Over the first three full months of the Biden-Harris Administration, the economy added more than 1.5 million jobs, or more than 500,000 jobs per month on average. That compares to an average of 60,000 jobs per month in the three previous months. These three months have seen the strongest first three months of job growth of any administration.

Despite this progress, there’s more work to do to climb out of the economic crisis brought on by the pandemic. The Biden-Harris Administration is acting aggressively to ensure that the millions of Americans who remain unemployed, through no fault of their own, can find safe, good-paying work as quickly as possible. That’s why the President is announcing today that the Administration will take steps to remove barriers that are preventing Americans from returning safely to good-paying work and take steps to make it easier for employers to hire new workers.

And, the President and the Administration will reaffirm the basic rules of the unemployment insurance (UI) program. Anyone receiving UI who is offered a suitable job must take it or lose their UI benefits. A core purpose of the UI program is helping workers get back to work, and UI provides laid-off workers with temporary assistance to help pay bills and relieve hardship. By reaffirming these rules and purposes, the Administration will ensure that the UI program continues to support workers and facilitate hiring.

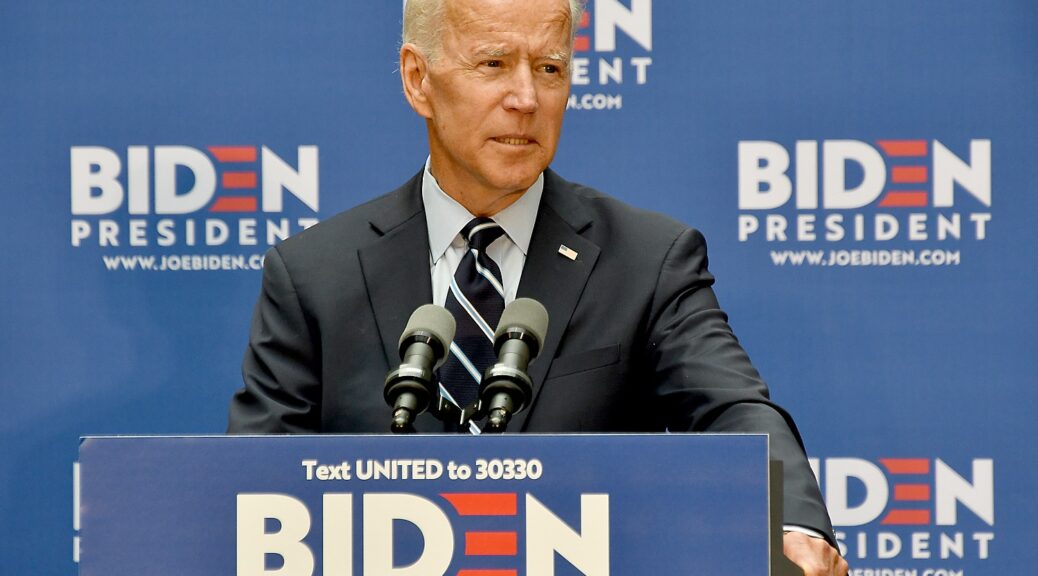

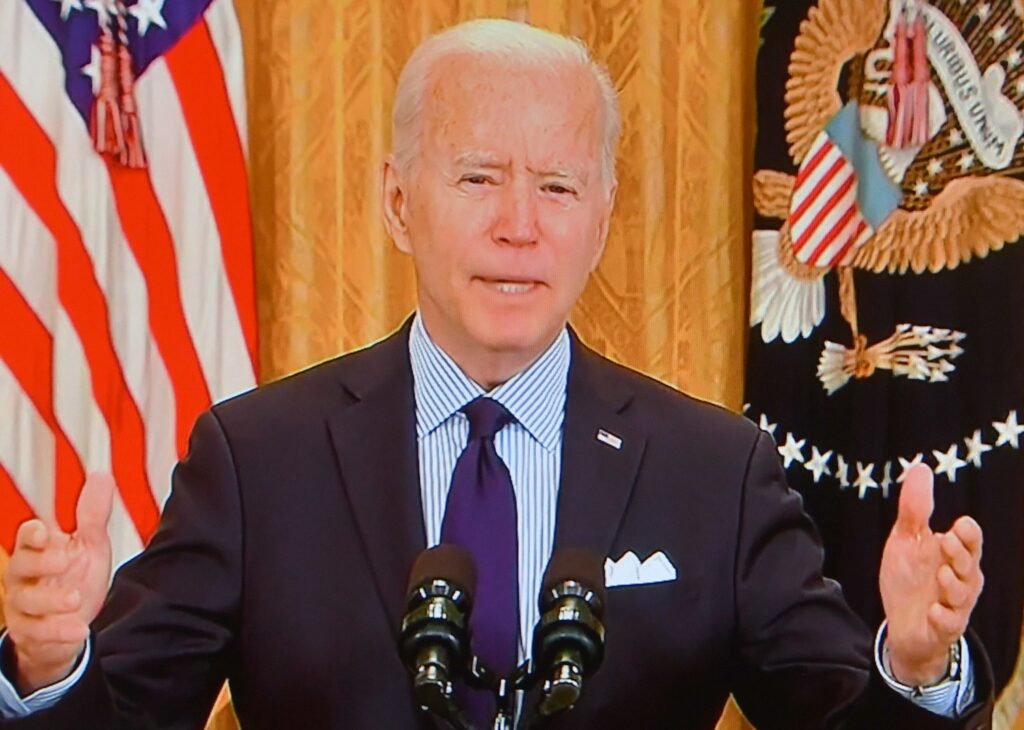

“Let’s be clear,” President Joe Biden stated, “our economic plan is working. I never said — and no serious analyst ever suggested — that climbing out of the deep, deep hole our economy was in would be simple, easy, immediate, or perfectly steady. Remember, 22 million Americans lost their jobs in this pandemic.

“So, some months will exceed expectations; others will fall short. The question is, ‘What is the trendline? Are we headed in the right direction? Are we taking the right steps to keep it going?’ And the answer, clearly, is yes…

“Twenty-two million people lost their jobs in this pandemic through no fault of their own. They lost their jobs to a virus, and to a government that bungled its response to the crisis and failed to protect them.

“We still have 8 million fewer jobs than we did when the pandemic started. And for many of those folks, unemployment benefits are a lifeline. No one should be allowed to game the system and we’ll insist the law is followed, but let’s not take our eye off the ball…

“So we need to stay focused on creating jobs and beating this pandemic today, and building back better for tomorrow. The American Rescue Plan is just that: a rescue plan. It’s to get us out of the crisis and back on the track, but it’s not nearly enough.

“That’s why we need the American Jobs Plan, which is an eight-year investment — an eight-year investment strategy to make sure working people of this country get to share in the benefits of a rising economy, and to put us in a position to win the competition with China and the rest of the world for the 21st century.”

Specifically, today the President is:

REMOVING BARRIERS THAT ARE KEEPING AMERICANS FROM RETURNING SAFELY TO GOOD-PAYING WORK

Accelerating the Provision of Assistance to Hard-Hit Child Care Providers to Get More Parents Back to Work

Between February 2020 and March 2021, 520,000 mothers and 170,000 fathers between ages 20 and 54 left the labor force and have not returned. Many need or want to work but cannot because of child care disruptions. At the same time, early childhood and child care providers – nearly all small businesses, overwhelmingly owned by women and disproportionately owned by people of color – have been hit hard by the pandemic. According to one survey, as of December, about one in four child care providers open at the start of the pandemic were closed, hindering access to care, especially for families of color. Child care providers that have stayed open have gone to enormous lengths to do so and are struggling to stay open: two in five providers report taking on debt for their programs using personal credit cards to pay for increased costs and three in five work in programs that have reduced expenses through layoffs, furloughs, or pay cuts. And, there are 150,000 fewer child care jobs today than there were at the beginning of the pandemic.

The American Rescue Plan provides funding to address the child care crisis caused by COVID-19 to help parents who need or want to work to return to their jobs. This includes funding to stabilize the child care industry so that parents can send their children to safe, healthy, stable child care environments and additional funding to help families access affordable, high-quality care, including by providing subsidized care to more than 800,000 families with the greatest need and by providing resources for hard-hit child care providers.

Today, the Department of Health and Human Services is releasing guidance to states, tribes, and territories so that states can start getting the child care stabilization funding to providers immediately. The guidance will encourage states to get funding out quickly and to make it as easy as possible for hundreds of thousands of child care providers, including centers and family-based providers, to receive the funding. It will also encourage states to allow the funds to be used broadly to meet the unique needs of providers so they can reopen or maintain essential services. It will explain, for example, how they can use the funds to bolster their workforce, cover expenses like rent and utilities, and pay for goods and services needed to stay open or reopen. And, it will provide guidance on ways providers can use funds to help them operate according to CDC guidelines, so that as parents return to work, they can have peace of mind their children are in a safe and healthy learning environment. In all, these funds will support child care providers in keeping their doors open, benefiting the parents of more than 5 million children who rely on them to stay in or return to the labor force.

And, thanks to the historic expansion of the Child and Dependent Care Tax Credit (CDCTC) in the American Rescue Plan, families can rest assured that they can receive up to half of their child care expenses this year when they file taxes for 2021. A median income family with two kids under age 13 will receive a tax credit of up to $8,000 towards this year’s expenses, compared with a maximum of $1,200 previously.

Directing the Secretary of Labor to Safely Expand States’ Reemployment Services and Workforce Development Boards’ Jobs Counseling for Unemployment Beneficiaries.

States receive federal funding for Reemployment Services and Eligibility Assessments (RESEA) of UI beneficiaries to help them find employment while ensuring they remain eligible for benefits. These services shorten workers’ time on unemployment benefits by helping them match with good jobs and confirm their eligibility for benefits. States significantly and appropriately slowed in-person RESEA meetings in the midst of historic unemployment and the COVID-19 pandemic. With the economy and jobs growing again, the President will direct the Secretary of Labor to issue guidance to states to quickly and safely – consistent with CDC and OSHA guidance – expand their RESEA programs so that more UI beneficiaries can return to work.

Similarly, the public workforce system’s Workforce Development Boards (WDB) collectively receive hundreds of millions of dollars they can use to provide individualized career counseling, called “individual career services,” to job seekers. However, because of the pandemic’s risks, many WDBs stopped providing in-person services and had to quickly transition to remote services. Now that tens of millions of Americans have been vaccinated, and we know how to operate physical locations safely, the President will direct the Secretary of Labor to work with the public workforce system to provide the maximum level possible of individual career services to UI beneficiaries and other unemployed workers using existing resources, and in a manner consistent with CDC and OSHA guidance.

MAKING IT EASIER FOR EMPLOYERS TO HIRE NEW WORKERS

Supporting Hard-Hit Restaurants and Bars

Restaurants, bars, and other small businesses offering on-site food and beverages are vital to our communities and economy. From big cities to small towns, these restaurants and bars offer communities a place to gather, celebrate, and share ideas. They also employed nearly 12 percent of all workers prior to the pandemic. Despite their importance, restaurants and bars have suffered severely during the pandemic. The leisure and hospitality sector, which includes restaurants and bars, had 17 percent fewer jobs this April than in February 2020.

Though we have seen significant progress under the Biden-Harris Administration – leisure and hospitality added 331,000 jobs in April, by far the most of any industry and more than it added in March – there is still more work to do to help this critical sector recover. Established through the American Rescue Plan, the Biden-Harris Administration recently launched the Restaurant Revitalization Fund (RRF) – a program to aid restaurants, bars, food trucks, and other food and drink establishments. These grants will give restaurants and bars the flexibility to hire back workers at good wages. In the first two days of the program, 186,200 restaurants, bars, and other eligible businesses in all 50 states, Washington, D.C., and five U.S. Territories applied for relief.

Today, the Administration is sending the first grants under the program to 16,000 hard-hit restaurants. These include restaurants in states and territories throughout the country, and restaurants owned and controlled by women, veterans, and socially and economically disadvantaged individuals.

Providing States and Localities with the Resources They Need to Help Return Americans to Work

The American Rescue Plan delivered flexible Coronavirus State and Local Fiscal Recovery Funds that will help state and local governments hire back public sector workers; ramp up the effectiveness of their COVID response and vaccination programs to make return to work, school, and care safer; and bolster efforts to help workers negatively affected by the pandemic to train for and secure good-paying jobs. With today’s announcement, the U.S. Department of Treasury is making the first segment of these funds available to states and localities and laying out how these funds can be used to address pandemic-response needs and support the communities and populations hardest-hit by the COVID-19 crisis.

State and local employment remains 1.3 million jobs down since before the pandemic. Learning from the mistakes of the Great Recession, when state and local government budget cuts were a drag on GDP growth for 23 of the 26 quarters following the crisis, the funds will provide these governments with the resources needed to help address challenges in returning Americans to work. This includes in the public sector, where state and local employment remains down over one million jobs since the start of the pandemic. Fiscal Recovery Funds will help bring firefighters, teachers, school staff, cops, and other public servants back to work.

Helping Employers – Especially Small Businesses – Rehire and Retain Workers Through the Extended and Expanded Employee Retention Credit

To help hard-hit employers rehire and retain workers, President Biden extended and expanded the Employee Retention Credit (ERC) in the American Rescue Plan. This year, the ERC offers eligible employers with 500 or fewer employees a tax credit of 70 percent of the first $10,000 in wages per employee per quarter. In other words, this refundable, advanceable credit will cover up to $7,000 in wages per quarter or $28,000 per year for each employee. For example:

- A small independent retailer in Milwaukee, Wisconsin with 25 employees has $130,000 in payroll expenses per quarter (all for employees earning less than $10,000 in the quarter), and experiences a 25 percent decline in gross receipts in the first quarter of 2021 compared to the first quarter of 2019. The retailer is eligible for the Employee Retention Credit in the first quarter since it experienced a greater than 20 percent decline in gross receipts. The retailer is also eligible for the ERC in the second quarter because of the decline as compared to 2019 in the immediately preceding first quarter. The retailer can claim a tax credit of $91,000 in both the first and second quarters (for a total of $182,000). The amount of the tax credit would be applied against the retailer’s quarterly federal payroll tax amount, and then, assuming that the $91,000 was in excess of the total liability for the quarter, the excess would be advanced (or paid by the government directly to the retailer). If the retailer experienced declines in gross receipts in the third quarter as compared to 2019, it could claim an additional tax credit (in a similar amount) for the third quarter and the fourth quarter. The small retail business could use this advance – which could amount to tens of thousands of dollars – to rehire workers, raise wages, improve facilities, and purchase new inventory.

While more than 30,000 small businesses have already claimed more than $1 billion in ERCs this year, the Biden-Harris Administration is working to increase awareness of and participation in this beneficial program. Specifically, this week, the Treasury Department will disseminate clear and concise steps on how businesses can determine their eligibility and claim the ERC. These and other efforts will help businesses bring employees back sooner and keep them on the job as the economy recovers.

Helping Employers Ramp Back Up

As businesses ramp back up without knowing how many workers they will need to operate as the economy recovers, some will look to bring workers on part-time. The UI system offers options for these employers and their returning workers. Workers shouldn’t have to choose between losing their full UI benefits to take part-time work that represents only a portion of their original salary. The Department of Labor will announce this week how unemployed workers who are rehired part-time don’t have to face that choice. They can work part-time while still receiving part of their UI benefits so they can work and still make ends meet.

There are two programs that can help and the Department of Labor this week will help highlight them:

- Short-Time Compensation: Short-time compensation was designed to help prevent layoffs by allowing workers to remain employed at reduced hours and still collect a portion of their UI benefits. But it can also be used to help employers rehire their already laid off workers. If an employer brings a laid-off employee back part-time and participates in the short-time compensation program, that worker will receive pro-rated UI benefits to help cover reduced compensation for not working full time, as well as the $300 weekly supplement until that supplement expires September 6th.

The Biden-Harris Administration will highlight this program to help employers rehire their laid-off employees in the coming weeks and work to make it as easy as possible for employers and workers to participate. Short-time compensation programs are currently available in . These benefits are fully federally funded through September 6 for those states.

- Partial UI: Another overlooked option for helping employers ramp up is the partial UI program, which allows workers to return to work at a new employer at reduced hours while still receiving some unemployment benefits. This is a good option for workers who may not qualify for short-time compensation because they are not returning to their previous employer. States can enhance the capacity of partial UI by raising the income threshold where workers can both work and receive some UI benefits, and the Department of Labor will be encouraging states to do so.

CLARIFYING RULES OF THE UI PROGRAM

This week, the Department of Labor will reaffirm longstanding UI requirements to make sure everyone, including states, employers, and workers, understands the rules of the road for UI benefits. These clarifications will also help ease a return to work. Specifically, the Secretary of Labor will issue a letter to states to reaffirm that individuals receiving UI may not continue to receive benefits if they turn down a suitable job due to a general, non-specific concern about COVID-19. In addition, the President is directing the Secretary of Labor to work with states to reinstate work search requirements for UI recipients, if health and safety conditions allow.

- Clarifying Rules of UI Programs: The Department of Labor will clarify that, under all UI programs including the Pandemic Unemployment Assistance (PUA) program put in place last year, workers may not turn down a job due to a general, non-specific concern about COVID-19 and continue to receive benefits. Under the PUA program, a worker may receive benefits if the worker certifies weekly that one of the few specific COVID-related reasons specified by Congress is the cause of their unemployment. These reasons include, for example, that the worker has a child at home who cannot go to school because of the pandemic or that the worker is offered a job at a worksite that is out of compliance with federal or state health requirements. Moreover, workers may not misreport a COVID-related reason for unemployment. The President is directing the Department of Labor to take concrete steps to raise awareness about these and other requirements.

- Directing the Secretary of Labor to Work with States on Work Search Requirements: The President is directing the Secretary of Labor to work with states to reinstate work search requirements for UI recipients, if health and safety conditions allow. As part of the Families First Coronavirus Response Act signed into law last year by the previous Administration, states receiving certain federal relief funds were required to waive their requirements that workers search for work in order to continue receiving unemployment benefits. While 29 states have already reinstated their work search requirements, the President is directing the Department of Labor to work with the remaining states, as health and safety conditions allow, to put in place appropriate work search requirements as the economy continues to rebound, vaccinations increase, and the pandemic is brought under control.

A core purpose of the UI program is helping workers get back to work. UI keeps workers connected to the labor market during spells of unemployment by providing workers with income that allows them to look for a job match commensurate with their skills or prior wages. UI recipients also gain access to crucial reemployment services to help with job search or retraining where necessary. Ensuring a good job match is good for workers, as well as employers who want the best candidates for their jobs.

Returning to work during a pandemic is more complicated than searching for work in ordinary times. The COVID-19 pandemic remains a genuine challenge for our country, with infections, hospitalizations, and deaths down substantially when compared with last year, but still at unacceptably high levels. While vaccinations are on the rise with over half of American adults having received at least one shot, around a quarter of those aged 18 to 29 and around a third of those aged 30 to 39 are fully vaccinated. There is a great deal more to do.

At the same time, our economy is growing again at an annual rate of more than 6% and more than 1.5 million jobs have been created over the last three months. Many more workers would like to return to work if they can overcome the barriers that stand in the way. We can and will continue to ensure workers and their families are protected from COVID-19, while also helping those who are able and available to search for good jobs in safe and healthy workplaces.

‘Key to Getting Funds Into Hands of Providers’

Katie Hamm, acting deputy assistant secretary for Early Childhood Development at HHS’ Administration for Children and Families, stated, “Today, the Administration for Children and Families (ACF) released guidance to support states, territories, and tribes in distributing $24 billion in relief funds for child care providers. The guidance explains specific requirements related to the child care stabilization funds and identifies opportunities for states, territories, and tribes to leverage these resources to support a wide range of child care providers.

“The guidance is key to getting funds into the hands of providers that employ essential workers and help make child care accessible to working families. These funds essentially help stabilize the industry and spur economic growth in communities hit hardest by the pandemic. Most of these funds will go to providers and can be used for a variety of operating expenses, including wages and benefits, rent and utilities, personal protective equipment and sanitization and cleaning.

“This guidance lays out a roadmap for stabilizing the child care sector. The document is meant to support and guide child care agencies in awarding grants to child care centers and family child care providers, which are vital to our nation’s economic recovery.”