During the inaugural convening of the new White House Council on Supply Chain Resilience, President Biden will unveil more than 30 new actions to strengthen America’s supply chains

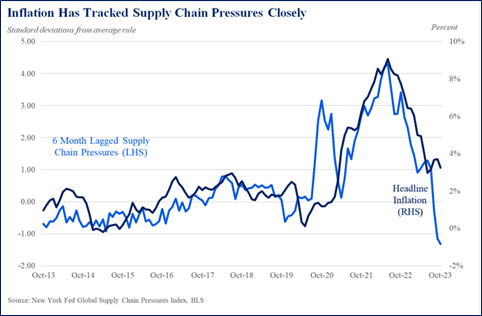

You don’t hear anything about it because 1) it’s lots of facts and figures and 2) the nonstop criminality, latest court craziness of Trump and his scheme to become a dictator are dominating news. But the collapse of supply chains during the COVID pandemic was the biggest reason for triggering inflation, and the Biden administration focus to develop Made in America manufacturing and reduce dependency on foreign production is one of the biggest factors in reducing costs for Americans (despite greed-based price hikes). Here’s a Fact sheet from the White House:

As part of his Bidenomics agenda to lower costs for American families, President Biden is announcing nearly 30 new actions to strengthen supply chains critical to America’s economic and national security. These actions will help Americans get the products they need when they need them, enable reliable deliveries for businesses, strengthen our agriculture and food systems, and support good-paying, union jobs here at home.

President Biden announced these actions alongside members of his Cabinet and other senior Administration officials at the inaugural meeting of the new White House Council on Supply Chain Resilience. The Council, which President Biden established, will support the enduring resilience of America’s critical supply chains.

Robust supply chains are fundamental to a strong economy. When supply chains smooth, prices fall for goods, food, and equipment, putting more money in the pockets of American families, workers, farmers, and entrepreneurs. That is why President Biden made supply chain resilience a priority from Day One of his Administration—including by signing an Executive Order on America’s Supply Chains and establishing a Supply Chain Disruptions Task Force that worked with states, Tribes, local governments, businesses, family farms, labor, and allies and partners to address the acute supply chain crises caused by the pandemic. Since then, the Administration has made historic investments to strengthen supply chains and prevent future disruptions by expanding production capacity in key sectors and building infrastructure through the CHIPS and Science Act, the Inflation Reduction Act, and the Bipartisan Infrastructure Law.

These efforts helped unsnarl supply chains, re-normalize the flow of goods, and lower inflation. From October 2021 to October 2023, supply chain pressures as measured by the New York Fed declined from near-record highs to a record low, helping lower inflation, which has fallen by 65% from its peak.

Today, President Biden is building on this progress by announcing bold new actions to further strengthen supply chains, lower costs for families, and help Americans get the goods they need, including:

- The creation of the Council on Supply Chain Resilience. Today, President Biden will convene the inaugural meeting of the White House Council on Supply Chain Resilience, which will advance his long-term, government-wide strategy to build enduring supply chain resilience. The Council will be co-chaired by the National Security Advisor and National Economic Advisor, and include the Secretaries of Agriculture, Commerce, Defense, Energy, Health and Human Services, Homeland Security, Housing and Urban Development, the Interior, Labor, State, Transportation, the Treasury, and Veterans Affairs; the Attorney General; the Administrators of the Environmental Protection Agency and the Small Business Administration; the Directors of National Intelligence, the Office of Management and Budget, and the Office of Science and Technology Policy; the Chair of the Council of Economic Advisers; the U.S. Trade Representative; and other senior officials from the Executive Office of the President and other agencies.

- Use of the Defense Production Act to make more essential medicines in America and mitigate drug shortages. President Biden will issue a Presidential Determination to broaden the Department of Health and Human Services’ (HHS) authorities under Title III of the Defense Production Act (DPA) to enable investment in domestic manufacturing of essential medicines, medical countermeasures, and critical inputs that have been deemed by the President as essential to the national defense. HHS has identified $35 million for investments in domestic production of key starting materials for sterile injectable medicines. HHS will also designate a new Supply Chain Resilience and Shortage Coordinator for efforts to strengthen the resilience of medical product and critical food supply chains, and to address related shortages. HHS intends to institutionalize this coordination to advance the department’s supply chain resilience and shortage mitigation goals over the long term. The Department of Defense (DOD) will also soon release a new report on pharmaceutical supply chain resilience aimed at reducing reliance on high-risk foreign suppliers. These actions are a subset of the Administration’s broader work to increase access to essential medicines and medical products.

- New cross-governmental supply chain data-sharing capabilities. The Administration has developed several cross-government partnerships to improve supply chain monitoring and strategy, including:

- The Department of Commerce’s new, first-of-its-kind Supply Chain Center is integrating industry expertise and data analytics to develop innovative supply chain risk assessment tools, and is coordinating deep-dive analyses on select critical supply chains to drive targeted actions to increase resilience. This Center is building broad partnerships across government, industry, and academia, including collaborating with the Department of Energy (DOE) to conduct deep-dive analyses on clean energy supply. Additionally, Commerce is partnering with HHS to assess industry and import data that can help address foreign dependency vulnerabilities and points of failure for critical drugs.

- The Department of Transportation’s (DOT) Freight Logistics Optimization Works (“FLOW”) program is a public-private partnership that brings together U.S. supply chain stakeholders to create a shared, common picture of supply chain networks and facilitate a more reliable flow of goods. DOT is announcing a new milestone for FLOW, in which participants are beginning to utilize FLOW data to inform their logistics decision making, helping to avoid bottlenecks, shorten lead times for customers, and enable a more resilient and globally competitive freight network through earlier warnings of supply chain disruption. As the effort continues to mature, DOT will work with the Department of Agriculture (USDA) to increase data transparency for containerized shipments of agricultural products in the United States, efforts that can help producers and sellers avoid disruptions that can increase food prices.

- These new analytical capabilities will enable the Council to coordinate a more complete, whole-of-government critical supply chain monitoring function.

Additional actions to support stronger supply chains and access to affordable, reliable energy and critical technology:

Investing in critical supply chains:

- DOE today announced $275 million in grant selections for its Advanced Energy Manufacturing and Recycling Grant Program, investments that will revitalize communities affected by coal mine or coal power plant closures through investment in clean energy supply chains, including production of critical materials, components for grid-scale batteries and electric vehicles, onshore wind turbines, and energy conservation technologies. DOE also announced up to $10 million of funding for a “critical material accelerator” and a $5.6-million prize to develop circular clean energy supply chains. These efforts build on action by President Biden to authorize DOE’s use of the DPA to increase domestic production of five key clean energy technologies—including electric heat pumps—as well as DOE’s recently announced $3.5-billion investment through the Bipartisan Infrastructure Law to boost domestic production of advanced batteries and battery materials needed for essential clean energy technologies such as stationary storage and electric vehicles.

- USDA is making investments worth $196 million to strengthen our domestic food supply chains and create more opportunity for farmers and entrepreneurs in 37 states and in Puerto Rico. These investments—which build on prior investments in diversified food processing, resilient agricultural markets, and fertilizer production—expand farmer income opportunities, create economic opportunities for people and businesses in rural areas, and lower food costs.

- DOD, building on the $714 million in DPA investments it has made in 2023 to support defense-critical supply chains, will publish the first ever National Defense Industrial Strategy (NDIS). The NDIS will guide engagement, policy development, and investment in the defense industrial base over the next three to five years. It will ensure a coordinated, whole-of-government approach to and focus on the multiple layers of suppliers and sub-suppliers that make up these critical supply chains.

Planning for long-term industrial resilience and future supply chain investments:

- Launch of the quadrennial supply chain review. The Council will complete the first quadrennial supply chain review by December 31, 2024. As part of the review, the Council will update criteria on industries, sectors, and products defined as critical to national and economic security. In addition, 12 months after the Council promulgates the criteria, and annually thereafter, the Council will apply the criteria to review and update the list of critical sectors, as appropriate.

- Smart manufacturing plan. DOE’s Office of Energy Efficiency and Renewable Energy (EERE) Advanced Materials and Manufacturing Technologies Office (AMMTO) is sponsoring a study by the National Academies of Science, Engineering, and Medicine to develop a nationwide plan for smart manufacturing. The report will establish key priorities for investment to support new digital and artificial intelligence technologies. These investments will enhance the productivity and security of the manufacturing systems that are critical for maintaining domestic supply chains.

Deploying new capabilities to monitor existing and emerging risks:

- New Resilience Center and tabletop exercises for supply chain disruptions. The Department of Homeland Security (DHS) is announcing the launch of a new Supply Chain Resilience Center (SCRC), which will be dedicated to ensuring the resilience of supply chains for critical infrastructure needed to deliver essential services to the American people. Near-term priorities will include addressing supply chain risks resulting from threats and vulnerabilities inside U.S. ports. Additionally, in 2024, in collaboration with other federal agencies and foreign governments, DHS will facilitate at least two tabletop exercises designed to test the resilience of critical cross-border supply chains. Further, DHS and the Department of Commerce will collaborate to continue to strengthen the semiconductor supply chain and further the implementation of the CHIPS and Science Act.

- Launch of DOT Multimodal Freight Office. As part of the Bipartisan Infrastructure Law (“BIL”) implementation, DOT is launching its Office of Multimodal Freight Infrastructure and Policy (“Multimodal Freight Office”). This office is responsible for maintaining and improving the condition and performance of the nation’s multimodal freight network including through the development of the National Multimodal Freight Network, review of State Freight Plans, and the continued advancement of the FLOW initiative in partnership with the Bureau of Transportation Statistics.

- Monitoring of climate impacts. The White House National Security Council, Office of Science and Technology Policy, and the Council of Economic Advisers will co-lead an interagency effort in partnership with the National Oceanic and Atmospheric Administration to monitor global developments related to El Niño, including this climate phenomenon’s impact on U.S. and global commodity prices, agriculture and fishery output, disruptions to global and trade supply chains, and resulting impacts on food security, human health, and social instabilities.

- Energy and critical mineral supply chain readiness. To more consistently track risk and opportunity across energy supply chains, DOE is developing an assessment tool that accounts for raw materials, manufacturing, workforce, and logistics considerations. Additionally, to help assess the potential for trade disruptions of select critical minerals and materials, the Department of the Interior’s U.S. Geological Survey (USGS) will map and develop geospatial databases for select global critical product supply chains, with a current focus on semiconductor components; and will seek designation by the Chief Statistician of the United States of a federal statistical unit providing the nation’s official minerals statistics. Additionally, the National Science and Technology Council’s Critical Minerals Subcommittee plans to launch a new criticalminerals.gov website in January 2024 that will highlight cross-governmental supply chain efforts.

- Defense supply chain mapping and risk management. DOD is increasing supply chain visibility through the creation of a Supply Chain Mapping Tool to analyze supplier data for 110 weapon systems. This capability will be used to develop defense industrial base wargaming scenarios to identify vulnerabilities and develop mitigation strategies.

Engaging public and private stakeholders to expand supply chain risk modeling:

- Supply Chain Data and Analytics Summit. The Department of Commerce will convene a diverse array of public and private stakeholders at a Supply Chain Data and Analytics Summit in 2024. A key aim of the summit will be to invite expert input into supply chain risk assessment models and tools. The summit will also assess data availability, utility, and limitations and consider actions to improve data flows.

- AI hackathons to strengthen critical mineral supply chains. USGS, the Defense Advanced Research Projects Agency (DARPA), and the Advanced Research Projects Agency-Energy (ARPA-E), building on their 2022 prize challenges announcement, will host a series of hackathons beginning in February 2024 to develop novel artificial intelligence approaches to assess domestic critical mineral resources.

- Risk mapping for labor rights abuses. The Department of Labor (DOL) updated its Comply Chain guidance for identifying and addressing labor rights violations in global supply chains. In addition, DOL is providing $8 million for two four-year projects to identify supply chain traceability methods and technologies to address child labor or forced labor risks in diverse supply chains, such as the cobalt and cotton sectors. DOL will also undertake new supply chain research on mining and agriculture products across Asia, Africa, and Latin America.

In addition to the announcements above, the Administration continues to deepen engagement with allies and partners to strengthen global supply chains, including:

Deepening international early warning systems to detect and respond to supply chain disruptions in critical sectors with allies and partners, including:

- With the European Union. In May 2023, the United States and the EU established an early warning system for semiconductor supply chain disruptions under the U.S.-EU Trade and Technology Council.

- With Japan and the Republic of Korea. In August, the United States, Japan, and the Republic of Korea committed at Camp David to launch early warning system pilots, starting by identifying priority products and materials such as critical minerals and rechargeable batteries and establishing mechanisms to rapidly share information on disruptions to critical supply chains.

- With Mexico and Canada. Through the United States-Mexico-Canada Agreement (USMCA), the United States, Canada, and Mexico established a trilateral Sub-Committee on Emergency Response to coordinate North American efforts to maintain regional trade flows during emergency situations.

- With Australia, Canada, the European Union, Japan, the United Kingdom, and the World Health Organization. The Global Regulatory Working Group on Drug Shortages, currently chaired by the U.S. Food and Drug Administration, meets quarterly to discuss product shortages participating jurisdictions are encountering and ways such shortages are being addressed. The group’s exchange of information helped address product shortages experienced by each partner during the COVID-19 pandemic and subsequent “tripledemic” including COVID-19, influenza, and respiratory syncytial virus.

- With global partners. Through the President’s Emergency Plan for Adaptation and Resilience (PREPARE), the U.S. government funds activities to improve the weather, water, and climate observing capabilities and data sharing in regions and countries that are needed to produce actionable local, regional, and global climate information and minimize impacts upon infrastructure, water, health, and food security.

Strengthening global supply chains through other innovative multilateral partnerships:

- Indo-Pacific Economic Framework for Prosperity (IPEF) Supply Chain Agreement. The United States and 13 IPEF partners concluded a first-of-its-kind Supply Chain Agreement that gives partners new tools to build diversified, competitive supply chains for critical sectors, including an IPEF Supply Chain Council to coordinate action. The Department of Commerce is kickstarting this effort through pilot projects to enhance the resilience of key supply chains, including those related to semiconductors, critical minerals, and cold chain services. In addition, the Supply Chains Agreement establishes a Crisis Response Network that will allow IPEF partners to better prepare for and respond to supply chain disruptions through emergency communication channels and joint crisis simulations, as well as a Labor Rights Advisory Board to promote worker rights across supply chains.

- Americas Partnership for Economic Prosperity (Americas Partnership). The Americas Partnership is focused on, among other things, strengthening and diversifying supply chains. In its first year of work, the Americas Partnership will focus on the development of regional competitiveness plans in three critical sectors: semiconductors, clean energy, and medical supplies.

- North American Leaders’ Summit (NALS). Through NALS, the United States, Canada, and Mexico are enhancing the resilience of North America’s supply chains for critical minerals, semiconductors, and other essential goods. This trilateral effort includes partnering with regional industry and academia to create quality jobs, promote investment, grow talent, and catalyze innovation.

- Partnership for Global Infrastructure and Investment (PGI). Through PGI, the United States is mobilizing public and private financing to incentivize investments and develop transformative economic corridors to diversify global supply chains and create new opportunities for American workers and businesses. From the development of the Lobito Corridor, connecting the Democratic Republic of the Congo and Zambia with global markets through Angola, to the launch of the landmark India-Middle East-Europe Economic Corridor—through PGI, the United States is creating novel interconnections across regions to facilitate trade and secure clean energy, digital, food security, and other critical supply chains.

- Global Labor Directive. On November 16, President Biden signed the Presidential Memorandum on Advancing Worker Empowerment, Rights, and High Labor Standards Globally. The President directed several departments to address labor rights abuses in global supply chains and identify innovative approaches to promote internationally recognized labor rights throughout the supply chain, including by collaborating with labor organizations, workers, and other labor stakeholders to consider efforts that support worker-led monitoring of labor rights compliance.

- The Mineral Security Partnership (MSP). The Department of State, along with partners including Australia, Canada, Finland, France, Germany, India, Italy, Japan, Norway, the Republic of Korea, Sweden, the United Kingdom, and the European Union (represented by the European Commission), established the MSP to accelerate the development of diverse and sustainable critical energy minerals supply chains. The MSP works with host governments and industry to facilitate targeted financial and diplomatic support for strategic projects along the value chain with an emphasis on those projects which adhere to and promote the highest labor, environmental and sustainability standards.

- International Technology Security and Innovation (ITSI) Fund. Created by the CHIPS and Science Act of 2022, the ITSI Fund promotes the diversification of the global semiconductor supply chain. State will partner with countries to develop the most attractive economic environments for private investment. With ITSI Fund support, the Organization of Economic Cooperation and Development has established the Semiconductor Exchange Network allowing policymakers in the semiconductor industry to examine risks and interdependencies on the current state of the semiconductor ecosystem. Additionally, the ITSI Fund is supporting ecosystem reviews in key partner countries that will inform future collaboration on developing this critical sector.