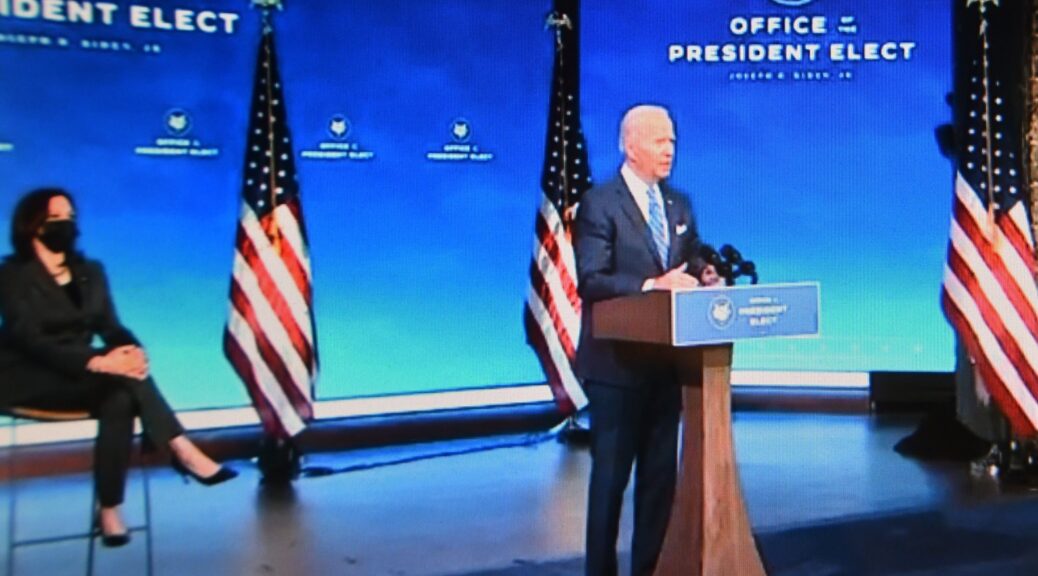

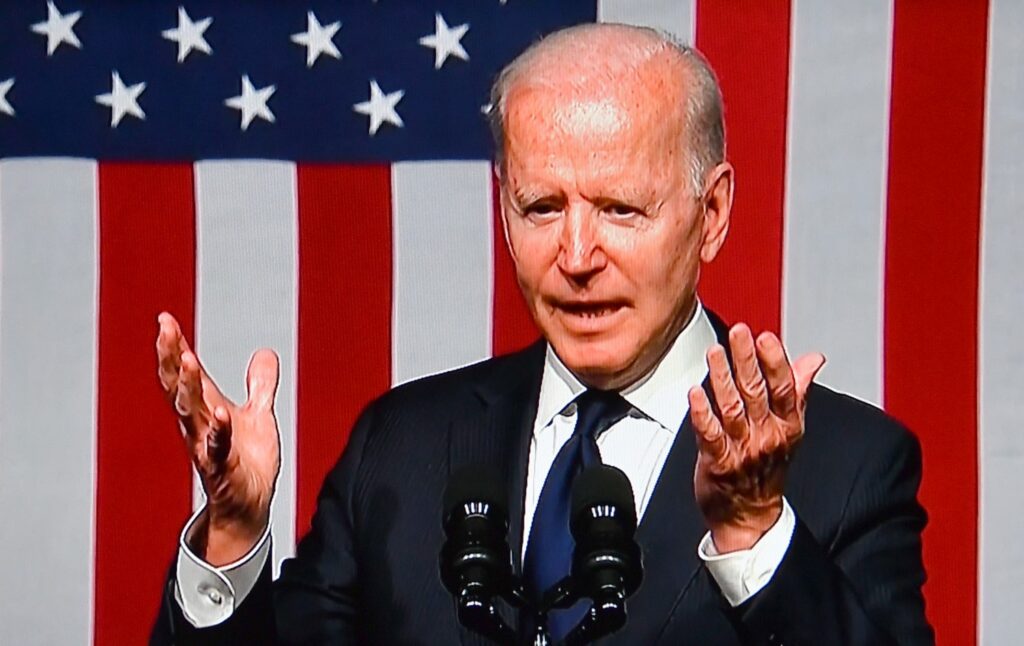

In moving remarks, President Joe Biden, only the first sitting president to acknowledge the Tulsa Race Massacre of 100 years ago, tackled systemic, institutional racism and laid out a plan for economic justice including improving access to homeownership (the most significant factor in family wealth), investments in minority-owned small businesses and disadvantaged communities, and said he would act to preserve voting rights. He pointed to the most significant threat against domestic tranquility – White Supremacy and the rise of domestic terrorists – drawing a line from the Tulsa Race Massacre a century ago and today, and tackled the latest assault by right-wingers to whitewash history, rather than take responsibility.

“We can’t just choose to learn what we want to know and not what we should know. We should know the good, the bad, everything. That’s what great nations do: They come to terms with their dark sides. And we’re a great nation. The only way to build a common ground is to truly repair and to rebuild”

“Only with truth can come healing and justice and repair.”

Biden said, “And there’s greater recognition that, for too long, we’ve allowed a narrowed, cramped view of the promise of this nation to fester — the view that America is a zero-sum game where there is only one winner. “If you succeed, I fail. If you get ahead, I fall behind. If you get a job, I lose mine.” And maybe worst of all, “If I hold you down, I lift myself up,” instead of “If you do well, we all do well.” (Applause.) We see that in Greenwood.

“This story isn’t about the loss of life, but a loss of living, of wealth and prosperity and possibilities that still reverberates today.”

He announced significant policies aimed at redressing generational discrimination:

“Today, we’re announcing two expanded efforts targeted toward Black wealth creation that will also help the entire community. The first is: My administration has launched an aggressive effort to combat racial discrimination in housing. That includes everything from redlining to the cruel fact that a home owned by a Black family is too often appraised at a lower value than a similar home owned by a white family…

“I’m going to increase the share of the dollars the federal government spends to small, disadvantaged businesses, including Black and brown small businesses” from 10 percent to 15 percent.

Biden laid out a plan to use infrastructure investments to specifically improve lives in historically disadvantaged communities.

Then the President turned to voting rights, which Congressman john Lewis called “precious,” “almost sacred”… “The most powerful nonviolent tool we have in a democratic society”.

Biden declared, “This sacred right is under assault with an incredible intensity like I’ve never seen.. It’s simply un-American. It is not, however, sadly, unprecedented,” and vowed to ”today, let me be unequivocal: we’re going to be ramping up our efforts to overcome again.” He said june would be a month of action, called upon voting rights groups to engage in voter registration campaigns and designated Vice President Kamala Harris as the point-person in his administration to get Congress to pass critical voting rights legislation, including the For the People Act and the John Lewis Voting Rights Act.

But returning to the Tulsa Massacre of 100 years ago, he said that violence resonates again in the rise of White Supremacy, Neo-Nazism, the resurrection of the KKK – the rise of hate crimes and terror against blacks, Asian-Americans, Jews – as was on display in Charlottesville NC that inspired Biden to run for president to “reclaim the soul of the nation.”

“Hate is never defeated; it only hides,” Biden declared. “And given a little bit of oxygen — just a little bit oxygen — by its leaders, it comes out of there from under the rock like it was happening again, as if it never went away. We must not give hate a safe harbor.”

“Terrorism from white supremacy is the most lethal threat to the homeland today. Not ISIS, not al Qaeda — white supremacists” and promised to soon lay out “a broader strategy to counter domestic terrorism and the violence driven by the most heinous hate crimes and other forms of bigotry.”

Here is a highlighted transcript:

I just toured the Hall of Survivors here in Greenwood Cultural Center, and I want to thank the incredible staff for hosting us here. And — (applause) — I mean that sincerely. Thank you.

In the tour, I met Mother Randle, who’s only 56 [107] years old. (Laughter.) God love her. And Mother Fletcher, who’s 67 [106] years old. (Laughter.) And her brother — her brother, Van Ellis, who’s 100 years old. (Laughter.) And he looks like he’s 60. Thank you for spending so much time with me. I really mean it. It was a great honor. A genuine honor.

You are the three known remaining survivors of a story seen in the mirror dimly. But no longer. Now your story will be known in full view.

The events we speak of today took place 100 years ago. And yet, I’m the first President in 100 years ever to come to Tulsa — (applause) — I say that not as a compliment about me, but to think about it — a hundred years, and the first President to be here during that entire time, and in this place, in this ground, to acknowledge the truth of what took place here.

For much too long, the history of what took place here was told in silence, cloaked in darkness. But just because history is silent, it doesn’t mean that it did not take place. And while darkness can hide much, it erases nothing. It erases nothing. Some injustices are so heinous, so horrific, so grievous they can’t be buried, no matter how hard people try.

And so it is here. Only — only with truth can come healing and justice and repair. Only with truth, facing it. But that isn’t enough.

First, we have to see, hear, and give respect to Mother Randle, Mother Fletcher, and Mr. Van Ellis. (Applause.) To all those lost so many years ago, to all the descendants of those who suffered, to this community — that’s why we’re here: to shine a light, to make sure America knows the story in full.

May 1921: Formerly enslaved Black people and their descendants are here in Tulsa — a boom town of oil and opportunity in a new frontier.

On the north side, across the rail tracks that divided the city already segregated by law, they built something of their own, worthy — worthy of their talent and their ambition: Greenwood — a community, a way of life. Black doctors and lawyers, pastors, teachers; running hospitals, law practices, libraries, churches, schools.

Black veterans, like a man I had the privilege to giving a Command Coin to, who fought — volunteered and fought, and came home and still faced such prejudice. (Applause.) Veterans had been back a few years helping after winning the first World War, building a new life back home with pride and confidence, who were a mom-and — they were, at the time — mom-and-plack [sic] — mom-and-pop Black diners, grocery stores, barber shops, tailors — the things that make up a community.

At the Dreamland Theatre, a young Black couple, holding hands, falling in love. Friends gathered at music clubs and pool halls; at the Monroe family roller-skating rink. Visitors staying in hotels, like the Stradford.

All around, Black pride shared by the professional class and the working class who lived together, side by side, for blocks on end.

Mother Randle was just six years old — six years old — living with her grandmom. She said she was lucky to have a home and toys, and fortunate to live without fear.

Mother Fletcher was seven years old, the second of seven children. The youngest, being Mr. Van Ellis, was just a few months old. The children of former sharecroppers, when they went to bed at night in Greenwood, Mother Fletcher says they fell asleep rich in terms of the wealth — not real wealth, but a different wealth — a wealth in culture and community and heritage. (Applause.)

But one night — one night changed everything. Everything changed. While Greenwood was a community to itself, it was not separated from the outside.

It wasn’t everyone, but there was enough hate, resentment, and vengeance in the community. Enough people who believed that America does not belong to everyone and not everyone is created equal — Native Americans, Asian Americans, Hispanic Americans, Black Americans. A belief enforced by law, by badge, by hood and by noose.

And it speaks to that — lit the fuse. It lit it by the spark that it provided — a fuse of fury — was an innocent interaction that turned into a terrible, terrible headline allegation of a Black male teenager attacking a white female teenager.

A white mob of 1,000 gathered around the courthouse where the Black teenager was being held, ready to do what still occurred: lynch that young man that night. But 75 Black men, including Black veterans, arrived to stand guard.

Words were exchanged. Then a scuffle. Then shots fired. Hell was unleashed. Literal hell was unleashed.

Through the night and into the morning, the mob terrorized Greenwood. Torches and guns. Shooting at will. A mob tied a Black man by the waist to the back of their truck with his head banging along the pavement as they drove off. A murdered Black family draped over the fence of their home outside. An elderly couple, knelt by their bed, praying to God with their heart and their soul, when they were shot in the back of their heads.

Private planes — private planes — dropping explosives — the first and only domestic aerial assault of its kind on an American city here in Tulsa.

Eight of Greenwood’s nearly two dozen churches burned, like Mt. Zion — across the street, at Vernon AME.

Mother Randle said it was like war. Mother Fletcher says, all these years later, she still sees Black bodies around.

The Greenwood newspaper publisher A.J. Smitherman penned a poem of what he heard and felt that night. And here’s the poem. He said, “Kill them, burn them, set the pace… teach them how to keep their place. Reign of murder, theft, and plunder was the order of the night.” That’s what he remembered in the poem that he wrote.

One hundred years ago at this hour, on this first day of June, smoke darkened the Tulsa sky, rising from 35 blocks of Greenwood that were left in ash and ember, razed and in rubble.

In less than 24 hours, 1,100 Black homes and businesses were lost. Insurance companies — they had insurance, many of them — rejected claims of damage. Ten thousand people were left destitute and homeless, placed in internment camps.

As I was told today, they were told, “Don’t you mention you were ever in a camp or we’ll come and get you.” That’s what survivors told me.

Yet no one — no arrests of the mob were made. None. No proper accounting of the dead. The death toll records by local officials said there were 36 people. That’s all. Thirty-six people.

But based on studies, records, and accounts, the likelihood — the likely number is much more, in the multiple of hundreds. Untold bodies dumped into mass graves. Families who, at the time, waited for hours and days to know the fate of their loved ones are now descendants who have gone 100 years without closure.

But, you know, as we speak, the process — the process of exhuming the unmarked graves has started. And at this moment, I’d like to pause for a moment of silence for the fathers, the mothers, the sisters, sons, and daughters, friends of God and Greenwood. They deserve dignity, and they deserve our respect. May their souls rest in peace.

[Pause for a moment of silence.]

My fellow Americans, this was not a riot. This was a massacre — (applause) — among the worst in our history, but not the only one. And for too long, forgotten by our history.

As soon as it happened, there was a clear effort to erase it from our memory — our collective memories — from the news and everyday conversations. For a long time, schools in Tulsa didn’t even teach it, let alone schools elsewhere.

And most people didn’t realize that, a century ago, a second Ku Klux Klan had been founded — the second Ku Klux Klan had been founded.

A friend of mine, Jon Meacham — I had written — when I said I was running to restore the soul of America, he wrote a book called “The Soul of America” — not because of what I said. And there’s a picture about page 160 in his book, showing over 30,000 Ku Klux Klan members in full regalia, Reverend — pointed hats, the robes — marching down Pennsylvania Avenue in Washington, D.C. Jesse, you know all about this. Washin- — Washington, D.C.

If my memory is correct, there were 37 members of the House of Representatives who were open members of the Klan. There were five, if I’m not mistaken — it could have been seven; I think it was five — members of the United States Senate — open members of the Klan. Multiple governors who were open members of the Klan.

Most people didn’t realize that, a century ago, the Klan was founded just six years before the horrific destruction here in Tulsa. And one of the reasons why it was founded was because of guys like me, who were Catholic. It wasn’t about African Americans, then; it was about making sure that all those Polish and Irish and Italian and Eastern European Catholics who came to the United States after World War One would not pollute Christianity.

The flames from those burning crosses torched every region — region of the country. Millions of white Americans belonged to the Klan, and they weren’t even embarrassed by it; they were proud of it.

And that hate became embedded systematically and systemically in our laws and our culture. We do ourselves no favors by pretending none of this ever happened or that it doesn’t impact us today, because it does still impact us today.

We can’t just choose to learn what we want to know and not what we should know. (Applause.) We should know the good, the bad, everything. That’s what great nations do: They come to terms with their dark sides. And we’re a great nation.

The only way to build a common ground is to truly repair and to rebuild. I come here to help fill the silence, because in silence, wounds deepen. (Applause.) And only — as painful as it is, only in remembrance do wounds heal. We just have to choose to remember.

We memorialize what happened here in Tulsa so it can be –so it can’t be erased. We know here, in this hallowed place, we simply can’t bury pain and trauma forever.

And at some point, there will be a reckoning, an inflection point, like we’re facing right now as a nation.

What many people hadn’t seen before or ha- — or simply refused to see cannot be ignored any longer. You see it in so many places.

And there’s greater recognition that, for too long, we’ve allowed a narrowed, cramped view of the promise of this nation to fester — the view that America is a zero-sum game where there is only one winner. “If you succeed, I fail. If you get ahead, I fall behind. If you get a job, I lose mine.” And maybe worst of all, “If I hold you down, I lift myself up,” instead of “If you do well, we all do well.” (Applause.) We see that in Greenwood.

This story isn’t about the loss of life, but a loss of living, of wealth and prosterity [prosperity] and possibilities that still reverberates today.

Mother Fletcher talks about how she was only able to attend school until the fourth grade and eventually found work in the shipyards, as a domestic worker.

Mr. Van Ellis has shared how, even after enlisting and serving in World War Two, he still came home to struggle with a segregated America.

Imagine all those hotels and dinners [diners] and mom-and-pop shops that could been — have been passed down this past hundred years. Imagine what could have been done for Black families in Greenwood: financial security and generational wealth.

If you come from backgrounds like my — my family — a working-class, middle-class family — the only way we were ever able to generate any wealth was in equity in our homes. Imagine what they contributed then and what they could’ve contributed all these years. Imagine a thriving Greenwood in North Tulsa for the last hundred years, what that would’ve meant for all of Tulsa, including the white community.

While the people of Greenwood rebuilt again in the years after the massacre, it didn’t last. Eventually neighborhoods were redlined on maps, locking Black Tulsa out of homeownerships. (Applause.) A highway was built right through the heart of the community. Lisa, I was talking about our west side — what 95 did to it after we were occupied by the military, after Dr. King was murdered. The community — cutting off Black families and businesses from jobs and opportunity. Chronic underinvestment from state and federal governments denied Greenwood even just a chance at rebuilding. (Applause.)

We must find the courage to change the things we know we can change. That’s what Vice President Harris and I are focused on, along with our entire administration, including our Housing and Urban Development Secretary, Marcia Fudge, who is here today. (Applause.)

Because today, we’re announcing two expanded efforts targeted toward Black wealth creation that will also help the entire community. The first is: My administration has launched an aggressive effort to combat racial discrimination in housing. That includes everything from redlining to the cruel fact that a home owned by a Black family is too often appraised at a lower value than a similar home owned by a white family. (Applause.)

And I might add — and I need help if you have an answer to this; I can’t figure this one out, Congressman Horsford. But if you live in a Black community and there’s another one on the other side of the highway — it’s a white community; it’s the — built by the same builder, and you have a better driving record than they guy with the same car in the white community, you’re — can pay more for your auto insurance.

Shockingly, the percentage of Black American homeownership is lower today in America than when the Fair Housing Act was passed more than 50 years ago. Lower today. That’s wrong. And we’re committing to changing that.

Just imagine if instead of denying millions of Americans

the ability to own their own home and build generational wealth, we made it possible for them to buy a home and build equity into that — into that home and provide for their families.

Second, small businesses are the engines of our economy and the glue of our communities. As President, my administration oversees hundreds of billions of dollars in federal contracts for everything from refurbishing decks of aircraft carriers, to installing railings in federal buildings, to professional services.

We have a thing called — I won’t go into it all because there’s not enough time now. But I’m determined to use every taxpayer’s dollar that is assigned to me to spend, going to American companies and American workers to build American products. And as part of that, I’m going to increase the share of the dollars the federal government spends to small, disadvantaged businesses, including Black and brown small businesses.

Right now, it calls for 10 percent; I’m going to move that to 15 percent of every dollar spent will be spent (inaudible). (Applause.) I have the authority to do that.

Just imagine if, instead of denying millions of entrepreneurs the ability to access capital and contracting, we made it possible to take their dreams to the marketplace to create jobs and invest in our communities.

That — the data shows young Black entrepreneurs are just as capable of succeeding, given the chance, as white entrepreneurs are. But they don’t have lawyers. They don’t have — they — they don’t have accountants, but they have great ideas.

Does anyone doubt this whole nation would be better off from the investments those people make? And I promise you, that’s why I set up the — a national Small Business Administration that’s much broader. Because they’re going to get those loans.

Instead of consigning millions of American children to under-resourced schools, let’s give each and every child, three and four years old, access to school — not daycare, school. (Applause.)

In the last 10 years, studies have been done by all the great universities. It shows that, if increased by 56 percent, the possibility of a child — no matter what background they come from; no matter what — if they start school at three years old, they have a 56 percent chance of going all through all 12 years without any trouble and being able to do well, and a chance to learn and grow and thrive in a school and throughout their lives.

And let’s unlock more than — an incredible creativity and innovation that will come from the nation’s Historically Black Colleges and Universities. (Applause.) I have a $5 billion program giving them the resources to invest in research centers and laboratories and high-demand fields to compete for the good-paying jobs in industries like — of the future, like cybersecurity.

The reason why they don’t — their — their students are equally able to learn as well, and get the good-paying job that start at 90- and 100,000 bucks. But they don’t have — they don’t have the back — they don’t have the money to provide and build those laboratories. So, guess what? They’re going to get the money to build those laboratories. (Applause.)

So, instead of just talking about infrastructure, let’s get about the business of actually rebuilding roads and highways, filling the sidewalks and cracks, installing streetlights and high-speed Internet, creating space — space to live and work and play safely.

Let’s ensure access to healthcare, clean water, clean air, nearby grocery stores — stock the fresh vegetables and food that — (applause) — in fact, deal with — I mean, these are all things we can do.

Does anyone doubt this whole nation would be better off with these investments? The rich will be just as well off. The middle class will do better, and everybody will do better. It’s about good-paying jobs, financial stability, and being able to build some generational wealth. It’s about economic growth for our country and outcompeting the rest of the world, which is now outcompeting us.

But just as fundamental as any of these investments I’ve discussed — this may be the most fundamental: the right to vote. (Applause.) The right to vote. (Applause.)

A lot of the members of the Black Caucus knew John Lewis better than I did, but I knew him. On his deathbed, like many, I called John, to speak to him. But all John wanted to do was talk about how I was doing. He died, I think, about 25 hours later.

But you know what John said? He called the right to vote “precious,” “almost sacred.” He said, “The most powerful nonviolent tool we have in a democratic society”.

This sacred right is under assault with an incredible intensity like I’ve never seen — even though I got started as a public defender and a civil rights lawyer — with an intensity and an aggressiveness that we have not seen in a long, long time.

It’s simply un-American. It is not, however, sadly, unprecedented. The creed “We Shall Overcome” is a longtime mainstay of the Civil Rights Movement, as Jesse Jackson can tell you better than anybody.

The obstacle to progress that have to be overcome are a constant challenge. We saw it in the ‘60s, but with the current assault, it’s not just an echo of a distant history.

In 2020, we faced a tireless assault on the right to vote: restrictive laws, lawsuits, threats of intimidation, voter purges, and more. We resolved to overcome it all, and we did. More Americans voted in the last election than any — in the midst of a pandemic — than any election in American history. (Applause.)

You got voters registered. You got voters to the polls. The rule of law held. Democracy prevailed. We overcame.

But today, let me be unequivocal: I’ve been engaged in this work my whole career, and we’re going to be ramping up our efforts to overcome again.

I will have more to say about this at a later date — the truly unprecedented assault on our democracy, an effort to replace nonpartisan election administrators and to intimidate those charged with tallying and reporting the election results.

But today, as for the act of voting itself, I urge voting rights groups in this country to begin to redouble their efforts now to register and educate voters. (Applause.)

June should be a month of action on Capitol Hill. I hear all the folks on TV saying, “Why doesn’t Biden get this done?” Well, because Biden only has a majority of, effectively, four votes in the House and a tie in the Senate, with two members of the Senate who vote more with my Republican friends.

But we’re not giving up. Earlier this year, the House of Representatives passed For the People Act to protect our democracy. The Senate will take it up later this month, and I’m going to fight like heck with every tool at my disposal for its passage.

The House is also working on the John Lewis Voting Rights Act, which is — which is critical — (applause) — to providing new legal tools to combat the new assault on the right to vote.

To signify the importance of our efforts, today I’m asking Vice President Harris to help these efforts and lead them, among her many other responsibilities.

With her leadership and your support, we’re going to overcome again, I promise you. But it’s going to take a hell of a lot of work. (Applause.)

And finally, we have to — and finally, we must address what remains the stain on the soul of America. What happened in Greenwood was an act of hate and domestic terrorism with a through line that exists today still.

Just close your eyes and remember what you saw in Charlottesville four years ago on television. Neo-Nazis, white supremacists, the KKK coming out of those fields at night in Virginia with lighted torches — the veins bulging on their — as they were screaming. Remember? Just close your eyes and picture what it was.

Well, Mother Fletcher said when she saw the insurrection at the Capitol on January the 9th [6th], it broke her heart — a mob of violent white extremists — thugs. Said it reminded her what happened here in Greenwood 100 years ago.

Look around at the various hate crimes against Asian Americans and Jewish Americans. Hate that never goes away. Hate only hides.

Jesse, I think I mentioned this to you. I thought, after you guys pushed through, with Dr. King, the Voting Rights Act and the Civil Rights Act — I thought we moved. But what I didn’t realize — I thought we had made enormous progress, and I was so proud to be a little part of it.

But you know what, Rev? I didn’t realize hate is never defeated; it only hides. It hides. And given a little bit of oxygen — just a little bit oxygen — by its leaders, it comes out of there from under the rock like it was happening again, as if it never went away.

And so, folks, we can’t — we must not give hate a safe harbor.

As I said in my address to the joint session of Congress: According to the intelligence community, terrorism from white supremacy is the most lethal threat to the homeland today. Not ISIS, not al Qaeda — white supremacists. (Applause.) That’s not me; that’s the intelligence community under both Trump and under my administration.

Two weeks ago, I signed into law the COVID-19 Hate Crimes Act, which the House had passed and the Senate. My administration will soon lay out our broader strategy to counter domestic terrorism and the violence driven by the most heinous hate crimes and other forms of bigotry.

But I’m going to close where I started. To Mother Randle, Mother Fletcher, Mr. Van Ellis, to the descendants, and to all survivors: Thank you. Thank you for giving me the honor of being able to spend some time with you earlier today. Thank you for your courage. Thank you for your commitment. And thank your children, and your grandchildren, and your unc- — and your nieces and your nephews.

To see and learn from you is a gift — a genuine gift. Dr. John Hope Franklin, one of America’s greatest historians — Tulsa’s proud son, whose father was a Greenwood survivor — said, and I quote, “Whatever you do, it must be done in the spirit of goodwill and mutual respect and even love. How else can we overcome the past and be worthy of our forebearers and face the future with confidence and with hope?”

On this sacred and solemn day, may we find that distinctly Greenwood spirit that defines the American spirit — the spirit that gives me so much confidence and hope for the future; that helps us see, face to face; a spirit that helps us know fully who we are and who we can be as a people and as a nation.

I’ve never been more optimistic about the future than I am today. I mean that. And the reason is because of this new generation of young people. They’re the best educated, they’re the least prejudiced, the most open generation in American history.

And although I have no scientific basis of what I’m about to say, but those of you who are over 50 — how often did you ever see — how often did you ever see advertisements on television with Black and white couples? Not a joke.

I challenge you — find today, when you turn on the stations — sit on one station for two hours. And I don’t know how many commercials you’ll see — eight to five — two to three out of five have mixed-race couples in them. That’s not by accident. They’re selling soap, man. (Laughter.) Not a joke.

Remember ol’ Pat Caddell? He used to say, “You want to know what’s happening in American culture? Watch advertising, because they want to sell what they have.”

We have hope in folks like you, honey. I really mean it. We have hope. But we’ve got to give them support. We have got to give them the backbone to do what we know has to be done. Because I doubt whether any of you would be here if you didn’t care deeply about this. You sure in the devil didn’t come to hear me speak. (Laughter.)

But I really mean it. I really mean it. Let’s not give up, man. Let’s not give up.

As the old saying goes, “Hope springs eternal.” I know we’ve talked a lot about famous people, but I’m — my colleagues in the Senate used to kid me because I was always quoting Irish poets. They think I did it because I’m Irish. They think I did it because we Irish — we have a little chip on our shoulder. A little bit, sometimes.

That’s not why I did it; I did it because they’re the best poets in the world. (Laughter.) You can smile, it’s okay. It’s true.

There was a famous poet who wrote a poem called “The Cure at Troy” — Seamus Heaney. And there is a stanza in it that I think is the definition of what I think should be our call today for young people.

It said, “History teaches us not to hope on this side of the grave, but then, once in a lifetime, the longed-for tidal wave of justice rises up, and hope and history rhyme.”

Let’s make it rhyme. Thank you.

See also:

Biden Uses Occasion of Tulsa Massacre Centennial to Advance Economic Justice Agenda