gap to help millions of Americans gain health insurance. The American Families Plan will build on the American Rescue Plan and continue our work to make health care more affordable. The biggest improvement in health care affordability since the Affordable Care Act, the American Rescue Plan provided two years of lower health insurance premiums for those who buy coverage on their own. With these changes, about three in four uninsured Black adults and nearly four in five uninsured Hispanic or Latino adults are now eligible for low-cost health care. The American Families Plan will make those premium reductions permanent, a $200 billion investment. As a result, nine million people will save hundreds of dollars per year on their premiums, and four million uninsured people will gain coverage. The Families Plan will also invest in maternal health and support the families of veterans receiving health care services.

- Extend the Child Tax Credit (CTC) increases in the American Rescue Plan through 2025 and make the CTC permanently fully refundable. The President is calling for the Child Tax Credit expansion, first enacted in the American Rescue Plan, to be extended. This legislation expands the Child Tax Credit from $2,000 per child to $3,000 per child six-years old and above, and $3,600 per child for children under six. It also makes 17-year-olds eligible for the first time and makes the credit fully refundable on a permanent basis, so that low-income families—the families that need the credit the most—can benefit from the full tax credit. The expanded Child Tax Credit in the American Rescue Plan will benefit nearly 66 million children, and is the single largest contributor to the plan’s historic reductions in child poverty, including by 52 percent for Black children, 45 percent for Latino children, 37 percent for Asian American, Native Hawaiian, and Pacific Islander children, and 61 percent for Native American children.

- Permanently increase tax credits to support families with child care needs. To help even more low- and middle-income families, President Biden is calling on Congress to make permanent the temporary Child and Dependent Care Tax Credit (CDCTC) expansion enacted in the American Rescue Plan. Families will get back as a tax credit as much as half of their spending on child care for children under age 13, so that they can receive a total of up to $4,000 for one child or $8,000 for two or more children. The CDCTC will be fully refundable, making the credit more equitable by allowing low-income working families to receive the full value of the credit towards their eligible child care expenses regardless of how much they owe in taxes. This is a dramatic expansion of support to low- and middle-income families. In 2019, a family claiming a CDCTC for the previous year got less than $600 on average towards the cost of care, and many low-income families got nothing.

- Make the Earned Income Tax Credit expansion for childless workers permanent. President Biden believes our tax code should reward work and not wealth. And that means rewarding workers who work hard every day at modest wages to provide their communities with essential services. Before this year, the federal tax code taxed low-wage childless workers into poverty or deeper into poverty — the only group of workers it treated this way. The American Rescue Plan addressed this problem by roughly tripling the EITC for childless workers, benefitting 17 million low-wage workers, many of whom are essential workers including cashiers, cooks, delivery drivers, food preparation workers, and childcare providers. For example, a childless worker who works 30 hours per week at $9 per hour earns income that, after taxes, leaves them below the federal poverty line. By increasing her EITC to more than $1,100, this EITC expansion helps pull such workers out of poverty. The President is calling on Congress to make this expansion permanent. Extending these changes will give a critical boost in earnings of an estimated 2.8 billion Black, 2.8 million Latino, and 678,000 Asian American workers.

To view this fact sheet in your browser, click here.