President Biden is working to lower housing costs and increase the housing supply to address the shortage of affordable homes. This fact sheet is provided by the White House:

President Biden is working to lower housing costs and increase the housing supply to address the large shortage of affordable homes inherited from his predecessor. In President Biden’s State of the Union address, he called on Congress to support the construction and rehabilitation of two million additional homes, lower costs for renters, and help first time homebuyers and families seeking to trade up or downsize.

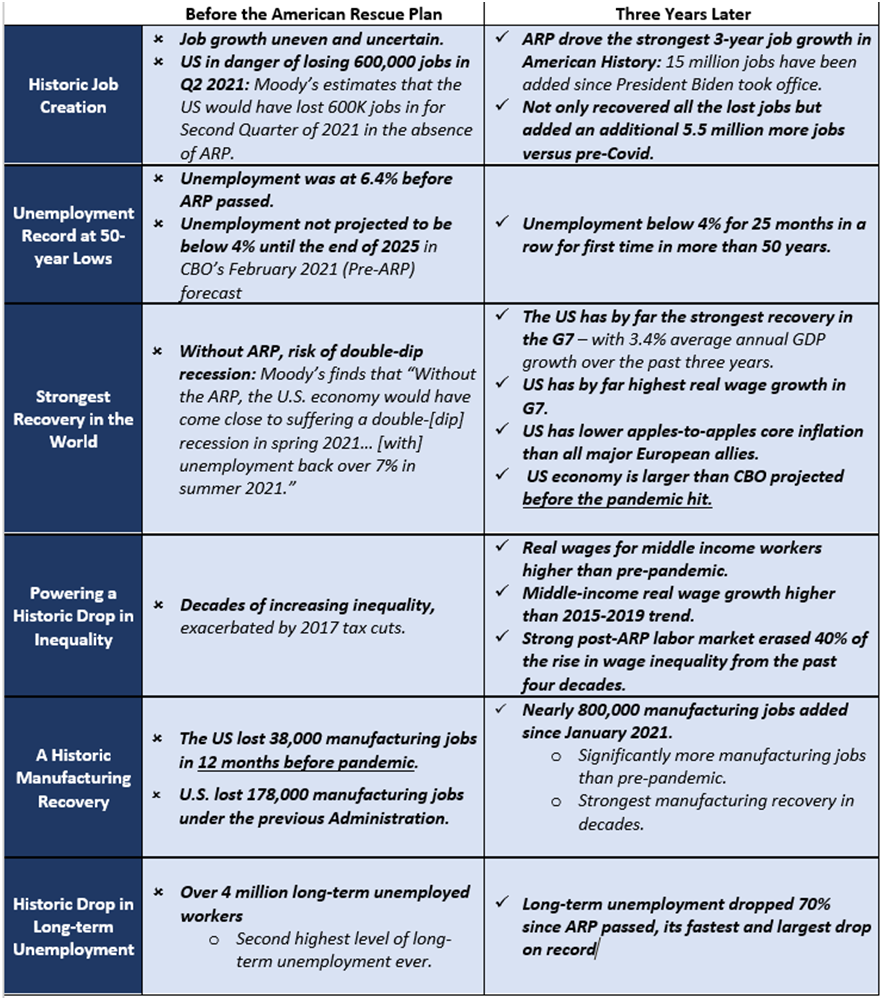

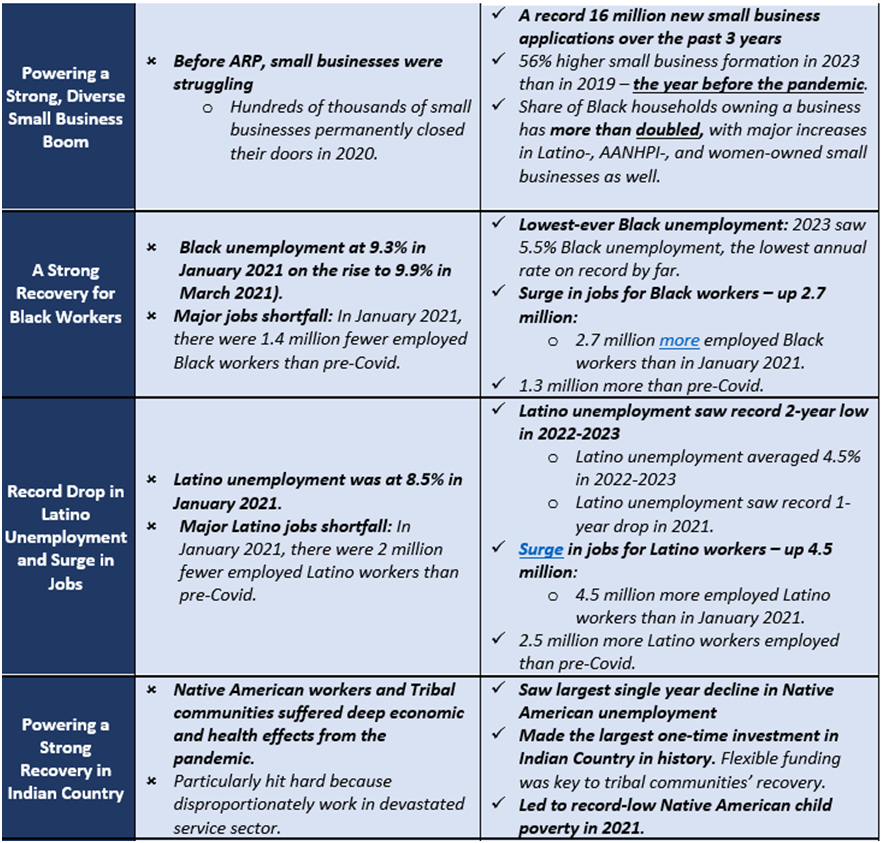

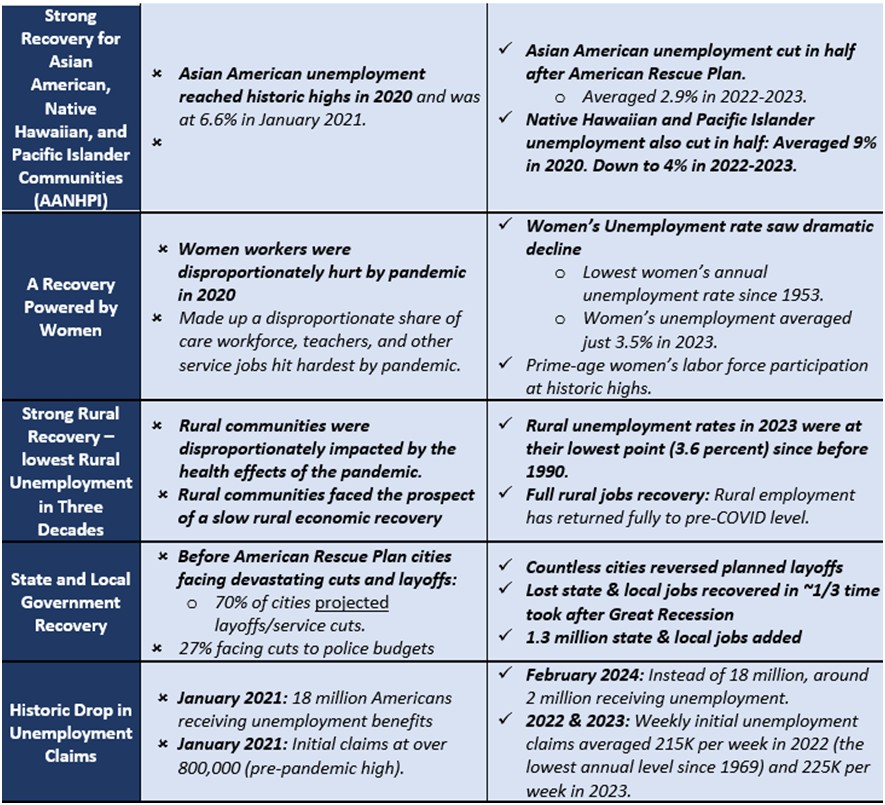

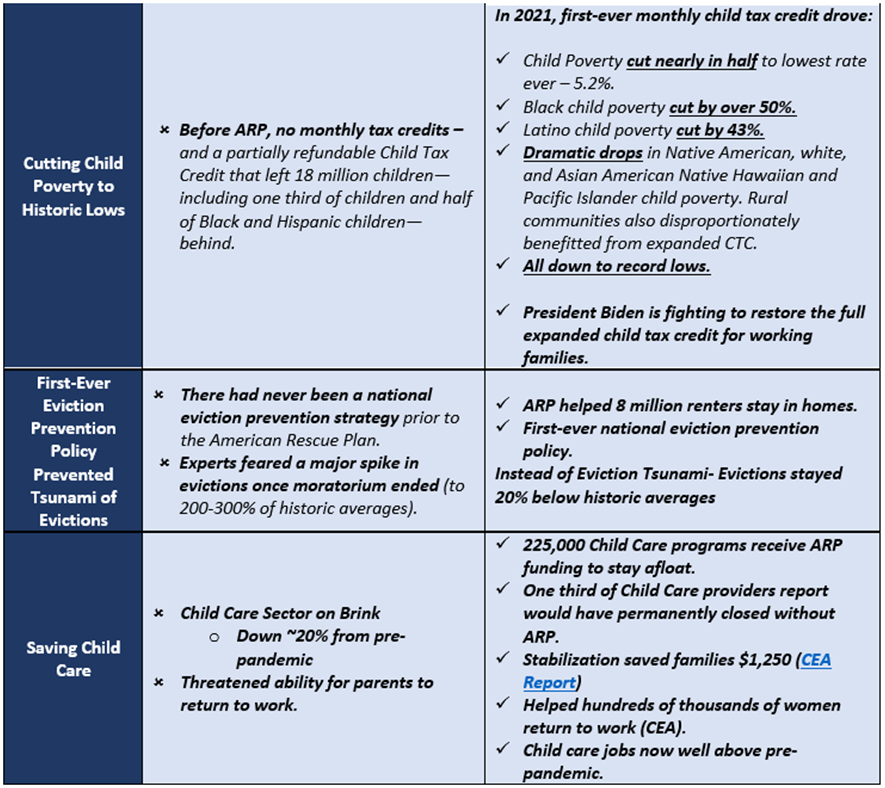

During a visit to Las Vegas, Nevada, President Biden detailed his agenda to bring down the cost of housing and described the investments the Biden-Harris Administration has already made through the American Rescue Plan (ARP). The ARP provided $1 billion in Nevada to help boost affordable housing, lower housing costs, and keep homeowners and renters in their homes. This includes $700 million invested in affordable housing supply that includes major investments in senior housing. As a result, Clark County has several major 200-unit affordable housing developments coming, and about 1,000 new senior apartments on the way thanks to the ARP.

The President’s Fiscal Year 2025 Budget includes a historic $258 billion in housing investments to give working families a fair shot, including an historic expansion in rental assistance for low-income families, while reducing the deficit by asking corporations and the wealthy to pay their fair share. These new proposals build on his Housing Supply Action Plan, major investments provided by the ARP, and actions the Biden-Harris Administration has already taken to increase the housing supply and lower housing costs for American families, including reducing mortgage insurance premiums by $800 per year for hundreds of thousands of homeowners, expanding rental assistance to more than 100,000 additional households, and building tens of thousands of affordable housing units. These actions have contributed to a record high of nearly 1.7 million homes currently under construction nationwide.

President Biden’s Plan to Lower Housing Costs and Build Two Million Homes

Reduce Barriers to Homeownership

For many Americans, owning a home is the cornerstone of raising a family, building wealth, and joining the middle class. Too many working families feel locked out of homeownership and are unable to compete with investors for a limited supply of affordable for-sale homes. President Biden is calling on Congress to enact legislation to enable more Americans to purchase a home, including:

- Mortgage Relief Credit. President Biden is calling on Congress to pass a mortgage relief credit that would provide middle-class first-time homebuyers with a tax credit of $10,000 over two years. This is the equivalent of reducing the mortgage rate by more than 1.5 percentage points for two years on the median home, saving families $400 per month on their mortgage payments. It will help more than 3.5 million middle-class families purchase their first home over the next two years. The President’s plan also calls for a new credit to unlock inventory of affordable starter homes, while helping middle-class families move up the housing ladder and empty nesters right size. The President is calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant. This proposal is estimated to help nearly 3 million families.

- Down Payment Assistance for First-Generation Homeowners. The President continues to call on Congress to provide up to $25,000 in down payment assistance to first-generation homebuyers whose families haven’t benefited from the generational wealth building associated with homeownership. This proposal would help about 400,000 families purchase their first home.

- Lowering Closing Costs. The Federal Housing Finance Agency has approved policies and pilots to reduce closing costs for homeowners, including a pilot to waive the requirement for lender’s title insurance on certain refinances. This would save thousands of homeowners up to $1500, and an average of $750, and the lower upfront fees will unlock substantial savings for homeowners as mortgage rates continue to fall and more homeowners are able to refinance. The Consumer Financial Protection Bureau will also pursue rulemaking and guidance to address anticompetitive closing costs imposed by lenders on homebuyers and homeowners. These charges—which benefit the lender but not the borrower—can add thousands to the upfront costs of a mortgage.

- Promoting Competition in the Housing Market. In his State of the Union Address, the President discussed the importance of boosting competition and lowering housing costs, and the Department of Justice has made those goals a priority. Last week’s settlement reached by the National Association of Realtors is an important step toward boosting competition in the housing market. It could save as much as $10,000 on the median home sale. Now, the Administration is calling on realtors and lenders to offer more choices and lower costs, while promoting access to homeownership for first-time, low-income, and low-wealth homebuyers.

Lowering Costs by Building and Preserving 2 Million Homes

America needs to build more housing in order to lower rental costs and increase access to homeownership. That’s why the President is calling on Congress to pass legislation to build and renovate more than 2 million homes, which would close the housing supply gap and lower housing costs for renters and homeowners.

- Tax Credits to Build More Housing. President Biden is calling for an expansion of the Low-Income Housing Tax Credit to build or preserve 1.2 million more affordable rental units. Renters living in these properties save hundreds of dollars each month on their rent compared with renters with similar incomes who rent in the unsubsidized market. The President is also calling for a new Neighborhood Homes Tax Credit, the first tax provision to build or renovate affordable homes for homeownership, which would lead to the construction or preservation of over 400,000 starter homes in communities throughout the country.

- Innovation Fund for Housing Expansion. The President is unveiling a new $20 billion competitive grant fund as part of his proposed Budget to support communities across the country to build more housing and lower rents and homebuying costs. This fund would support the construction of affordable multifamily rental units; incentivize local actions to remove unnecessary barriers to housing development; pilot innovative models to increase the production of affordable and workforce rental housing; and spur the construction of new starter homes for middle-class families. According to independent analysis, this will create hundreds of thousands of units which will help lower rents and housing costs.

- Increasing Banks’ Contributions Towards Building Affordable Housing. The President is proposing that each Federal Home Loan Bank double its annual contribution to the Affordable Housing Program – from 10 percent of prior year net income to 20 percent – which will raise an additional $3.79 billion for affordable housing over the next decade and assist nearly 380,000 households. These funds would support the financing, acquisition, construction, and rehabilitation of affordable rental and for-sale homes, as well as help low- and moderate-income homeowners to purchase or rehabilitate homes.

- Bolstering Efforts to Prevent and End Homelessness. The President is calling for $8 billion for a new grant program to rapidly expand temporary and permanent housing strategies for people experiencing or at risk of homelessness. Funds from this proposal would support non-congregate emergency shelter solutions, interim housing, rapid rehousing, permanent supportive housing, and rental housing for extremely low-income households experiencing housing instability or homelessness.

Lowering Costs for Renters

President Biden is also taking actions to lower costs and promote housing stability for renters. The White House Blueprint for a Renters Bill of Rights lays out the key principles of a fair rental market and has already catalyzed new federal actions to make those principles a reality. Today, President Biden is announcing new steps to crack down on unfair practices that are driving up rental costs:

- Fighting Rent Gouging by Corporate Landlords. The Biden-Harris Administration is taking action to combat egregious rent increases and other unfair practices that are driving up rents. Corporate landlords and private equity firms across the country have been accused of illegal information sharing, price fixing, and inflating rents. As part of the President’s Strike Force on Unfair and Illegal Pricing, he is calling on federal agencies to root out and stop illegal corporate behavior that hikes prices on American families through anti-competitive, unfair, deceptive, or fraudulent business practices. In a recent filing, the Department of Justice (DOJ) made clear its position that inflated rents caused by algorithmic use of sensitive nonpublic pricing and supply information violate antitrust laws. Earlier this month, the Federal Trade Commission and DOJ filed a joint brief further arguing that it is illegal for landlords and property managers to collude on pricing to inflate rents – including when using algorithms to do so.

- Cracking Down on Rental Junk Fees. Millions of families incur burdensome costs in the rental application process and throughout the duration of their lease, from “convenience fees” simply to pay rent online to fees charged to sort mail or collect trash. These fees are often more than the actual cost of providing the service, or are added onto rents to cover services that renters assume are included—or that they don’t even want. Last fall, the FTC proposed a rule that if finalized as proposed would ban misleading and hidden fees across the economy, including in housing rental agreements. HUD has released a summary of banned non-rent fees within their rental assistance programs. These actions build on voluntary commitments the President announced last summer from major rental housing platforms to provide customers with the total, upfront cost on rental properties on their platform.

- Expanding Housing Choice Vouchers. Over the last three years, the Administration has secured rental assistance for more than 100,000 additional households. The President is calling on Congress to further expand rental assistance to more than half of a million households, including by providing a voucher guarantee for low-income veterans and youth aging out of foster care – the first such voucher guarantees in history. Receiving a voucher would save these households hundreds of dollars in rent each month.

The ARP Provides $1 Billion to Boost Housing Supply and Provide Housing Help in Nevada:

- Nevada is a national leader in investing ARP funding in affordable housing: In Nevada, the ARP has provided over $1 billion for housing investments, including helping to fund the construction of thousands of new units in Clark County, making them one of the national leaders in using this money to expand supply of affordable housing.

- Investing in Down-Payment Assistance to help Nevadans buy homes: The state also used ARP funds to provide 500 Nevadans with $15,000 in down-payment assistance to purchase a home.

- Nevada State and local governments have used $700 million through the ARP to support major affordable housing projects.

- About 1,000 ARP-supported Senior Affordable Apartments on the way in Clark County today, including, for example:

- 195 Units of affordable housing at Pebble and Eastern Senior Apartments in Clark County currently under construction.

- 125 Units of affordable housing at Nevada HAND’s Buffalo and Cactus Senior Apartments in Clark County currently under construction.

The ARP Has Invested Billions of Dollars to Support Affordable Housing:

- Through the State and Local Fiscal Recovery Fund, over 940 state and local governments have invested more than $18 billion for housing assistance, homelessness, and affordable housing initiatives, including over $6 billion to build and preserve housing.

- State and local governments are using an additional $5 billion in funding through the ARP’s HOME Investment Partnerships Program to build or rehabilitate at least 20,000 units of affordable housing and support an additional 23,000 households with rental assistance, non-congregate shelter, or supportive services.

New data released today shows that since the ARP’s passage, states, Tribal governments, and territories have distributed $6.6 billion HAF award funds to over 500,000 homeowners for past due mortgage payments, utility expenses, and property taxes, as well as other housing related expenses. As a result of this program and the strong economic recovery, foreclosure starts are well below pre-pandemic levels.