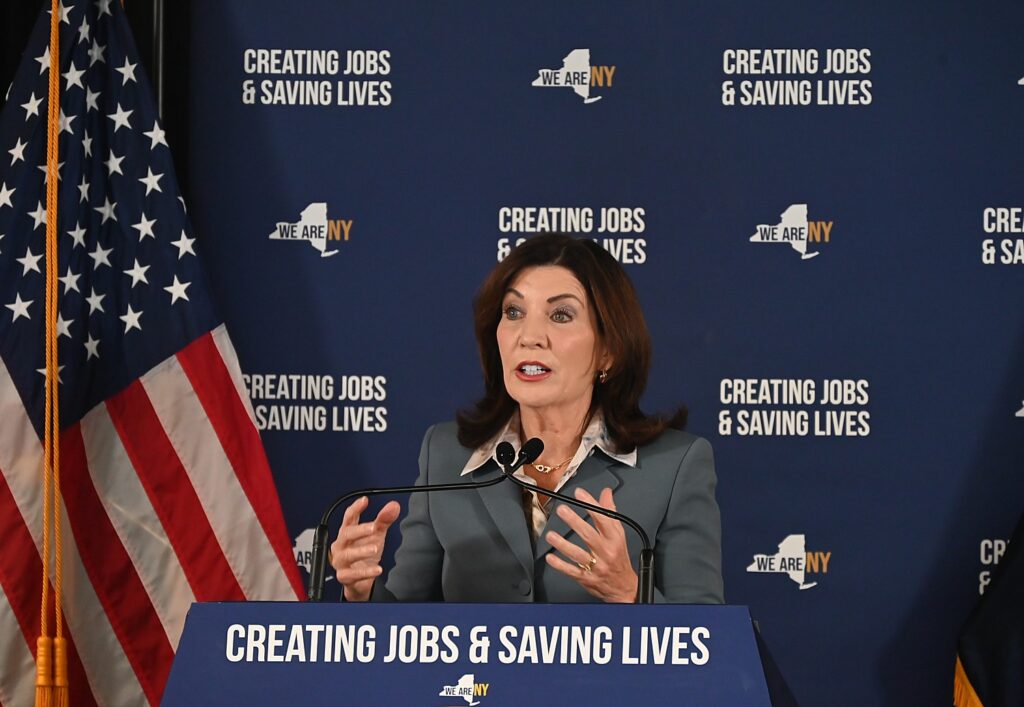

“New Yorkers and business owners all across the state have felt a sense of uncertainty when it comes to the impacts of President Trump’s callous tariffs on our imported goods,” Governor Kathy Hochul said.“No business should have to close shop due to these unfair and unwanted taxes that were imposed on states by the Trump administration. This resource guide will help provide individuals with the guidance they need to lower potential risk to their businesses and give New Yorkers a better understanding of how tariffs can impact them.” © Karen Rubin/news-photos-features.com

NY.gov/tariffs Will Keep New Yorkers Up-To-Date on Impacts of Tariffs

Amid the economic turmoil created by President Trump’s chaotic tariffs, Governor Kathy Hochul today announced a new tariff resource guide to keep New Yorkers up-to-date on programs available for business owners who have been impacted by tariffs. Additionally, the Governor announced a survey to allow business owners the opportunity to share how their businesses have been impacted by the federal government’s recently announced tariffs.

“New Yorkers and business owners all across the state have felt a sense of uncertainty when it comes to the impacts of President Trump’s callous tariffs on our imported goods,” Governor Hochul said. “No business should have to close shop due to these unfair and unwanted taxes that were imposed on states by the Trump administration. This resource guide will help provide individuals with the guidance they need to lower potential risk to their businesses and give New Yorkers a better understanding of how tariffs can impact them.”

Tariffs Impacts on the Economy and Tourism

Governor Hochul has heard from small and mid-sized businesses across the state who are worried about rising costs and their future. A recent survey from the National Small Business Association found that the majority of small businesses are concerned about tariffs and one in three are very concerned. Examples include North Country manufacturer Alcoa, which took an estimated $20 million hit on imports from Canada, and North Country Golf Club which is facing declines in businesses due to the decline in tourism from Canada.

Due to the tariff trade war with Canada, New York’s number one trade partner, and the rhetoric that Canada could be the “51st state,” impacts are widespread. Visitors from Canada are avoiding the U.S. and New York State. Overall, cross-border traffic from Canada has plummeted since Trump implemented his tariff policies. The most recent data shows that there were 400,000 fewer Canadian visitors in May compared to the same period in 2024. Bridge crossings over the Ogdensburg Bridge and the Champlain crossing in May were down 30 percent during that same time period from last year. In a recent North Country Chamber of Commerce survey, 66 percent of tourism businesses report a drop in Canadian customers and one in four businesses in the region may cut staff as a result. Reservations are down at hotels, campgrounds, local marinas, golf courses and other businesses that rely on visitors from Canada.

It deserves reminding that the president has no authority to unilaterally impose tariffs. Moreover, Trump is using tariffs to strong arm other countries to obey his will: telling Brazil, for example, that he will raise tariffs on Brazilian goods by 50 percent unless the country ends its prosecution of Bolsanaro for attempting the same kind of coup as Trump mounted on January 6, 2021, but unlike Trump, was held to account. (Trump Threatens Brazil With Tariffs of 50% as He Assails Prosecution of Bolsonaro)

New York State is also contradicting and countering the destructive policies of the climate-change denying Trump administration and Republican-dominated states (like Texas and Florida):

Madison County Gets Major Renewable Energy Project

Governor Kathy Hochul announced today that the New York State Office of Renewable Energy Siting and Electric Transmission (ORES) has issued a final siting permit to Cypress Creek Renewables to develop and operate Oxbow Hill Solar, a 140-megawatt (MW) solar array in the Town of Fenner in Madison County. The project will create good-paying jobs, improve grid reliability, invest in crucial infrastructure, and increase tax revenues for local schools and other community priorities.

“We are extremely pleased to announce the latest investment in solar technology, upholding our commitment to improving grid reliability and building a clean energy economy,” Governor Hochul said. “The projects we have approved over the last few years are a testament to New York’s commitment to sustainability and resiliency.”

The Oxbow Hill Solar facility will contribute 140 MW of clean, renewable energy to New York’s electric grid while offsetting over 177,000 metric tons of CO2 and providing power for approximately 23,000 average-sized homes.

The new solar facility will consist of the solar array and associated support equipment, along with an interconnection substation, fencing, access roads and an operations and maintenance building. The facility will interconnect to the New York electrical grid via the Fenner Wind to Whitman Road 115 kV transmission line that is owned and operated by National Grid. Oxbow Hill is sited on a portion of the existing Fenner Wind Farm, making it the first ORES permit where a solar facility is co-located with a wind facility.

This project was approved in less than the one-year timeframe required under the law, and was issued after a thorough, timely, and transparent review process that included public comment periods and hearings.

Office of Renewable Energy Siting and Electric Transmission Executive Director Zeryai Hagos said, “As the state approaches 4 gigawatts of clean, renewable energy, a monumental achievement, we are reminded that we still have work to do to address New York’s growing energy needs. ORES will continue to advance New York’s nation-leading clean energy policies while being responsive to community feedback and protecting the environment.”

This project is anticipated to create a total of 330 jobs during construction and marks 24 clean energy projects approved by ORES since 2021, when it was created to accelerate permitting for renewable energy generation. New York State has approved 28 large-scale solar and wind projects since 2021, including 24 permitted by ORES and four approved by the NYS Siting Board under Article 10, the statute that governed solar and wind projects over 25-MW prior to the creation of ORES. The 28 permitted facilities represent 3.9 gigawatts of new clean, renewable energy.

ORES’ decision for these facilities follows a detailed and transparent review process with robust public participation to ensure the proposed project meets or exceeds the requirements of Article VIII of the New York State Public Service Law and its implementing regulations. The application for the Oxbow Hill Solar project was deemed complete on November 18, 2024 with a draft permit issued by ORES on January 14, 2025. This solar power project meaningfully advances New York’s clean energy goals while establishing the State as a paradigm for efficient, transparent, and thorough siting permitting process of major renewable energy facilities.

Today’s decisions may be obtained by going to the ORES website.

Assemblymember Al Stirpe said, “By strengthening New York’s energy economy, we position ourselves to not only meet the growing electricity demand, but to do so sustainably. The solar array in Madison County brings us one step closer in reaching our climate and energy goals. Each major renewable energy project helps deliver the critical climate action that our state urgently needs, while also creating hundreds of local jobs and new revenue for community priorities. At a time where the federal government threatens progress on clean energy, New York remains unwavering in its provision of renewable and efficient energy for years to come.”

New York State’s Climate Agenda

New York State has approved 28 large-scale solar and wind projects since 2021, consistent with its Climate Agenda.

New York State’s climate agenda calls for an affordable and just transition to a clean energy economy that creates family-sustaining jobs, promotes economic growth through green investments, and directs a minimum of 35 percent of the benefits to disadvantaged communities. New York is advancing a suite of efforts to achieve an emissions-free economy by 2050, including in the energy, buildings, transportation, and waste sectors.

Southern Tier Gets $21 Million in Flood Protection Projects

Governor Kathy Hochul today announced $21 million to support flood protection projects in the Southern Tier. The projects address vital stormwater management and resilient infrastructure projects in communities including Binghamton, Elmira, Olean, and Whitney Point to help advance New York’s comprehensive clean water and resiliency efforts that will safeguard New Yorkers from extreme weather and the costly expenses of rebuilding after a flood.

“As we face more and more devastating extreme storms, we must do everything we can to ensure our communities are resilient, sustainable and ready,” Governor Hochul said. “We saw the flooding in Binghamton almost 15 years ago, and we don’t want to see it again. These projects help us get ahead of the storm damage, save taxpayers millions of dollars in the long run, and prevent post-flood recovery costs for homeowners and businesses alike.”

The $21 million provided through the ‘Restoration and Flood Risk’ category of the historic $4.2 billion Clean Air, Clean Water and Green Jobs Environmental Bond Act of 2022 will support projects implemented by the State Department of Environmental Conservation (DEC). The initial four projects announced today will help make necessary updates and bolster the resilience of existing flood infrastructure like levees and flood walls, to help ensure these structures’ long-term effectiveness in protecting communities from flooding. These flood control structures were originally constructed under the federal 1936 Flood Control Act to specifically address flooding along the Southern Tier of New York State and built in the 1940s and early 1950s.

Video of The Project Areas are Available Here

Department of Environmental Conservation Commissioner Amanda Lefton said, “Thanks to Governor Hochul’s leadership and historic investments, New York State is making important progress to protect communities and infrastructure from the devastating impacts of flooding. By supporting DEC’s repairs and upgrades in Binghamton, Elmira, Olean, and Whitney Point with the record funding from the Clean Water, Clean Air and Green Jobs Environmental Bond Act, the Governor is advancing key projects in communities that are susceptible to flooding, helping provide residents the support they need to avoid potential costly repairs if flooding occurs.”

“As climate change continues to intensify storms and flooding across New York, proactive investments like these are critical to protecting communities, infrastructure, and ecosystems,” Assemblymember Deborah Glick said. “The $21 million in Environmental Bond Act funding announced today will strengthen flood control systems in the Southern Tier, projects that are not only long overdue, but essential for public safety and long-term resiliency. I applaud Governor Hochul and Commissioner Lefton for advancing these vital efforts to build a safer, more climate-resilient New York.”

City of Binghamton Flood Control Project: DEC is making improvements to the Binghamton Flood Control Project located along the Susquehanna and Chenango Rivers in the City of Binghamton. Rehabilitation of the floodwalls is necessary to ensure Binghamton has a resilient working flood protection system. The construction includes replacement of two floodwall panels, replacing deteriorated concrete, and application of a protective coating on the floodwalls to extend the useful life of the concrete walls.

City of Elmira Flood Control Project: DEC is making improvements to the Elmira Flood Control Project along the Chemung River, which provides flood protection for the city of Elmira. The project consists of levees, and flood walls with appurtenant drainage structures. The project will install 65 relief wells along with collector pipes to provide pressure relief caused by floodwaters and will ensure the structure meets U.S. Army Corps of Engineers requirements.

City of Olean Flood Control Project: DEC is making improvements to the Olean Flood Control Project located on the Allegheny River and Olean Creek in the city of Olean. The project will stabilize a section of existing levee system, mitigate erosion, and improve access to the levee for regular DEC maintenance.

Village of Whitney Point Flood Control Project: DEC is making improvements to the Whitney Point Flood Control Project located on the Tioughnioga River in the village of Whitney Point. The project will upgrade the manual gate system and install a new swing gate closure structure to more efficiently and effectively close the existing stoplog railroad closure.

On Nov. 8, 2022, New Yorkers overwhelmingly approved the Clean Water, Clean Air and Green Jobs Environmental Bond Act ballot proposition to make $4.2 billion available for environmental and community projects. The Environmental Bond Act supports new and expanded projects across the state to safeguard drinking water sources, reduce pollution, and protect communities and natural resources from climate change. State agencies, local governments, and partners can access this historic funding to protect water quality, help communities adapt to climate change, improve resiliency, and create green jobs.

The projects announced today complement other state investments and opportunities to protect communities from flood damage. In May, Governor Hochul announced more than $78 million in funding available through the Water Quality Improvement Project Program and $22 million in Climate Smart Community grants, which both support projects that include flood risk reduction. Applications for these latest rounds of funding are due by July 31, 2025. In April, the Governor also announced $60 million in Environmental Bond Act funding for the next round of Green Resiliency Grants. The program supports vital stormwater management and resilient infrastructure projects in flood-prone communities across New York State. Applications for this program are due by Aug. 15, 2025. To learn more about resources available for resilient Bond Act-supported projects, visit environmentalbondact.ny.gov.

New York’s Commitment to Water Quality

New York State continues to increase its nation-leading investments in water infrastructure. With an additional $500 million for clean water infrastructure in the 2025-2026 enacted State Budget announced by Governor Hochul, New York will have invested a total of $6 billion in water infrastructure since 2017. The budget also maintains a strong commitment to environmental conservation with a $425 million Environmental Protection Fund (EPF). This funding bolsters a wide array of vital programs, including land acquisition for habitat and open space preservation, climate change mitigation and adaptation initiatives, and water quality improvement projects.