The Biden Administration is justifiably touting a $1.3 trillion decrease in the budget deficit – the largest one-year decline in U.S. history – to demonstrate the success of its fiscal policies, and particularly, its success in getting control of the coronavirus pandemic and justifying its FY2023 budget proposal. Here’s a statement from the White House:

When the President took office, the pandemic was raging in communities across the country and our economy was struggling to recover from the most severe downturn since the Great Depression. The economy shrunk, and the unemployment rate stood at 6.4 percent. And, the deficit had risen to $3.1 trillion in 2020—yet with trillions in resources, the Trump Administration didn’t secure vaccines for all Americans, most schools were closed, and testing and medical equipment shortages continued.

Even before the pandemic, the Trump tax cuts had added $2 trillion to deficits over a decade. The deficit increased every year of the previous administration.

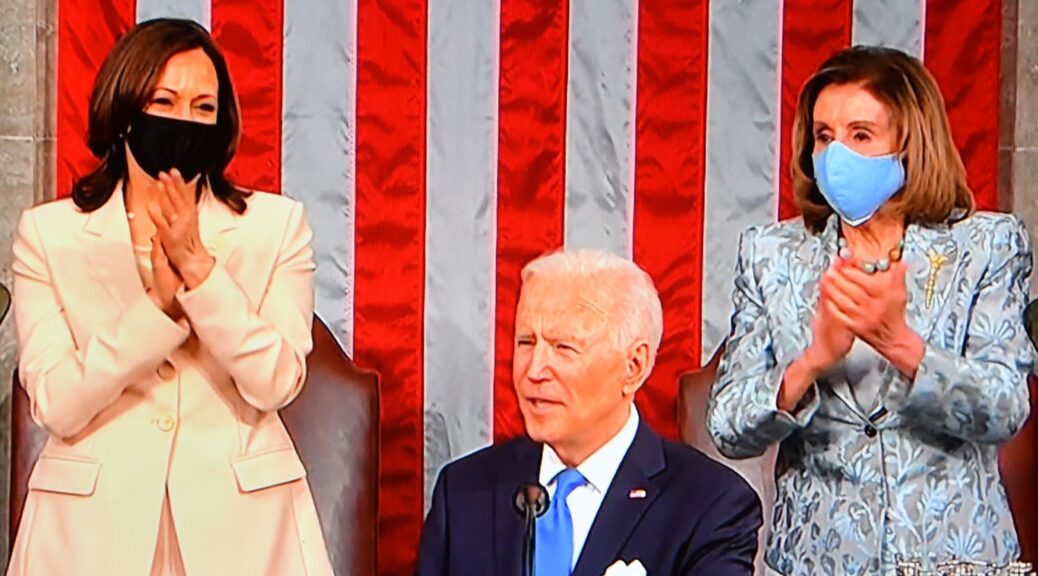

Unlike his predecessor, President Biden prioritized fiscal responsibility. In the face of the extraordinary challenges he inherited, the President made clear that bold action was needed to jumpstart the economic recovery. He knew that robust investment to change the course of the pandemic and support workers, families, and small businesses was not only the right strategy to build a stronger economy, but also to decrease the deficit. A strong economic recovery would result in less emergency spending and drive future deficits down. In March 2021, he signed into law the historic American Rescue Plan.

The President’s Budget shows that this strategy paid off. The strongest economic growth in four decades, powered by the American Rescue Plan, has also contributed to a historic decline in the deficit—by fueling strong revenue growth and allowing the Administration to responsibly phase down emergency pandemic-related spending. The President’s Budget projects that the deficit in 2022 will be more than $1.3 trillion lower than last year’s—the largest ever one-year decline in our country’s history. It will be less than half of the 2020 deficit the President inherited.

The President is now working to build on that progress and further reduce the deficit by reforming the tax system so that corporations and the wealthiest Americans pay their fair share. As the Budget shows, with these reforms, we can cut costs for families, continue growing the economy from the bottom up and middle out, and put America on a sound fiscal course for the future—shrinking the deficit the President inherited by two-thirds as a share of the economy.

President Biden’s Strategy to Combat the Pandemic and Jumpstart the Economy is Driving Down Deficits

Thanks to the American Rescue Plan and the President’s strategy to control the pandemic, in 2021 our economy grew at 5.7 percent, the fastest rate in nearly 40 years. We created more than 6.5 million jobs, the most our country has ever recorded in a single year. The unemployment rate has dropped to 3.8 percent, lower than the Congressional Budget Office had projected in its pre-American Rescue Plan baseline at any point over the next decade. And between the start and the end of 2021, we went from about 41,000 to more than 200 million Americans vaccinated, and from most schools closed to 99 percent of schools are open for in-person learning.

The Administration’s economic success and success in controlling the pandemic is lowering the deficit in two ways.

First, because of the historic pace of our economic and labor market recovery, the economy no longer needs the kind of emergency support it received last year. With businesses open and people back at work, the Federal Government will spend about $1 trillion less on pandemic and economic support in 2022 than in 2021. That includes hundreds of billions of dollars less support to businesses, which are now making investments and creating jobs without the need for help. Likewise, after historic drops in both the overall unemployment rate and the long-term unemployment rate—the share of people out of work for more than six months—we no longer need emergency unemployment assistance, and ongoing Unemployment Insurance claims are at their lowest level since 1970.

Second, a stronger economy means higher incomes for households and higher earnings for businesses. Because of this economic progress, the government is projected to collect more than $300 billion in additional revenues compared to last year, a nearly 10 percent increase.

The President’s Budget Continues to Lower Deficits

Even before the pandemic, the Trump Administration added $2 trillion to deficits over 10 years through tax cuts that largely helped wealthy people and large corporations. President Biden believes in a different approach: growing the economy from the middle out, not the top down, and paying for all new investments by ensuring that the wealthiest Americans and large corporations pay their fair share.

As he made clear in his State of the Union address, the President is committed to working with Congress to enact legislation that lowers costs for American families, expands the productive capacity of the American economy, and further reduces the deficit: by reducing prescription drug costs and fixing the tax code to ensure corporations and wealthy people pay the taxes they already owe and close loopholes they exploit.

The President’s FY 2023 Budget also proposes additional smart, targeted investments designed to spur durable economic growth, create jobs, reduce cost pressures, and foster shared prosperity—while more than fully offsetting their cost. The Budget reduces deficits by more than $1 trillion over the next 10 years.

Under the Budget policies, deficits as a share of the economy would fall to less than one-third of the 2020 level the President inherited. Overall, the Budget details an economically and fiscally responsible path forward—addressing the long-term fiscal challenges facing our country while making investments that will produce stronger economic growth and broadly shared prosperity for generations to come.