Newly finalized rules will mandate automatic, cash refunds for cancelled or significantly delayed flights and save consumers over half a billion dollars every year in airline fees

WASHINGTON – Building on a historic record of expanding consumer protections and standing up for airline passengers, the Biden-Harris Administration announced final rules that require airlines to provide automatic cash refunds to passengers when owed and protect consumers from costly surprise airline fees. These rules will significantly expand consumer protections in air travel, provide passengers an easier pathway to refunds when owed, and save consumers over half a billion dollars every year in hidden and surprise junk fees.

The rules are part of the Biden-Harris Administration’s work to lower costs for consumers and take on corporate rip-offs. President Biden signed an Executive Order on Promoting Competition in 2021 that encouraged DOT to take steps to promote fairer, more transparent, and competitive markets.

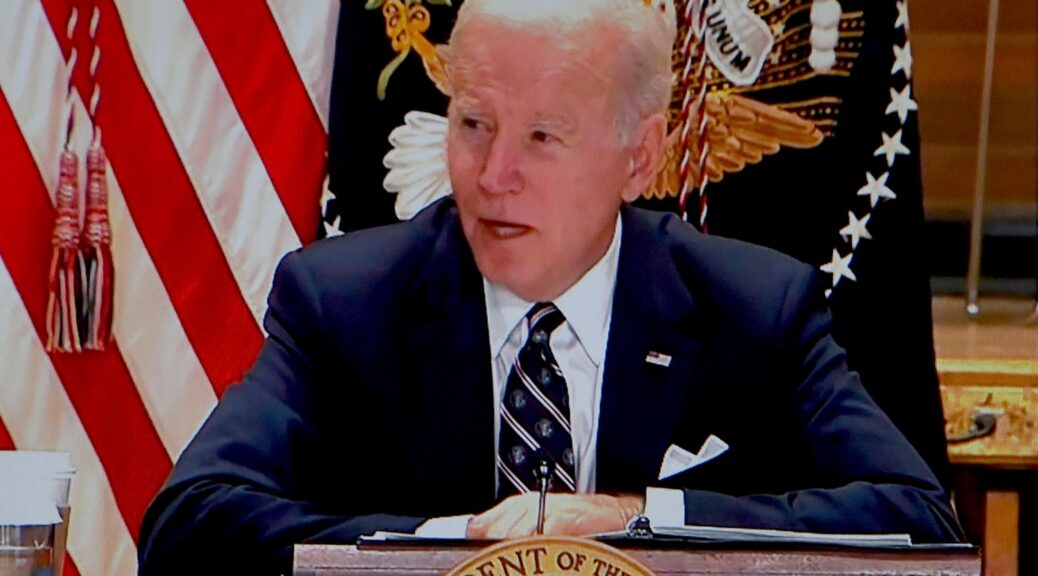

Today, the Biden-Harris Administration announced rules that require airlines to provide automatic cash refunds to passengers when owed and protect consumers from costly surprise airline fees. The President released the below statement and video.

“Our department just issued rules to protect people from hidden airline fees and to require airlines to give passengers automatic cash refunds when owed,” said Transportaiton Secretary Pete Buttigieg. “No more having to fend for yourself and jump through hoops to get your money back—airlines will have to automatically do this. This is about airlines treating passengers better, and it will save people more than half a billion dollars. Avoiding unwanted, expensive, unnecessary surprise airline fees.”

“Too often, airlines drag their feet on refunds or rip folks off with junk fees,” President Biden stated. “It’s time Americans got a better deal. Today, my Administration is requiring that airlines provide automatic refunds to passengers when they’re owed, and protect them from surprise fees.

“We all know what it’s like when airlines drag their feet on refunds or surprise us with junk fees. That’s why today my Administration is holding airlines accountable and bringing costs down for American families. This is just one part of my Administration’s plan to prevent companies from playing the American people for suckers. It matters,” Biden stated.

Requiring Automatic Cash Airline Refunds

The first rule requires airlines to promptly provide passengers with automatic cash refunds when owed because their flights are cancelled or significantly changed, their checked bags are significantly delayed, or the ancillary services, like Wi-Fi, they purchased are not provided.

Without this rule, consumers have to navigate a patchwork of cumbersome processes to request and receive a refund — searching through airline websites to figure out how to make the request, filling out extra “digital paperwork,” or at times waiting for hours on the phone. Passengers would also receive a travel credit or voucher by default from many airlines instead of getting their money back, so they could not use their refund to rebook on another airline when their flight was changed or cancelled without navigating a cumbersome request process.

DOT’s rule makes it simple and straightforward for passengers to receive the money they are owed. The final rule requires refunds to be:

- Automatic: Airlines must automatically issue refunds without passengers having to explicitly request them or jump through hoops.

- Prompt: Airlines and ticket agents must promptly issue refunds within seven business days of refunds becoming due for credit card purchases and 20 calendar days for other payment methods.

- Cash or original form of payment: Airlines and ticket agents must provide refunds in cash or whatever original payment method the individual used to make the purchase, such as credit card or airline miles. Airlines may not substitute vouchers, travel credits, or other forms of compensation unless the passenger affirmatively chooses to accept alternative compensation.

- Full amount: Airlines and ticket agents must provide full refunds of the ticket purchase price, minus the value of any portion of transportation already used. The refunds must include all government-imposed taxes and fees and airline-imposed fees.

- Protecting Against Surprise Airline Junk Fees

- Secondly, DOT is requiring airlines and ticket agents to tell consumers upfront what fees they charge for checked bags, a carry-on bag, for changing a reservation, or cancelling a reservation. This ensures that consumers can avoid surprise fees when they purchase tickets from airlines or ticket agents, including both brick-and-mortar travel agencies or online travel agencies.

- The rule will help consumers avoid unneeded or unexpected charges that can increase quickly and add significant cost to what may, at first, look like a cheap ticket. Extra fees, like checked baggage and change fees, have been a growing source of revenue for airlines, while also becoming more complex and confusing for passengers over time. In total, thanks to the final rule, consumers are expected to save over half a billion dollars every year that they are currently overpaying in airline fees.

- DOT’s rule ensures that consumers have the information they need to better understand the true costs of air travel. Under the final rule, airlines are required to:

- Disclose baggage, change, and cancellation fees upfront: Each fee must be disclosed the first time that fare and schedule information is provided on the airline’s online platform — and cannot be displayed through a hyperlink.

- Explain fee policies before ticket purchase: For each type of baggage, airlines and ticket agents must spell out the weight and dimension limitations that they impose. They must also describe any prohibitions or restrictions on changing or cancelling a flight, along with policies related to differences in fare when switching to a more or less expensive flight.

- Share fee information with third parties: An airline must provide useable, current, and accurate information regarding its baggage, change, and cancellation fees and policies to any company that is required to disclose them to consumers and receives fare, schedule, and availability information from that airline.

- Inform consumers that seats are guaranteed: When offering an advance seat assignment for a fee, airlines and ticket agents must let consumers know that purchasing a seat is not necessary to travel, so consumers can avoid paying unwanted seat selection fees.

- Provide both standard and passenger-specific fee information: Consumers can choose to view passenger-specific fee information based on their participation in the airline’s rewards program, their military status, or the credit card that they use — or they can decide to stay anonymous and get the standard fee information.

- End discount bait-and-switch tactics: The final rule puts an end to the bait-and-switch tactics some airlines use to disguise the true cost of discounted flights. It prohibits airlines from advertising a promotional discount off a low base fare that does not include all mandatory carrier-imposed fees.

DOT’s Historic Record of Consumer Protection Under the Biden-Harris Administration

Both of these actions were suggested for consideration by the DOT in the Executive Order on Promoting Competition and build on historic steps the Biden-Harris Administration has already taken to expand consumer protections, promote competition, and protect air travelers. Under the Biden-Harris Administration, DOT has advanced the largest expansion of airline passenger rights, issued the biggest fines against airlines for failing consumers, and returned more money to passengers in refunds and reimbursements than ever before in the Department’s history.

- DOT launched the flightrights.gov dashboard, and now all 10 major U.S. airlines guarantee free rebooking and meals, and nine guarantee hotel accommodations when an airline issue causes a significant delay or cancellation. These are new commitments the airlines added to their customer service plans that DOT can legally ensure they adhere to and are displayed on flightrights.gov.

- Since President Biden took office, DOT has helped return more than $3 billion in refunds and reimbursements owed to airline passengers – including over $600 million to passengers affected by the Southwest Airlines holiday meltdown in 2022.

- DOT has issued over $164 million in penalties against airlines for consumer protection violations. Between 1996 and 2020, DOT collectively issued less than $71 million in penalties against airlines for consumer protection violations.

- DOT recently launched a new partnership with a bipartisan group of state attorneys general to fast-track the review of consumer complaints, hold airlines accountable, and protect the rights of the traveling public.

- In 2023, the flight cancellation rate in the U.S. was a record low at under 1.2% — the lowest rate of flight cancellations in over 10 years despite a record amount of air travel

- DOT is undertaking its first ever industry-wide review of airline privacy practices and its first review of airline loyalty programs

In addition to finalizing the rules to require automatic refunds and protect consumers from surprise fees, DOT is also pursuing rulemakings that would:

- Propose to ban family seating junk fees and guarantee that parents can sit with their children for no extra charge when they fly. Before President Biden and Secretary Buttigieg pressed airlines last year, no airline committed to guaranteeing fee-free family seating. Now, four airlines guarantee fee-free family seating, as the Department is working on its family seating junk fee ban proposal.

- Propose to make passenger compensation and amenities mandatory so that travelers are taken care of when airlines cause flight delays or cancellations.

- Expand the rights for passengers who use wheelchairs and ensure that they can travel safely and with dignity. The comment period on this proposed rule closes on May 13, 2024.

Travelers can learn more about their protections when they fly at FlightRights.gov. Consumers may file an airline complaint with the Department here.