Today, October 21, 2024, the Biden-Harris Administration proposed a rule to expand coverage of affordable contraception under the Affordable Care Act (Obamacare). Here is a memo from Jennifer Klein, Director of the White House Gender Policy Council which Biden established, and a fact sheet from the White House on the proposal:

Interested Parties Memo: Biden-Harris Administration Expands Coverage of Contraception Under the Affordable Care Act as Republican Elected Officials Continue Attacks on Reproductive Freedom

From: Jennifer Klein, Director, White House Gender Policy Council

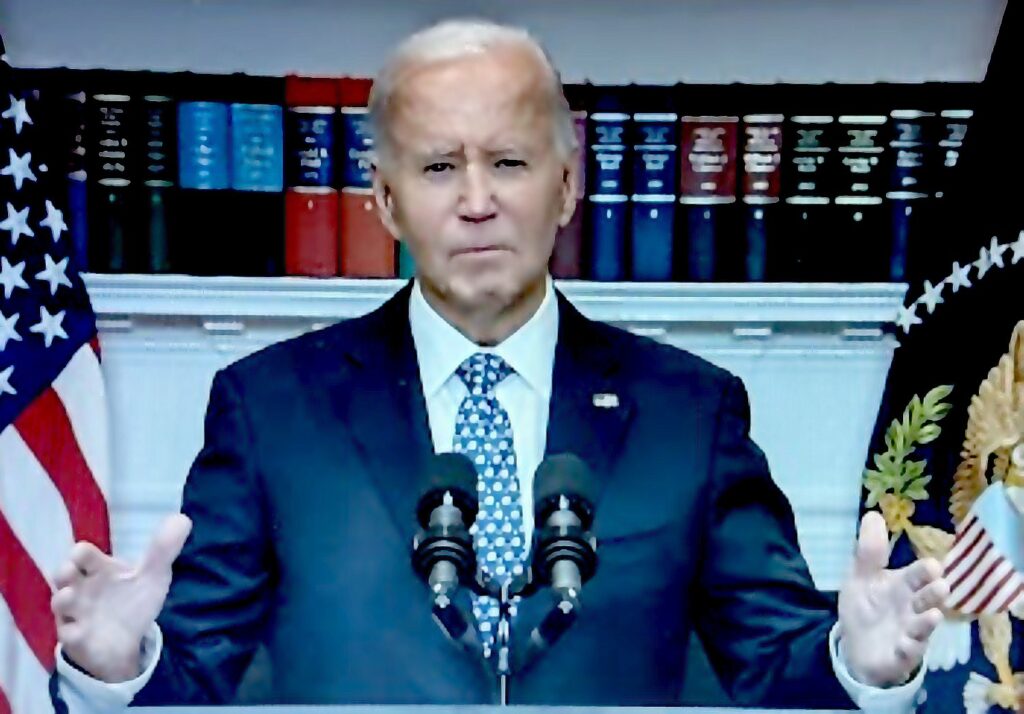

Under President Biden and Vice President Harris’s leadership, the Administration is taking bold action to expand coverage of contraception for the 52 million women of reproductive age with private health insurance, marking the most significant expansion of contraception benefits under the Affordable Care Act in more than a decade.

Today’s announcement builds on the Biden-Harris Administration’s strong record of defending access to reproductive health care and commitment to ensuring that women have the freedom to make deeply personal health care decisions, including if and when to start or grow their family.

Meanwhile, Republican elected officials continue to threaten women’s health, lives, and freedom through extreme abortion bans, some with no exceptions for rape or incest. Women are being denied essential medical care while doctors and nurses are threatened with jail time. Abortion, contraception, and IVF are under attack, while Republicans in Congress refuse to protect nationwide access to this vital reproductive health care. This extreme agenda is out-of-touch with the American people—which is why voters have overwhelmingly chosen to protect reproductive freedom in every state where abortion has been on the ballot.

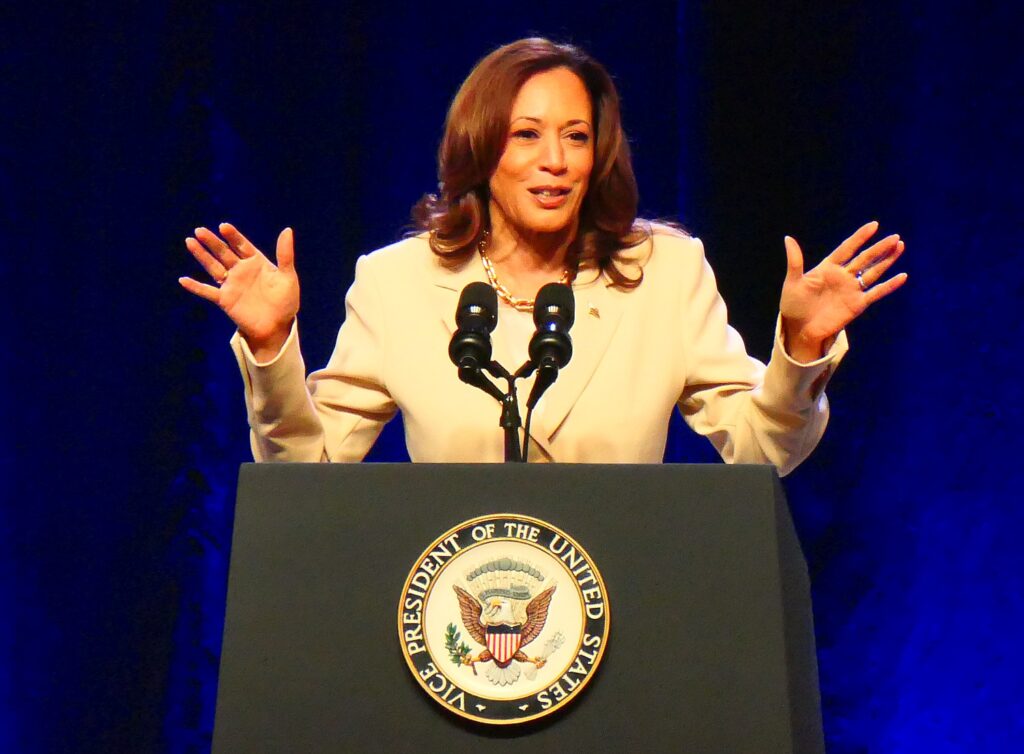

President Biden and Vice President Harris stand with the vast majority of Americans in supporting a woman’s right to choose, and they will continue the fight against a national abortion ban and call on Congress to restore the protections of Roe v. Wade in federal law once and for all.

Read the Rest of the Interested Parties Memo Here

Read President Biden’s Statement Here

Read Vice President Harris’ Statement Here

Read the Fact Sheet Here (and below)

FACT SHEET: Biden-Harris Administration Proposes Rule to Expand Coverage of Affordable Contraception Under the Affordable Care Act

Biden-Harris Administration Announces Proposal for Most Significant Expansion of Contraception Coverage Under the Affordable Care Act in More Than a Decade

President Biden and Vice President Harris have protected and built on the Affordable Care Act. Nearly 50 million people over the past decade have had coverage through the Affordable Care Act’s Marketplaces, and the law has protected more than 100 million people with preexisting medical conditions. Thanks to the Biden-Harris Administration, Affordable Care Act coverage is more affordable than ever with millions of families saving an average of $800 per year on Marketplace coverage.

The Affordable Care Act has also helped millions of women save billions of dollars on contraception—an essential component of reproductive health care that has only become more important since the Supreme Court overturned Roe v. Wade. As part of President Biden and Vice President Harris’ steadfast commitment to reproductive rights, the Biden-Harris Administration has further strengthened contraception access and affordability under the Affordable Care Act, through Medicare and Medicaid, through the Title X Family Planning Program, through federally qualified health centers, and for federal employees, Service members, veterans, and college students.

Today, the Biden-Harris Administration is proposing a rule that would significantly increase coverage of contraception without cost sharing for 52 million women of reproductive age with private health insurance. Building on the Affordable Care Act’s requirement that most private health plans must cover contraception without cost sharing, today’s proposed rule from the Departments of Health and Human Services (HHS), Labor, and the Treasury would:

- Expand coverage of over-the-counter contraception without cost sharing. Under the proposed rule, for the first time, women would be able to obtain over-the-counter (OTC) contraception without a prescription at no additional cost. As a result, more women would be able to access and afford critical OTC medications such as emergency contraception and the first-ever daily oral contraceptive approved by the Food and Drug Administration (FDA) for use without a prescription that is now widely available across the country.

- Make it easier to learn about coverage for OTC contraception. To help ensure that women understand this new benefit, most private health plans would be required to disclose that OTC contraception is covered without cost sharing and without a prescription—and take steps to help women learn more about their contraception coverage.

- Strengthen coverage of prescribed contraception without cost sharing. The proposed rule would make it easier for most women with private health insurance to obtain contraception without cost sharing that is prescribed by their health care provider. Health plans would be required to cover every FDA-approved contraceptive drug or drug-led combination product without cost sharing unless the plan also covers a therapeutic equivalent without cost sharing, eliminating barriers that some women continue to face in accessing contraception prescribed by their provider.

This proposed rule, if finalized, would be the most significant expansion of contraception coverage under the Affordable Care Act since 2012, when contraception was first required to be covered. Also today, the Biden-Harris Administration is issuing new guidance to help ensure that patients can access other preventive services, such as cancer screenings, that must be covered without cost sharing under the Affordable Care Act.

The Biden-Harris Administration is issuing this proposed rule at a time when reproductive rights are under attack, and Republican elected officials remain committed to repealing the Affordable Care Act. Following the Supreme Court’s decision to overturn Roe v. Wade, dangerous and extreme abortion bans are putting women’s health and lives at risk and disrupting access to critical health care services, including contraception, as health care providers are forced to close in states across the country. At the same time, Republican elected officials in some states have made clear they want to ban or restrict birth control in addition to abortion, and Republicans in Congress have attacked contraception access nationwide by proposing to defund the Title X Family Planning Program. In contrast, President Biden and Vice President Harris believe that women in every state must have the freedom to make deeply personal health care decisions, including the right to decide if and when to start or grow their family.

Today’s announcements build on actions that the Biden-Harris Administration has already taken to expand access to affordable contraception, including to implement the President’s Executive Order on Strengthening Access to Affordable, High-Quality Contraception and Family Planning Services from June 2023. The Administration has taken action to:

- Expand contraception coverage and affordability under the Affordable Care Act. The Departments of HHS, Labor, and the Treasury proposed a rule to provide a new pathway under the Affordable Care Act for women to access coverage of contraceptives when their private health coverage is exempt from covering this benefit due to a religious objection. These agencies also issued new guidance to support expanded coverage of a broader range of FDA-approved, cleared, or granted contraceptives at no additional cost under the Affordable Care Act, building on guidance issued after Roe v. Wade was overturned to clarify protections for contraceptive coverage under the Affordable Care Act. Further, HHS strengthened the standard for inclusion of family planning providers in Marketplace plan provider networks and provided nearly $9 million in grant funding to support state efforts to enhance and expand coverage of, and access to, reproductive and maternal health services, including contraception. And the Internal Revenue Service issued new guidance affirming that high-deductible health plans can cover OTC contraception as preventive care.

- Bolster family planning services through Title X clinics. HHS continues to rebuild and grow the Title X Family Planning Program, which has played a critical role in ensuring access to a broad range of high-quality family planning and preventive health services for more than 50 years. During the prior administration, more than 1,000 service sites left the Title X Family Planning Program, leading to a significant decline in people served. The Biden-Harris Administration reversed the policy changes that led to those departures, strengthening the Title X Family Planning Program and helping ensure that the Program remains a critical part of the nation’s health safety net. In 2023, HHS provided about $287 million to nearly 4,000 Title X clinics across the country to provide free or low-cost voluntary, client-centered family planning and related preventive services for 2.8 million women and families—an 80 percent increase since 2020.

- Support family planning coverage through the Medicaid and Medicare programs. The Centers for Medicare & Medicaid Services (CMS) issued new guidance to state Medicaid programs and Children’s Health Insurance Programs (CHIP) to help ensure that enrollees can access family planning services. The new guidance outlined existing state obligations under federal law, highlighted strategies to enhance access to contraception, affirmed confidentiality requirements for those seeking family planning services, and shared recommendations on ways to measure quality in delivering family planning services. To help ensure that women with Medicare coverage have access to more covered types of contraception without unnecessary barriers, CMS updated its Medicare Part D formulary clinical review process for plan year 2024 and 2025 to include additional contraceptive types, such as long-acting contraceptives, and is increasing public awareness of contraceptive coverage options under Medicare Part B. The Secretary of HHS also issued a letter to state Medicaid and CHIP programs as well as private health insurers and Medicare plans about their existing obligations to cover contraception for those they serve.

- Increase contraception access through federal health centers. Federal health centers continue to be an important source of family planning services: in 2023, health centers provided nearly 3 million contraceptive services visits to patients, a 14 percent increase since 2020. To support health centers in providing high-quality family planning services, the Health Resources and Services Administration (HRSA) provided updated guidance on existing federal requirements for family planning and related services, which is a required primary health care service under federal law, as well as evidence-based recommendations and resources. HRSA also adopted new data measures for health centers that will help assess whether patients have been screened for contraception needs. Screening and data measures will help enhance the overall delivery of voluntary family planning and related services.

- Support contraception access for federal employees and their families. The Office of Personnel Management strengthened access to contraception for federal workers, retirees, and family members by issuing guidance to insurers participating in the Federal Employee Health Benefits Program to clarify standards and support expanded coverage of a broader range of FDA-approved, cleared, or granted contraceptives at no additional cost. The Office of Personnel Management also required insurers that participate in the Federal Employee Health Benefits Program to take additional steps to educate enrollees about their contraception benefits and launched a public education campaign to highlight contraception benefits available to federal employees and their families.

- Promote contraception access and affordability for Service members and their families and certain dependents of veterans. To improve access to contraception at military hospitals and clinics, the Department of Defense expanded walk-in contraceptive care services for active-duty Service members and other Military Health System beneficiaries and eliminated TRICARE copays for certain contraceptive services. And the Department of Veterans Affairs eliminated out-of-pocket costs for certain types of contraception through the Civilian Health and Medical Program of the Department of Veterans Affairs.

- Support access to affordable contraception for college students. To help increase access to contraception for college students, President Biden directed the Secretary of Education to convene institutions of higher education to share best practices and ways to help students understand their options for accessing contraception. In 2023, Vice President Harris joined a Department of Education convening of representatives from 68 colleges and universities across 32 states to discuss promising strategies for protecting and expanding access to contraception for their students. This convening followed Vice President Harris’s multiple conversations about reproductive health access with students on college campuses across the country.

- Enhance contraception access through technical assistance and public-private partnership. In June 2023, HHS announced a new five-year public-private partnership to expand access to contraception with Upstream, a national nonprofit organization that provides health centers with free patient-centered, evidence-based training and technical assistance to eliminate provider-level barriers to offering the full range of contraceptive options. To date, HHS has connected Upstream to more than 130 health care clinics, resulting in partnerships that will help Upstream accelerate their national expansion to reach 5 million women of reproductive age every year.

- Promote research and data analysis on contraception access. To document the gaps and disparities in contraception access as well as the benefits of comprehensive coverage, HHS convened leading experts to discuss the state of research, data collection, and data analysis on contraception access and family planning services. These convenings helped identify research gaps, opportunities for collaboration, and ways to bolster research efforts for both Federal agencies and external partners.

In addition to strengthening access to affordable contraception, the Biden-Harris Administration continues to implement President Biden’s threeExecutiveOrders and a Presidential Memorandum directing federal agencies to protect access to reproductive health care issued since the Court overturned Roe v. Wade. To date, the Biden-Harris Administration has taken action to protect access to abortion, including FDA-approved medication abortion; defend access to emergency medical care; support the ability to travel for reproductive health care; safeguard the privacy of patients and health care providers; and ensure access to accurate information and legal resources.

The Vice President has led the White House’s efforts to partner with leaders on the frontlines of protecting access to abortion, highlighting the harm of abortion bans to women’s health at more than 100 events in more than 20 states since Roe v. Wade was overturned, and meeting with hundreds of state legislators, health care providers, and advocates. On what would have been the 51st anniversary of Roe v. Wade, the Vice President launched a nationwide Fight for Reproductive Freedoms tour to continue fighting back against extreme attacks throughout America.

President Biden and Vice President Harris will continue to call on Congress to restore the protections of Roe v. Wade in federal law to ensure that women in every state are able to make their own decisions about reproductive health care.

See also:

To Protect Women’s Freedom, Liberty, Life, Vote for Harris, Democrats and the ERA