It is truly shocking to hear “poll” results where the majority of people think President Biden has done nothing, that the economy is weak, that no new jobs have been created. Beyond absurd – you have to wonder about who was polled, how the polling was done, or what rock these people have been under, or if they are permanently wired to Fox Fake News. This preview of the State of the Union Address providing a Fact Sheet on the Biden Administration’s economic record, comes from the White House:

President Biden has long believed that we must build the economy from the bottom up and middle out, not the top down. As the President says, when the middle class does well, the poor have a ladder up and the wealthy still do very well. He believes the best way to grow the economy, create good-paying jobs, and lower costs for families is by promoting workers, investing in America and its people, making the economy more competitive, and reforming the tax code to reward work and not wealth. Our progress over the last two years shows that his economic strategy is working.

The state of the economy is strong. In his State of the Union address, President Biden will highlight the historic progress we have made to bring the economy back from the pandemic and create more jobs in a two-year period than under any other president on record. He will discuss progress lowering costs and providing more breathing room for families, including cutting prescription drug costs, health insurance premiums, and energy bills, while driving the uninsured rate to historic lows. He will outline the manufacturing boom across the country—in infrastructure, semi-conductors, and clean energy—that is strengthening parts of the country left behind and creating good jobs, including for workers without college degrees.

And, he will emphasize that his economic strategy has been a fiscally responsible one. President Biden’s predecessor passed a nearly $2 trillion unpaid for tax cut with benefits skewed to the wealthy and large corporations, and the deficit went up every single year under his watch. Under President Biden, the deficit has fallen by $1.7 trillion, and his reforms to take on Big Pharma, lower prescription drug costs, and make the wealthy and large corporations pay their fair share will reduce the deficit by hundreds of billions more.

President Biden knows that the work to build an economy from the bottom up and middle out is far from done. He will say that we need to build on this work to continue growing our economy and lowering costs. He will discuss the work to come to implement his historic investment agenda in a way that benefits all Americans. And, the President will preview the budget he will send to Congress on March 9, which will build on the historic economic progress of the past two years by continuing to invest in America and its people, continuing to lower costs for families—from child care to housing to college to health care—protecting and strengthening Social Security and Medicare, and reducing the deficit through additional reforms to ensure the wealthy and largest corporations pay their fair share.

Historic Progress to Create Jobs, Promote Workers, and Transition to Steady and Stable Growth

When President Biden took office, the economy was in crisis, millions were out of work, and Main Streets were shuttered. In two years, the President has overseen a historic economy recovery and laid the foundation for steady and stable growth in the years to come.

A historic, equitable economic recovery. President Biden’s economic strategy led to a historic recovery with tangible benefits for workers and families. Since President Biden took office, the economy has created more than 12 million jobs—including more than 800,000 manufacturing jobs—and the unemployment rate is at a 54-year low, including near record lows for Black workers. The unemployment rate for Hispanic workers hit a record low last year. The past two years were also the best two years for new small business applications on record. None of this progress was pre-ordained. Before President Biden signed his Rescue Plan into law, experts predicted it would take far longer to create this many jobs. And few—if any—experts predicted it would be possible to get the unemployment rate down to a level last seen in 1969. In fact, before the Rescue Plan passed, the Congressional Budget Office projected the unemployment rate in the first quarter of 2023 would be 4.8%, rather than its current level of 3.4%.

More breathing room and economic security for families. This historic jobs recovery, along with Biden-Harris Administration policies designed to help workers and families, has left families more economically secure than before the pandemic. Compared to pre-pandemic levels, households are now less likely to be delinquent on their credit card bills and mortgages, and more likely to have health insurance. They are facing fewer evictions and foreclosures than there were before the pandemic, and bankruptcy rates are lower as well. This economic security is giving families peace of mind and breathing room that they didn’t have before the pandemic. Child poverty also fell to a historic low in 2021, and the President will call on Congress to continue these gains through the expanded Child Tax Credit, even as he has taken action to lift nearly 1 million children out of poverty by modernizing nutrition benefits.

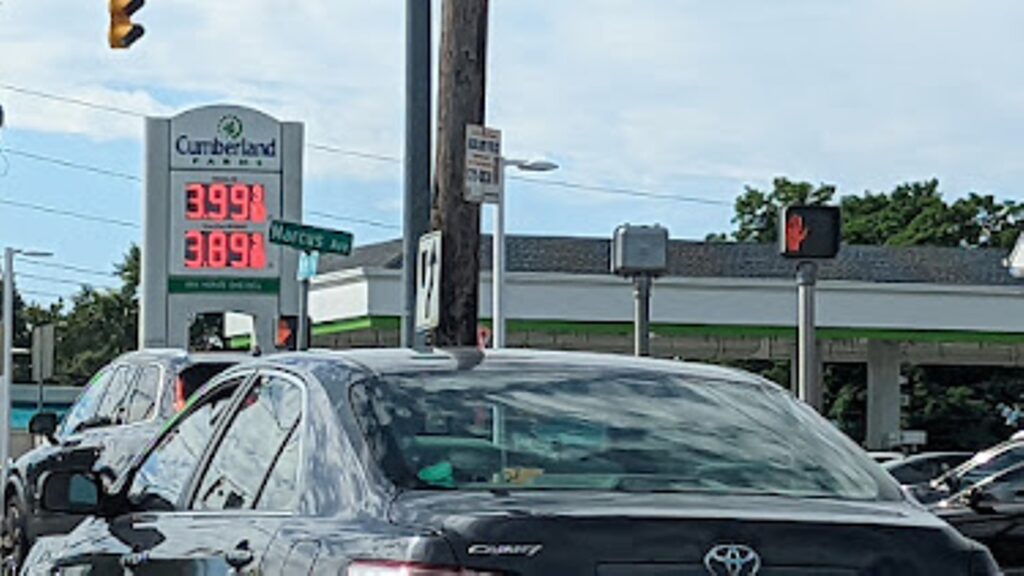

Progress on transitioning to steady, stable growth with lower inflation. In the wake of unprecedented economic disruption from a historic pandemic, inflation has been a challenge all over the globe. Last spring, President Biden set the goal of transitioning our economy to lower inflation, while maintaining a resilient job market for American workers. Now, annual inflation has fallen for six months straight, driven in large part by a roughly $1.50 decline in gas prices compared to last summer. Over the second half of 2022, three-month core inflation fell from nearly 8% at an annualized rate to 3% at an annualized rate—at the same time that the unemployment remained at or near 50-year lows. As a result of the progress on inflation and the resilience of the job market, wages adjusted for inflation are higher than they were seven months ago. While there is more work to do to bring inflation down and lower costs for families—and there may be setbacks along the way—the past six months have marked significant progress toward the President’s goal of bringing down inflation without giving up the economic progress we’ve made.

Manufacturing Boom Across the Country and Historic Investments in Infrastructure

Even before the pandemic, the middle class was hollowed out. Manufacturing jobs moved overseas and factories closed down. The President believes that the United States can lead the world in manufacturing again. His economic plan has done just that—generate a manufacturing boom across the country and build an economy where no one is left behind. The President’s economic plan is stimulating new factories and manufacturing lines and creating good-paying jobs that don’t require a four-year degree. His plan includes the most significant upgrade to our nation’s infrastructure in generations—an investment larger than FDR’s investment Rural Electrification and Eisenhower’s efforts to build the Interstate Highway system. It includes the most significant clean energy plan ever, transitioning the clean energy economy and lowering households’ energy costs. And, it includes the most substantial investment in science, innovation, and industrial strategy in over 50 years.

In just the two years since President Biden took office, we have spurred more than $700 billion in announced private investment in manufacturing, utilities, and energy from more than 200 companies in all 50 states. Much of this investment is driven by the semiconductor, energy, electric vehicles and batteries, and other cutting-edge sectors.

Ensuring President Biden’s agenda creates a future made in America. Building on the historic investment agenda the President has signed into law, President Biden is ensuring that our historic infrastructure investments use materials made in America. For decades, Buy America laws focused on iron and steel and only covered certain federally funded infrastructure projects. This giant loophole meant projects could be built with other materials sourced from anywhere in the world. The Biden-Harris Administration is working to close this loophole and implement new standards, once and for all, so materials for roads and bridges, airports, transit, rail, water, high-speed internet, and clean energy infrastructure are made in America and support American jobs.

The President will announce in the State of the Union that he is issuing proposed guidance to ensure construction materials from copper and aluminum to fiber optic cable, lumber, and drywall, are made in America. Once finalized, these standards will apply to virtually all infrastructure spending supported by Federal financial assistance—not simply roads and bridges, but also buildings, water infrastructure and high-speed internet, providing consistency for companies and state and local governments to apply the standards and a strong federal government-wide demand signal.

These steps complement the Administration’s implementation of the most robust updates in nearly 70 years to the Buy American Act for federal procurement. Those updates are helping to ensure that taxpayers’ dollars support American manufacturing, boost resiliency in critical industries, and create good-paying jobs right here at home. The Buy American rule increased the percentage value of component parts manufactured in the US from 55% to 60% this past fall as the first step toward increasing that value to 75%.

Lowering Health Care Costs for Families

The President knows what it’s like to stare at the ceiling, worried about paying for prescriptions or health care. He believes that every American has a right to the peace of mind that comes with knowing they have access to affordable, quality health care. President Biden passed legislation to lower health care and prescription drug costs for American families, giving families more breathing room. Tomorrow, he will discuss the historic progress we have made on lowering health care costs under his watch, including steps to strengthen Medicare, Medicaid, and the Affordable Care Act (ACA), and steps we must take to build on that progress and give more families the peace of mind of affordable prescriptions and health care.

$800 lower health care premiums. A record-setting 16.3 million people signed up for ACA coverage this year, and the national uninsured rate hit an all-time low last year. That’s thanks in large part to President Biden and Democrats in Congress’ work to lower premiums for ACA coverage by an average of $800 per person per year—along with President Biden’s actions to quadruple consumer assistance, increase outreach, and close the “family glitch” loophole that blocked many children and spouses from affordable coverage. Tomorrow, the President will call on Congress to make these savings for American families permanent, so we can continue our work to make health care a right, not a privilege.

60 million Medicare beneficiaries will be protected from skyrocketing drug costs. President Biden took on Big Pharma—and won. Thanks to the new prescription drug law, Medicare will be able to negotiate drug prices and cap out-of-pocket pharmacy costs at $2,000 per year under Part D, and drug companies will pay rebates to Medicare if they try to hike their prices faster than the rate of inflation. For the last six weeks, seniors across the country have been benefiting from key drug pricing protections that are putting money back in their pockets:

- $35 price cap on insulin in Medicare. Starting this year, Medicare beneficiaries will pay no more than $35 per month per insulin prescription. 1.5 million people would have each saved, on average, $500 per year had this law been in effect in 2020. The President will call on Congress to extend this commonsense, life-saving protection to all Americans, not just people with Medicare.

- $0 vaccines through Medicare. More adult vaccines are now available without any co-pays under Medicare Part D thanks to the new prescription drug law. This includes the shingles vaccine, which used to cost seniors as much as $200.

1 million surprise medical bills are prevented every month. Before President Biden took office, millions of people received surprise bills for out-of-network care, costing them hundreds or thousands of dollars. The Administration is protecting millions of consumers from surprise medical bills through the implementation of the No Surprises Act, which has already protected 10 million Americans from unfair, undeserved out-of-network charges.

$3,000 in savings on hearing aids. In October 2022, over-the-counter hearing aids hit the shelves following a rule from the Food and Drug Administration. Now, millions of Americans can buy hearing aids for low to moderate hearing loss without a prescription or exam. This is anticipated to save Americans as much as $3,000 per pair, providing more breathing room for the estimated 30 million Americans with mild-to-moderate hearing loss.

39 states and the District of Columbia have expanded Medicaid coverage. Missouri, Oklahoma, and South Dakota are the most recent states to expand Medicaid to hundreds of thousands of low-income adults previously locked out of Medicaid coverage. The Administration remains committed to closing the coverage gap in the remaining 11 states, and the President will call on Congress to finish the job. In addition, the Administration also worked with over half the states and DC to extend Medicaid postpartum coverage for millions of women.

Promoting Competition

As President Biden said at last year’s State of the Union, “capitalism without competition isn’t capitalism. It’s exploitation—and it drives up prices.” Over the past year, the Administration has been delivering for the American people to lower prices, protect workers, and increase competition across the economy. In this year’s State of the Union, the President will highlight progress we need to continue to make to promote competition and protect consumers.

Cracking down on junk fees. The Consumer Financial Protection Bureau (CFPB) is lowering or eliminating the banking and credit card “junk” fees that too many Americans pay. The CFPB announced a proposal that will slash excessive credit card late fees to $8 from approximately $30, which combined with other measures could save consumers up to $9 billion a year in late fees. Last year, the CFPB also targeted overdraft and bounced check fees—making changes that will cut fees by over $1 billion a year. The Department of Transportation (DOT) also proposed a rule that would require airlines and online search sites to disclose up front any fees to choose seats including to sit next to one’s child, for baggage, and for changes or cancellations. It also published a dashboard of airline policies when flights are delayed or cancelled due to issues under the airlines’ control, leading 9 airlines to change policies to guarantee coverage of hotels and 10 airlines to guarantee coverage of meals.

The President will re-state his call on Congress to pass a Junk Fees Prevention Act to ban resort and family seating fees, eliminate unnecessary early termination fees for internet and phone services, and crack down on excessive fees and other practices that drive up ticket prices. DOT will also launch a family seating dashboard to raise awareness about airline policies and undertake a rulemaking to ban these fees.

Addressing non-compete agreements. Roughly 30 million Americans, including many low-wage workers, are covered by non-compete agreements that can stifle wage growth for American workers by making it more difficult for workers to leave for higher-paying jobs. The Federal Trade Commission released a proposed rule in January 2023 to ban non-compete clauses, which it estimates will increases wages by $300 billion annually.

Lowering ocean shipping costs. Ocean carriers increased their rates by as much as 1,000% during the pandemic. Last June, Congress passed the Ocean Shipping Reform Act heeding the President’s call in the 2022 State of the Union. This legislation will cut costs for shippers, and in turn American families, and ensure fairer treatment for exports from our farmers and ranchers.

Lowering meat prices. The Administration has taken a number of steps to increase competition in the meat and poultry markets. The Department of Agriculture (USDA) has also issued proposed regulations under the Packers & Stockyards Act to increase competition and market integrity and to prevent abuse of farmers in the poultry growing system. USDA is also using $1 billion to expand independent meat processing capacity, so the market isn’t dominated by just a few big players.

Helping consumers get the right to repair. The President believes that consumers shouldn’t be restricted by big manufacturers from repairing their own equipment—whether it’s a tractor or a smartphone. After President Biden expressed strong support for the right to repair in his Competition Executive Order, Microsoft conducted a study on the issue and made its Surface devices more easily repairable and Apple announced self-service repair for certain devices.

Improving safety and accountability in nursing homes. As the President directed in last year’s State of the Union, CMS has taken action to strengthen oversight of the worst performing nursing homes, prevent abuse and Medicare fraud, and improve families’ ability to comparison shop across nursing homes. In the coming days and months, CMS will announce new actions to increase safety and accountability at nursing homes.

Reducing the Deficit by Ensuring the Wealthy and Large Corporations Pay their Fair Share

In the last two years, the Administration cut the deficit by more than $1.7 trillion—the largest deficit reduction in American history. The President believes we need to continue that progress—and reward work, not wealth.

Since coming to office, the President has signed legislation to make the wealthy and large corporations pay their fair share and provide tax cuts for working families, while reducing the deficit. Under his plan, no one making under $400,000 per year will pay more in taxes.

Billionaire Minimum Tax. President Biden is a capitalist and believes that anyone should be able to become a millionaire or a billionaire. He also believes that it is wrong for America to have a tax code that results in America’s wealthiest households paying a lower tax rate than working families. In a typical year, billionaires pay an average tax rate of just 8%. In the State of the Union, he’ll call on Congress to pass his billionaire minimum tax. This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters.

Surcharge on corporate stock buybacks. Stock buybacks enable corporations to funnel tax-advantaged payouts to wealthy and foreign investors, instead of paying dividends that shareholders are required to pay taxes on. In addition, a number of experts have argued that CEOs—who are compensated mostly in stock—use buybacks to enrich themselves to the detriment of the long-term growth of the company. Last year, oil and gas companies made record profits and invested very little in domestic production and to keep gas prices down—instead they bought their own stock, giving all that profit to their CEOs and shareholders. President Biden signed into law a surcharge on corporate stock buyback, which reduces the differential tax treatment between buybacks and dividends and encourages businesses to invest in their growth and productivity as opposed to paying out corporate executives or funneling tax-preferred profits to foreign shareholders. In the State of the Union, the President will call for quadrupling the tax on corporate stock buybacks.

Corporate minimum tax. In 2020, 55 of the largest corporations that were profitable paid $0 in federal income tax. To end that unfairness in the tax code, President Biden signed into law a 15 percent minimum tax on the profits that large corporations—those with over $1 billion in profits—report to shareholders. This book minimum tax means that it will be harder for companies that say they’re earning a billion in profits to pay tax rates in the single digits on those profits. It also levels the playing field for companies—including small businesses—that are already paying their fair share.

Legislation to crack down on tax cheats and create a fairer tax system. Working people pay 99% of the taxes they owe on their income from wages and salaries, while the top 1 percent hides about 20% of their income from tax, including by funneling it through offshore accounts in tax havens that don’t report earnings. The President signed legislation into law that will crack down on wealthy people and large corporations that cheat on their taxes, while improving customer service for taxpayers. The legislation will not increase audit rates for families or small businesses making under $400,000 per year.