By Karen Rubin, editor@news-photos-features.com, news-photos-features.com

Leaders of Long Island’s health care, social service organizations and environmental groups warned of the damaging impacts to lives “of neighbors, family, community” as a result of the funding cuts in the Republican budget bill (known as Trump’s “Big Beautiful Bill”) that passed the House in the middle of the night by a single vote. The bill, while slashing Medicaid, SNAP, clean energy projects and raising costs, delivers the needless tax cuts to the wealthiest, and will explode the national debt by $3.3 trillion.

As the Democrats on the Ways and Means Committee reported, the “GOP Tax Scam” cuts nearly $1 trillion from the health care system – effectively chipping away if not repealing entirely the Affordable Care Act – eliminating health coverage for at least 13.7 million Americans including 1.5 million New Yorkers.

The largest cut to hospitals and healthcare providers in history, will raise costs for consumers, shift costs to states and cut payments to providers, and make it harder for people to get and keep affordable health coverage.. People who no longer have access to care early and in clinics, will be forced to go to emergency rooms when they are sicker, at much higher cost. Since New York and other states guarantee access to health care, that results in higher taxes and higher premiums on private insurance – so even if you thought that these historic cuts to Medicaid would not impact you, they will.

The bill cuts a historic $700 billion in Medicaid; $267 billion in SNAP benefits; triggers $490 billion in Medicare cuts; and would result in 10 million Americans losing health insurance, all to deliver an average tax break for the top 0.1 percent of $225,000, paid for by taking away the services from millions of the most vulnerable people who will suffer from the loss in services the most, while still resulting in exploding the national debt by $3.8 trillion.

The proposed healthcare cuts in the House-passed reconciliation package represent the largest cut to hospitals and healthcare providers in history. The bill eliminates health coverage for at least 13.7 million Americans, including 1.5 million New Yorkers. It raises costs for consumers, shifts costs to states and cuts payments to providers, and makes it harder for people to get and keep affordable health coverage.

Nearly 7 million New Yorkers benefit from Medicaid. New York State estimates these changes will cost New York $13.4B per year. NYS currently spends $35.5B per year in state dollars on Medicaid.

Hospital losses in NYS will exceed $1.3B annually due to an increase in uncompensated care and reduced reimbursements. According to the Fiscal Policy Institute, Long Island will lose almost 30,000 jobs as a result.

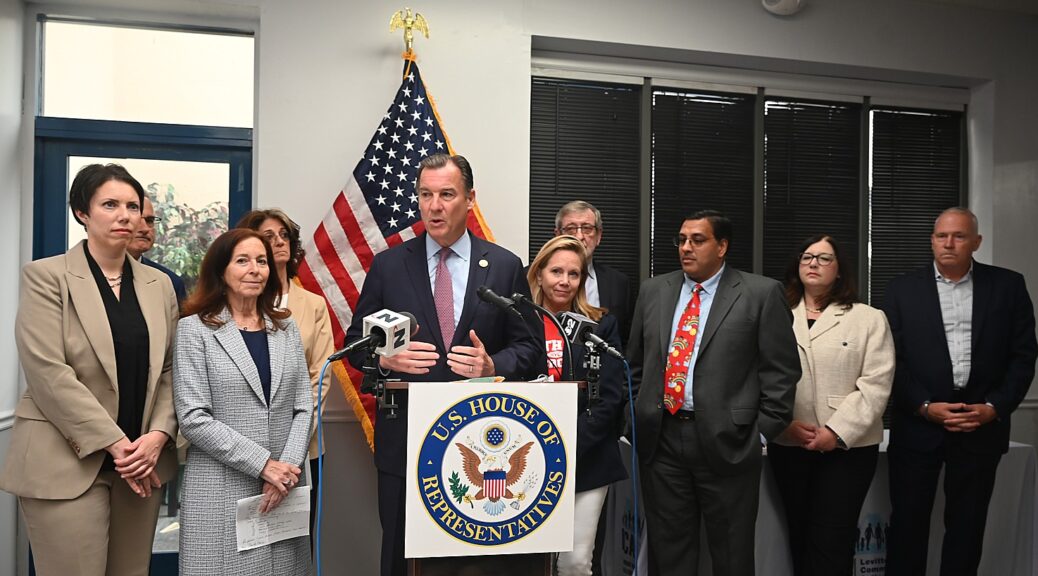

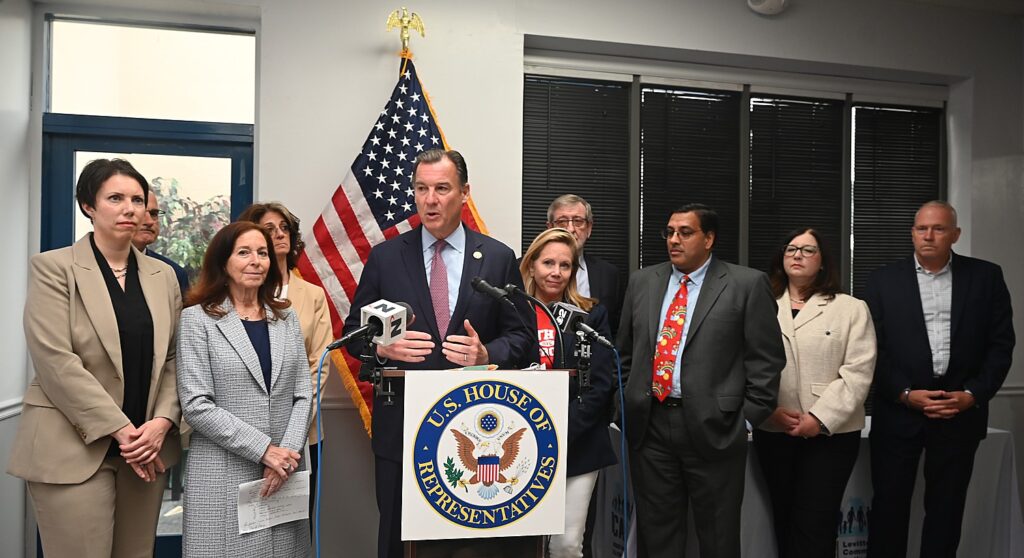

Congressmembers Tom Suozzi and Laura Gillen, Democrats of Nassau County, brought together community leaders at the YES Community Counseling Center in Levittown, Long Island, to address the impact of cuts to Medicaid, SNAP and other essential safety net programs.

“I have serious concerns about the reconciliation and budget plan for several reasons,” said Rep. Suozzi. “Most notably, the package includes callous cuts to Medicaid, SNAP, and other vital programs that support hospitals, nursing homes, and children’s care centers. These cuts will significantly undermine the delivery of healthcare services, putting access and quality of care at risk for everyone.”

“Additionally, the reconciliation package expands tax cuts for the wealthiest Americans—those who need them the least,” Suozzi continued. “While implementing these deep and harmful cuts, the budget plan also adds significantly to the national deficit.”

“I’m all for making people’s lives better with the SALT deduction, but we don’t need to cut taxes for wealthiest while taking away health insurance and food assistance from people who need it most,” Suozzi said.

People making more than $1 million per year would have an average tax cut of almost $90,000. The top 5% would receive almost half of the total tax cuts

Rep. Gillen said, “Being factual, not fear mongering, there are real life impacts these cuts will have on neighbors, friends, our own wallets. When Medicaid cuts go through, it will increase premiums on private insurance. Cuts to SNAP, to Island Harvest, will have devastating impact. When health care costs go up, parents won’t eat to have money for child’s medication.

“Be honest: all this is cost shifting scheme to make it look like they are making cuts to be fiscally responsible, but they are increasing deficit, while shifting the burden to New York State to pick up bill for what federal government will no longer be spending in New York to feed hungry. If New York has to pick up the bill, our taxes will go up in one of most highly taxed places, because we [in New York] take care of our poor, our elderly.

“What kind of country do we want to be? One that cares about the vulnerable or only cares about those who pay to play?

”There is no greater champion for eliminating waste fraud abuse [than me], but this is about putting up roadblock to those who need assistance to get ahead.” Gillen said.

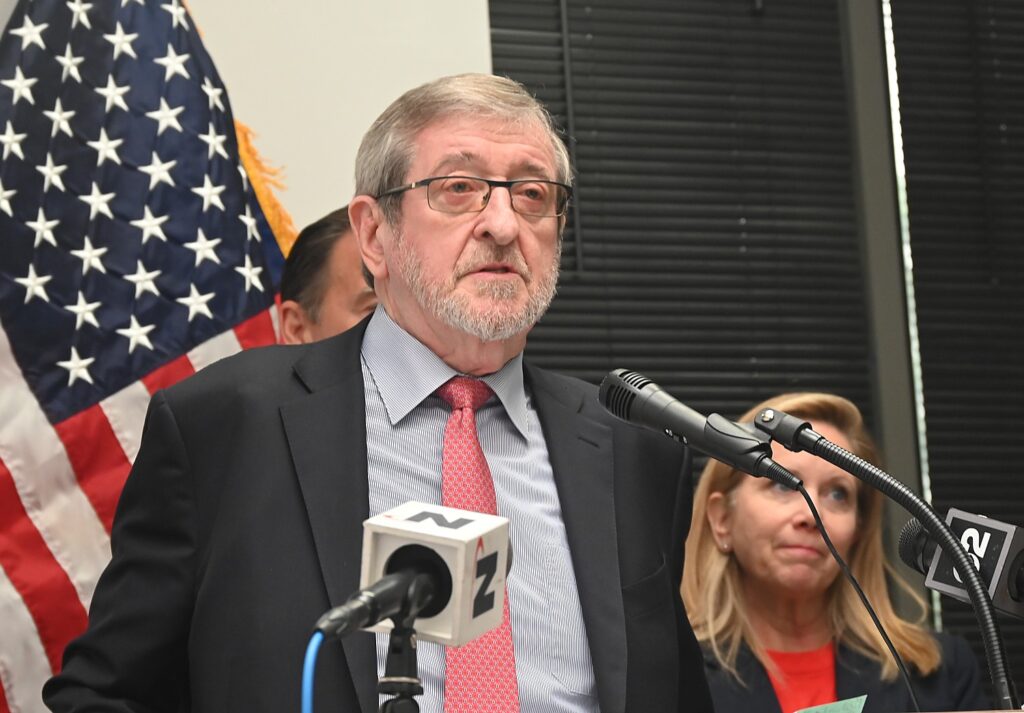

This budget bill, Northwell Health CEO Michael Dowling declared, “is undermining our commitment to public health and health overall – not just hospitals and ambulatory clinics, but everything. It is a curtailment of protecting people against pollution, against commitment to dealing with gun violence, undermining major commitment to research and science across the board – 50% reduction in funding for National Institutes of Health – [engendering] the idea that science is bad, that science doesn’t work. We’re all healthier because of commitment to science of last 50 years. What is happening is undermining of trust in government, trust in organizations.

“We also see an assault on international partnerships and alliances – eliminating the alliance with the World Health Organization which provides us across the board information on what happening around world healthwise, alerting us to what might happen here.

“It is a devaluation of past successes we’ve all had. Taken all together, it sends the message we don’t care much about health, wellbeing, people’s livelihoods, especially those not at top echelon, that we can’t trust anything unless we tell you what we want you to trust,” Dowling declared.

Turning to the specifics of the budget bill, Dowling noted “the implications are larger than you think.” It will reduce revenue by $370 million; cut Medicaid by $200 million; curtailing eligibility for Medicaid will render 1.5 million people in New York ineligible for Medicaid. The bill also cuts millions from Northwell’s research. (Northwell is the largest employer in New York State.)

“It’s about what we believe in – health, environment. This is the opposite. We should be going forward, not backward – help people more, not taking away for which people fought so many years to get, and assume it doesn’t matter – it’s about a philosophy of government, about caring, it’s what you believe in. Up here, we believe America is better than this. We have got to make sure this is curtailed and can be reversed as the bill goes into the Senate,” Dowling said.

Wendy Darwell, President and CEO of Suburban Hospital Alliance of New York State, noted, “The numbers here for health care are staggering – $1 trillion in health care cuts in all, means $13.5 billion in cuts to New York State; 1.5 million will lose insurance coverage; $150 million cut a year to Nassau and Suffolk hospitals. It is not possible for New York State to absorb $13.5 billion hit without cutting benefits, eligibility, providers.

“The numbers are hard to relate to. You may think the cuts may hit somebody else, but they hit everybody. People who need care will continue regardless of insurance or not, so will come to the ER without insurance, get care in the most expensive way, probably when they are much sicker. Instead of spending a little money on coverage, we will spend a lot on emergencies, and most will get charity care. That destabilizes the healthcare infrastructure – health systems will have to respond. It will be hard to retain the level of service, the kind of access as now.

“If don’t think this applies to you, you will likely face longer wait times at the ER, less access to service in community, it will be harder to get appointments to see doctor. It cuts across the health care system.”

Most people do not realize how expansive the state’s health insurance coverage options are now because of the funding system, but could include the adult child who aged off insurance at 26 (thanks Obamacare!); a parent in nursing home. In absence of a better option, Medicaid is long term care insurance for New Yorkers.

Cuts will have impact on commercial insurance, because costs will have to be offset – if you have private insurance, you won’t be immune either. From a hospital perspective: the median operating margin in New York State 0%, so any cuts put that margin into negative.Cuts this staggering can’t be absorbed and will fundamentally destabilize the state’s healthcare system.”

Congressman Suozzi noted,”I’’m in a relatively wealthy district, yet 29% of children in my district [40% nationally] rely on Medicaid for health insurance; two out of three senior citizens in nursing homes in America are covered by Medicaid, one out of 10 of vets in America are covered by Medicaid. Think of the children, the elderly, the disabled that will be impacted by this.”

Dr. Shetal Shah, Past President of American Academy of Pediatrics NY Chapter 2 (Long Island) said, the House bill jeopardizes health of 37 million children across country at risk.

“Medicaid is foundational to children’s health in New York State – 49% of all newborns are covered by Medicaid; 44% depend upon Medicaid for life saving asthma medication…Medicaid is for all of us -not just for people more socially vulnerable.” Even if you get insurance through your employer there are annual caps on coverage. “if you are unlucky to have a newborn with congenital heart lesion, you will surpass the limits in a matter of weeks; few could afford the tens of thousands a day to care.” Medicaid can be the difference between selling a home to pay for medical debt. “It is a safety net for all of us – sad fact is most don’t think about it until we need it.”

Also, hospitals rely on each other to provide high level care across Long Island and state – children’s hospitals across Long Island are shared resources, specialized resources. Medicaid helps keep them open, but drastic cuts are a threat that hospitals will close. Then we all lose community resources – pediatric ER , specialized burn and rehabilitation, pediatric dialysis and intensive care centers.

“Make no mistake: these cuts will cause all of us to pay more; will detach children from primary care; simple problems that could be addressed in clinic become bigger problems in ER; and private insurance will raise premiums to offset costs.”

Mental health services are also jeopardized, at a time when the state and Long Island are still struggling under a mental health crisis, with overdoses and suicides.

Dr. Jeffrey Reynolds, President and CEO, Family and Children’s Association, said his agency serves 36,000 children facing drug addiction, mental health crises, and suicidal ideation.

“It’s no secret this country, this state, and Long Island struggled under mental health crisis since covid – number of overdoses – over time – more than 1 in 4 adults have demonstrated symptoms of anxiety and depression; one in six kids contemplated suicide. The single largest payer of children’s mental healthcare is Medicaid

“Things are starting to get better in attempted suicides, suicides, involuntary placements, school avoidance. It’s undeniable – one of the ways we’ve made any progress has been through Medicaid programs that support mental health, that support facilities to support kids considering taking own life. We could take a victory lap in drop in opioid overdoses – decrease in fatalities is cause to celebrate but not for too long – 30,000 didn’t die. But 80,000 Americans did die – nothing to celebrate.”

“Now is not the time to rip the rug from out from under families, hospitals, communities, folks who spent 10 years looking for hope in midst of crisis – finally have glimmer of hope only for Washington to take away. Everyday average folks should understand that this could happen to any one’s family – make sure care and treatment available, speak up now.”

(Reminder: Republicans are constantly blaming the gun violence epidemic on mental health, rather than the unconscionable easy access to weapons of war, but do nothing to provide mental health services. Instead, as Suozzi pointed out, the budget bill repeals a $200 fee and requirement to register “unusual or dangerous firearm accessories like silencers that dates from 1934, and that brought $145 million in revenue on 710,000 silencers sold in the USA in 2024. “They gut the Affordable Care Act, but make it easier to buy silencer,” Suozzi said.]

The Republican “Big Beautiful Bill” cuts funding for Narcan that has saved thousands of people who would have died from overdoses, and for drug treatment. And Nassau County Executive Bruce Blakeman is sitting on $100 million in federal money to address opioid addiction, noted Larry Lamendola, Co-Chair of Levittown Community Action Coalition.

The House bill would also impact more than 7000 who depend on disability services – housing, employment services, transportation, day services, and direct support from meals to medication. In New York, medicaid funds 95% of services overseen by office of disability services to organizations like AHRC, said Nicole Zerillo, Director of Strategic Communications of AHRC.

Medicaid is a shared federal and state program. When the federal share shrinks, the state has to choose whether to reduce services, put people on wait list. More staff leave, smaller providers close and people with developmental disabilities lose the supports they need to live safely.

New York spends $850 million, “but continued investment relies on a sustainable federal match. We can’t afford to backslide. Forcing people to recertify Medicaid eligibility twice year won’t improve accuracy or root out fraud, it will just limit coverage,” she said.

“The Republican Budget bill “undoes 75 years of progress to help move from institutions to inclusion [note: that is the DEI that Trump has declared “illegal.”]

“The bill risks cutting critical supports – and pushing people back to margin: protect Medicaid, right to live in community and protect the future spent generations building.”

Randi Shubin Dresner, President and CEO of Island Harvest, noted that 2.8 million New Yorkers – 14% of the population – depend on SNAP dollars. It’s not just about giving people who are vulnerable money so they can buy food. That money is spent in local supermarkets, delis, bodegas, with an $11.5 billion impact on local businesses in New York State.

The cuts in SNAP will take 9.5 billion means off the table every year, across the country. Every meal supports a person. 9.5 billion meals are at risk for our neighbors, relatives most in need.

Cuts have already impacted Island Harvest – $1.7 million in cuts has taken a million meals off the table.

“Many Long Islanders don’t qualify for SNAP benefits because the cost of living is so high on Long Island. So why in one of the richest communities, richest zipcodes, is Island Harvest helping over 200,000 people each year? Because it is one ecosystem- so if there are cuts in others – housing, mental health, Medicaid – it always means people have to make decisions about where to cut in family budget. The easiest is food budget – we eat 3 meals a day, countless parents are giving up 1 or 2 meals in order to fed children, pay med gills and transportation to doctor. If there are more cuts , they will cut more meals at home. Young mothers have to water down formula for their infant to make it through the day.”

Besides the direct impacts on health care, Trump’s “Big Beautiful Bill” slashes funding for clean energy and climate action, in order to force people back to relying on fossil fuels that impact health and contribute to pollution, global warming, climate change and climate disasters.

“This big ugly bill takes us back to 1960s energy policy,” declared Adrienne Esposito, Executive Director of Citizens Campaign for the Environment. “Today, we are implementing 21st century energy policy for the 21st century, tomorrow, we will be taken back to the 1960s. This bill derails the clean energy sector, one of fastest growing job ;sectors in America.”

Since Biden’s Inflation Reduction Act, over 2000 new industry, manufacturing companies have been created in the U.S.; $289 billion in private sector investment; 130,000 jobs in clean energy. This bill completely eliminates the tax credit for solar, for residential and commercial. Low income and working class Americans are using the tax credits, not to save the planet but because of affordability and stability to home energy gills.

It eliminates all tax credits for electric vehicles – workign class and mid-income residents were using to add affordability to their transportation, so they aren’t at the mercy of unpredictable and expensive gas prices.

It does away with all tax credits for energy efficiency – appliances, HVAC systems, changing windows that made homes warmer in winter, cooler in summer, and helped stretch dollars and save energy.

While removing incentives for clean energy, the bill promotes “Drill, baby, drill,” – going back to oil and natural gas that will increase air pollution – asthma, heart attacks, respiratory illness, premature deaths, water contamination, and increase and accelerate the impacts of climate change – which Long Island cares about. Overall, taking us back in energy policy is bad for health, It makes no sense, unless you are invested in the oil industry..

Suozzi and Gillen noted that House Democrats attempted to amend the budget bill – offering 500 different amendments over the marathon sessions in committees and on the floor – all of which were shot down by Republicans, who even shot down raising taxes on those earning $100 million a year.

_____________________________

© 2025 News & Photo Features Syndicate, a division of Workstyles,Inc. All rights reserved. For editorial feature and photo information, go to www.news-photos-features.com,email editor@news-photos-features.com.Blogging at www.dailykos.com/blogs/NewsPhotosFeatures