Two years ago, President Biden signed the Inflation Reduction Act, with Vice President Harris casting the tie-breaking vote in Congress. Not a single Republican voted for it and Trump/Vance and the Republicans vow to repeal it and replace it with Project 2025 laundry list of policies which will harm working and middle-class families. and undermine progress toward an equitable, sustainable economy. –Karen Rubin/news-photos-features.com

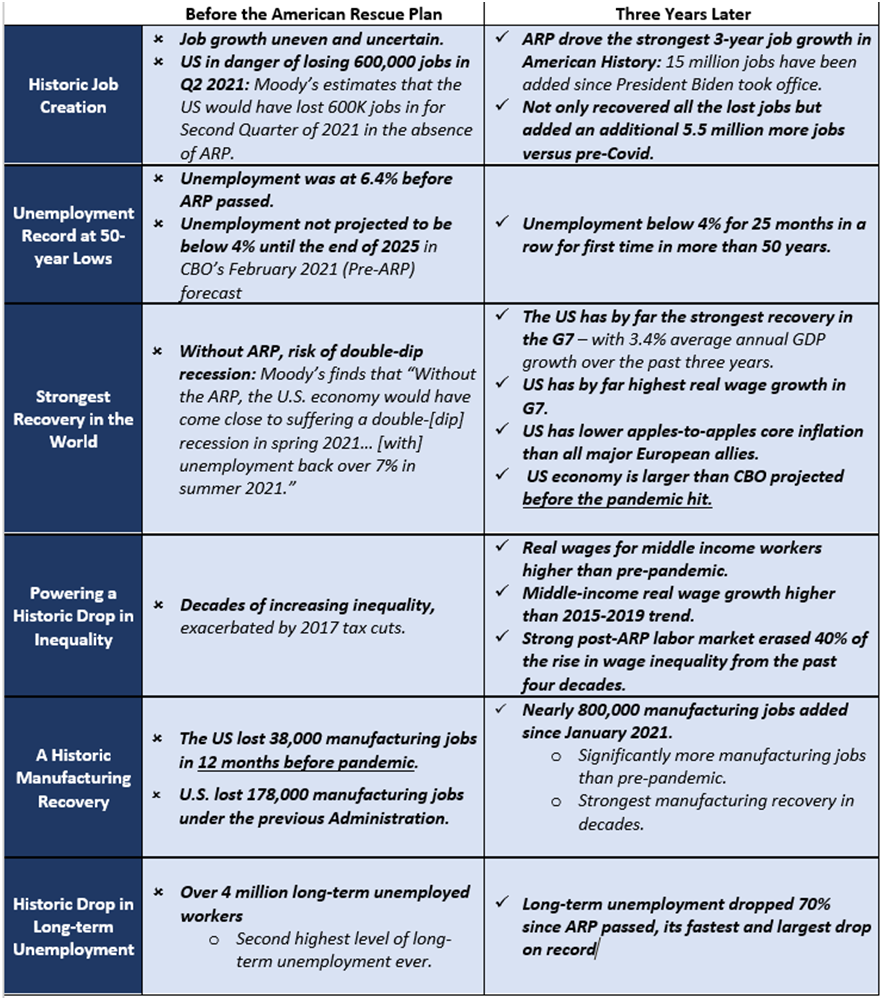

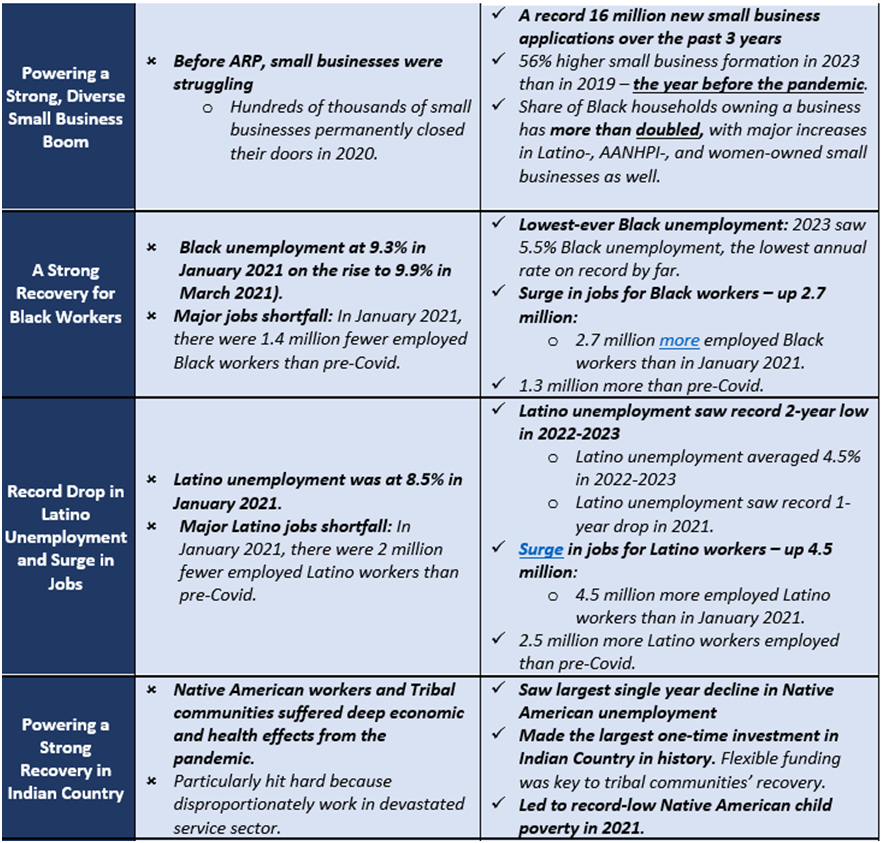

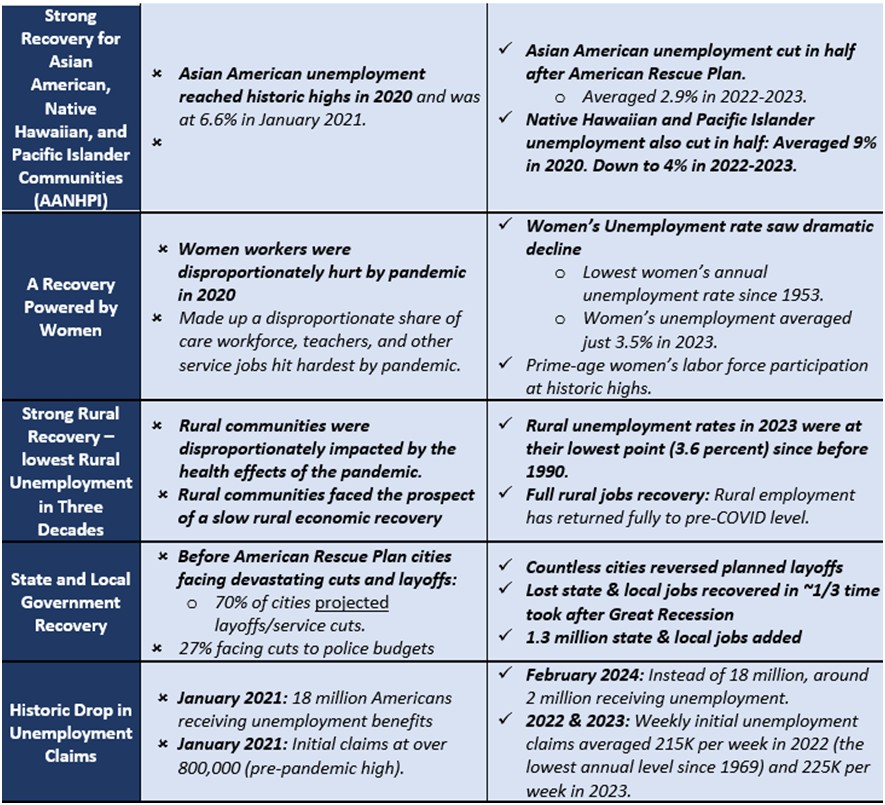

The Inflation Reduction Act is a key part of the Biden-Harris Administration’s Investing in America agenda, which has driven the fastest and most equitable recovery on record – creating good-paying jobs, expanding opportunity, and lowering costs in every corner of the country.

Already, the Inflation Reduction Act is transforming American lives by finally beating Big Pharma to negotiate lower prescription drug prices, making the largest investment in clean energy and climate action in history, creating hundreds of thousands good-paying jobs, lowering health care and energy costs, and making the tax code fairer.

Visit the White House Savings Explorer to see how Americans are saving money on their annual expenses because of the Inflation Reduction Act and other Biden-Harris Administration actions.

Statement from President Joe Biden on Inflation Reduction Act Anniversary

Two years ago, I signed the Inflation Reduction Act—the largest climate investment in history that is lowering energy costs and creating good-paying union jobs, while taking on Big Pharma to lower prescription drug costs—with Vice President Harris casting the tie-breaking vote. Already, this law is lowering health care costs for millions of families, strengthening energy security, and creating more than 330,000 clean energy jobs according to outside groups. It has also unleashed $265 billion in clean energy and manufacturing investments from the private sector in the last two years—part of the nearly $900 billion invested in America since we took office.

This historic legislation is fiscally responsible. It lowers the deficit over the long run by cutting wasteful spending on special interests and making big corporations and the wealthy pay more of their fair share. And just yesterday, my Administration announced lower prescription drug prices for the first ten drugs that have been negotiated by Medicare, which will cut the prices of drugs used to treat blood clots, heart disease, cancer, and more by nearly 40% to 80%, and save taxpayers $6 billion in the first year alone.

While Republicans in Congress try to repeal this law—which would increase prescription drug costs and take good-paying jobs away from their constituents, all to give massive tax cuts to big corporations—Vice President Harris and I will keep fighting to move our country forward by investing in America and giving families more breathing room.

Statement from President Joe Biden on Inflation Reduction Act Anniversary

Two years ago, I signed the Inflation Reduction Act—the largest climate investment in history that is lowering energy costs and creating good-paying union jobs, while taking on Big Pharma to lower prescription drug costs—with Vice President Harris casting the tie-breaking vote. Already, this law is lowering health care costs for millions of families, strengthening energy security, and creating more than 330,000 clean energy jobs according to outside groups. It has also unleashed $265 billion in clean energy and manufacturing investments from the private sector in the last two years—part of the nearly $900 billion invested in America since we took office.

This historic legislation is fiscally responsible. It lowers the deficit over the long run by cutting wasteful spending on special interests and making big corporations and the wealthy pay more of their fair share. And just yesterday, my Administration announced lower prescription drug prices for the first ten drugs that have been negotiated by Medicare, which will cut the prices of drugs used to treat blood clots, heart disease, cancer, and more by nearly 40% to 80%, and save taxpayers $6 billion in the first year alone.

While Republicans in Congress try to repeal this law—which would increase prescription drug costs and take good-paying jobs away from their constituents, all to give massive tax cuts to big corporations—Vice President Harris and I will keep fighting to move our country forward by investing in America and giving families more breathing room.

FACT SHEET: Two Years In, the Inflation Reduction Act is Lowering Costs for Millions of Americans, Tackling the Climate Crisis, and Creating Jobs

In the two years since the Inflation Reduction Act was signed into law:

- Just yesterday, the President and Vice President announced that, for the first time in history, Medicare successfully negotiated lower prescription drug prices, which will save millions of seniors, people with disabilities, and other Medicare beneficiaries over $1.5 billion out-of-pocket in the first year.

- Millions of Americans are saving an average of $800 per year on health insurance premiums because of cost savings from the American Rescue Plan that the Inflation Reduction Act extended, helping drive the nation’s uninsured rate to historic lows. 4 million seniors and other Medicare beneficiaries saved money on insulin because of the law’s cap at $35 for a month’s supply. 10.3 million Medicare enrollees received a free vaccine in 2023, saving them more than $400 million in out-of-pocket vaccine costs.

The IRS successfully piloted Direct File in 12 states, saving 140,000 people an estimated $5.6 million in tax preparation fees by enabling them to file their taxes directly with the IRS online, for free. And, the IRS has recovered over $1 billion by cracking down on millionaire tax cheats since the law passed.

Last year, 3.4 million Americans benefited from $8.4 billion in Inflation Reduction Act tax credits to lower the cost of clean energy and energy efficiency upgrades in their homes – significantly outpacing projections of the popularity of the tax credits in just the first year they were available.

Since January 2024, more than 250,000 Americans have claimed the IRA’s electric vehicle tax credit, saving these buyers about $1.5 billion total. Nearly all of these buyers claimed the incentive at the point of sale.

Since the beginning of the Biden-Harris Administration, companies have announced$900 billion in clean energy and manufacturing investments in the US, including over $265 billion in clean energy investments since the Inflation Reduction Act was signed into law. These investments are creating over 330,000 new jobs in the United States according to an outside group.

- Economically distressed areas are poised to benefit the most from those investments. Over 99% of high-poverty counties in the United States are benefitting from an Investing in America project funded by the Inflation Reduction Act, Bipartisan Infrastructure Law, or CHIPS and Science Act. According to Treasury Department analysis, since the Inflation Reduction Act passed, 75% of private sector clean energy investments have flowed to counties with lower than median household incomes, and clean energy investment in energy communities has doubled. And, the Inflation Reduction Act is the largest investment in environmental justice in history.

- Millions of Americans are saving an average of $800 per year on health insurance premiums because of cost savings from the American Rescue Plan that the Inflation Reduction Act extended, helping drive the nation’s uninsured rate to historic lows. 4 million seniors and other Medicare beneficiaries saved money on insulin because of the law’s cap at $35 for a month’s supply. 10.3 million Medicare enrollees received a free vaccine in 2023, saving them more than $400 million in out-of-pocket vaccine costs.

Additionally, the Biden-Harris Administration has taken action to protect the critical investments that the Inflation Reduction Act is making in the domestic clean energy economy from unfair trade practices. In May, President Biden increased tariffs on $18 billion of Chinese imports to combat China’s artificially low-priced exports in strategic sectors such as electric vehicles, batteries, and solar. These actions protect American jobs, businesses, investments, and economic growth.

Lowering health care costs for millions of Americans

President Biden and Vice President Harris have made expanding access to high-quality, affordable health care and lowering prescription drug costs for American families a top priority. Thanks to the Inflation Reduction Act, health care is more accessible and more affordable than ever before. In just the last two years:

- The law enhanced the Affordable Care Act’s financial assistance that is available to consumers to purchase health insurance. Millions of Americans are saving, on average, about $800 a year on their health insurance plans, with more than 80 percent of consumers able to find health insurance for $10 or less a month. As a result, a record-breaking 21 million people signed up for ACA coverage in 2024. That’s 9 million more than when the President and Vice President took office, and more underserved communities are enrolling in coverage, with 1.7 million Black Americans and 3.4 million Latinos enrolled, a 95% and 103% increase, respectively, since 2020.

- The Inflation Reduction Act capped insulin costs at $35 for a month’s supply and making recommended adult vaccines free. Four million Medicare beneficiaries are now saving on their monthly insulin costs, and over 10 million beneficiaries received a free vaccine, saving more than $400 million in out-of-pocket cost.

Drug companies that increase prices faster than inflation now have to pay a rebate to Medicare—which is translating into lower out of pocket costs for seniors.

Next year, out of pocket drug costs will be capped at $2,000 per year for Medicare beneficiaries, which is expected to save nearly 19 million seniors an average of $400 per year.

- The Inflation Reduction Act capped insulin costs at $35 for a month’s supply and making recommended adult vaccines free. Four million Medicare beneficiaries are now saving on their monthly insulin costs, and over 10 million beneficiaries received a free vaccine, saving more than $400 million in out-of-pocket cost.

- The Inflation Reduction Act – for the first time ever – gives Medicare the power to negotiate lower prescription drug prices. Just this week, the Biden-Harris Administration announced new, lower prescription drug prices for all ten drugs selected for the first year of the Inflation Reduction Act’s Medicare Drug Price Negotiation Program. The new, lower prices, which go into effect in 2026, will save American taxpayers $6 billion and will save seniors and people with disabilities $1.5 billion in out of pocket costs in 2026 alone. These new prices cut the list cost for drugs that treat heart disease, blood clots, diabetes, cancer, and more by nearly 40% to 80%.

Lowering energy costs with the largest climate investment in history

The Inflation Reduction Act is tackling the climate crisis by advancing clean power, cutting pollution from buildings, transportation, and industry and supporting climate-smart agriculture and forestry. The law is accelerating our progress toward President Biden and Vice President Harris’ goal of cutting U.S. climate pollution by 50 to 52 percent below 2005 levels in 2030.

Two years after the signing of the Inflation Reduction Act, the Biden-Harris Administration has made tremendous progress implementing the climate and clean energy provisions of this law quickly and effectively. Treasury guidance is now available for nearly all of the Inflation Reduction Act’s clean energy tax provisions. On the grant, loan, and rebate side of the law, nearly two thirds of Inflation Reduction Act funding has been awarded. As an example of the Administration’s rapid progress on implementation, today the Environmental Protection Agency announced that all $27 billion in awards through their Greenhouse Gas Reduction Fund are now obligated. $20 billion of these awards go toward a national clean energy financing network that will support tens of thousands of clean energy projects, reducing or avoiding millions of metric tons of carbon pollution annually over the next seven years. The other $7 billion in awards through the Solar for All program will save over $350 million each year on energy bills for over 900,000 low-income and disadvantaged households through residential solar.

In the two years since President Biden signed the Inflation Reduction Act into law:

- Clean energy projects are creating more than 330,000 jobs in nearly every state in the country, according to outside groups.

- Companies have announced $265 billion in new clean energy investments in nearly every state in the nation. According to Treasury Department analysis, many of these investments are happening in underserved communities—since the IRA passed, 75% of private sector clean energy investments made since the Inflation Reduction Act passed have occurred in counties with lower than median household incomes, and clean energy investment in energy communities has doubled. Last week, Treasury and IRS released new data showing that in 2023, more than 3.4 million American families saved $8.4 billion from IRA consumer tax credits on home energy technologies. These tax credits can save families up to 30% off heat pumps, insulation, rooftop solar, and other clean energy technologies. New York and Wisconsin have now launched home energy rebate programs, with more states expected to launch later this summer and fall. Already, 22 states have submitted their applications to DOE to receive their full rebate funding. These rebate programs help low- and middle-income families afford cost-saving electric appliances and energy efficiency improvements by providing rebates up to $14,000 per household. In total, the IRA rebates programs are expected to save consumers up to $1 billion annually in energy costs and support an estimated 50,000 U.S. jobs in residential construction, manufacturing, and other sectors.

- Since January 2024, more than 250,000 Americans have claimed the Inflation Reduction Act’s EV tax credits—either $7,500 off a qualified new electric vehicle, or up to $4,000 off a qualified used electric vehicle. In total, these taxpayers have saved about $1.5 billion and nearly all buyers claimed the incentive at the point of sale.

Making the tax system fairer and making the wealthy pay their fair share

The Inflation Reduction Act fully pays for these investments, and reduces the deficit over the long run, by cutting wasteful spending on special interests and making big corporations and the wealthy pay more of their fair share. After 55 of the biggest corporations in America paid $0 in federal income tax on $40 billion in profits in 2020, the Inflation Reduction Act requires billion-dollar corporations to pay at least 15 percent in tax. It also requires corporations to pay a 1 percent excise tax on stock buybacks, encouraging businesses to invest in their growth and productivity instead of funneling tax-preferred profits to foreign shareholders. By making large corporations pay more of their fair share, the IRA will raise around $300 billion over a decade.

The Inflation Reduction Act also makes a historic investment in modernizing the IRS, providing funding to better taxpayer experience, reduce fraud, and upgrade critical technology infrastructure. Thanks to these investments, the IRS has already:

- Improved services for millions of taxpayers. This spring, the IRS answered 3 million more phone calls than in 2022, cut phone wait times to three minutes from 28 minutes, served 200,000 more taxpayers in person, and saved taxpayers 1.4 million hours on hold last filing season. It also expanded online services, enabling 94% of taxpayers to submit forms digitally instead of via mail if they so choose.

- Successfully piloted Direct File, allowing taxpayers to easily file their taxes online and for free, directly with the IRS for the first time. Over 140,000 Americans successfully filed their taxes through Direct File this year, claiming over $90 million in refunds and saving an estimated $5.6 million in tax preparation fees. Users said Direct File was easy and fast to use, with 90% rating their experience excellent or above average. Building on this success, the IRS has invited all 50 states and the District of Columbia to join Direct File starting in 2025.

- Collected $1 billion from 1,500 millionaire tax cheats, launched enforcement action against 25,000 millionaires who have not filed a tax return since 2017, began audits on dozens of the largest corporations and partnerships, and cracked down on high-end tax evasion like deducting personal use of corporate jets as a business expense. At the same time, the IRS is adhering to Treasury Secretary Yellen’s commitment to not increase audit rates relative to current levels for small businesses and Americans making less than $400,000 a year.

Over the next decade, the Inflation Reduction Act’s investments will enable the IRS to further crack down on wealthy and corporate tax cheats and collect over $400 billion in additional revenue.

Going forward, the IRS is on track to implement additional improvements to taxpayer experience; provide additional in-person services in rural and underserved areas; redesign notices and forms to be less confusing; and expand online and mobile-friendly tools.

Investing in America to create jobs and expand opportunity

When President Biden thinks about climate change, he thinks about jobs. Two years into implementation of the Inflation Reduction Act, it’s easy to see why.

Across the nation, the Inflation Reduction Act is catalyzing a clean energy and manufacturing boom. Since President Biden took office, the Biden-Harris Administration’s Investing in America agenda has catalyzed nearly $900 billion in private sector investment commitments, including roughly $400 billion in clean energy across every state in the nation. That topline figure includes enough power generation to replace 40 Hoover Dams, the largest wind tower manufacturing facility in the world, the largest solar investment in US history.

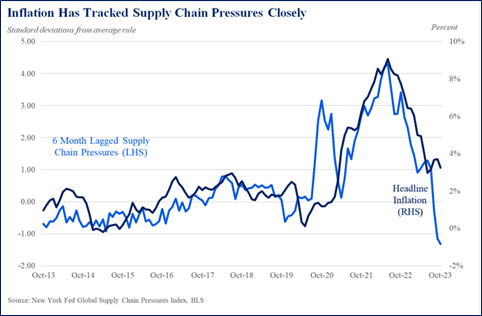

Broader macroeconomic indicators also illustrate how, through tax credits and domestic content requirements within the law–we are successfully onshoring critical supply chains and encouraging a resurgence of domestic manufacturing. Real investment in manufacturing structures is at an all-time high—and has been for six quarters. Manufacturing’s contribution to GDP broke quarters for three consecutive quarters in 2023. And Americans have filed to open a record 300,000 new manufacturing businesses.

These investments are having real impacts on communities—particularly those that need it most. Public dollars are flowing disproportionately to disadvantaged and left behind communities: 99% of high-poverty counties have received funding from the infrastructure law, CHIPS Act, or Inflation Reduction Act, and non-metro communities have received nearly double the per capita funding of their urban counterparts. On the private sector side, analysis from the US Treasury tells a similar story. Since the IRA passed, 84% of announced clean investments have flowed to counties with college graduation rates below the national average, and the rate of investment in energy communities has more than doubled. Given these successes, it is no wonder that Republicans who voted against the bill are suddenly trying to take credit for it—and urging their leadership not to proceed with an unpopular repeal effort.

Statement from Vice President Kamala Harris on the Inflation Reduction Act Anniversary

Since day one of our Administration, President Joe Biden and I have made it a priority to strengthen the middle class by lowering costs, creating jobs, and advancing opportunity. That is why we fought to enact our Inflation Reduction Act, historic legislation that I was proud to cast the tie-breaking vote on in the Senate. In the two years since President Biden signed it into law, this landmark bill has already delivered for American families.

This transformational legislation is reducing the cost of health care for millions of people in communities across our nation – from capping the price of insulin at $35 a month for seniors to capping out-of-pocket drug costs at $2,000 a year for Americans on Medicare, which is expected to save nearly 19 million seniors an average of $400 per year. Additionally, Medicare is now able to negotiate lower prescription prices for millions of Americans while saving taxpayers billions by paying rates 40% to 80% lower for expensive medications used to treat conditions such as blood clots, heart disease, and cancer.

Our Inflation Reduction Act is also the single largest climate investment in American history. While taking on the climate crisis and lowering utility bills for families, it is helping us to rebuild American manufacturing and drive American innovation – creating good-paying union jobs, furthering economic opportunity, and contributing to the nearly $900 billion of private-sector investment since President Biden and I took office.

As we mark this two-year anniversary, President Biden and I recommit to doing everything in our power to ensure that families throughout our country have the freedom to thrive